Form Sd-1 - Employer'S School District Income Tax Withholding Instructions - 2000

ADVERTISEMENT

SD-1

S

D

I

T

Rev. 02/00

CHOOL

ISTRICT

NCOME

AX

P.O. BOX 182388

Columbus, OH 43218-2388

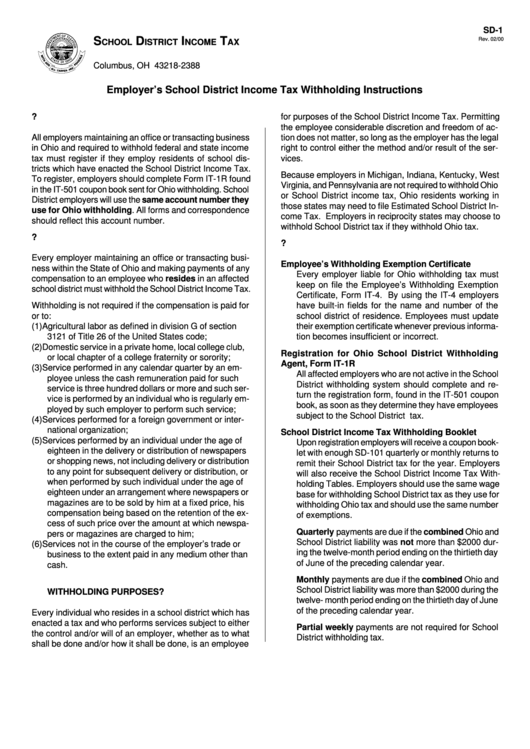

Employer’s School District Income Tax Withholding Instructions

1. WHO MUST REGISTER?

for purposes of the School District Income Tax. Permitting

the employee considerable discretion and freedom of ac-

All employers maintaining an office or transacting business

tion does not matter, so long as the employer has the legal

in Ohio and required to withhold federal and state income

right to control either the method and/or result of the ser-

tax must register if they employ residents of school dis-

vices.

tricts which have enacted the School District Income Tax.

Because employers in Michigan, Indiana, Kentucky, West

To register, employers should complete Form IT-1R found

Virginia, and Pennsylvania are not required to withhold Ohio

in the IT-501 coupon book sent for Ohio withholding. School

or School District income tax, Ohio residents working in

District employers will use the same account number they

those states may need to file Estimated School District In-

use for Ohio withholding. All forms and correspondence

come Tax. Employers in reciprocity states may choose to

should reflect this account number.

withhold School District tax if they withhold Ohio tax.

2. WHO MUST WITHHOLD?

4. WHAT FORMS MUST BE COMPLETED?

Every employer maintaining an office or transacting busi-

Employee’s Withholding Exemption Certificate

ness within the State of Ohio and making payments of any

Every employer liable for Ohio withholding tax must

compensation to an employee who resides in an affected

keep on file the Employee’s Withholding Exemption

school district must withhold the School District Income Tax.

Certificate, Form IT-4. By using the IT-4 employers

Withholding is not required if the compensation is paid for

have built-in fields for the name and number of the

or to:

school district of residence. Employees must update

(1) Agricultural labor as defined in division G of section

their exemption certificate whenever previous informa-

3121 of Title 26 of the United States code;

tion becomes insufficient or incorrect.

(2) Domestic service in a private home, local college club,

Registration for Ohio School District Withholding

or local chapter of a college fraternity or sorority;

Agent, Form IT-1R

(3) Service performed in any calendar quarter by an em-

All affected employers who are not active in the School

ployee unless the cash remuneration paid for such

District withholding system should complete and re-

service is three hundred dollars or more and such ser-

turn the registration form, found in the IT-501 coupon

vice is performed by an individual who is regularly em-

book, as soon as they determine they have employees

ployed by such employer to perform such service;

subject to the School District tax.

(4) Services performed for a foreign government or inter-

national organization;

School District Income Tax Withholding Booklet

(5) Services performed by an individual under the age of

Upon registration employers will receive a coupon book-

eighteen in the delivery or distribution of newspapers

let with enough SD-101 quarterly or monthly returns to

or shopping news, not including delivery or distribution

remit their School District tax for the year. Employers

to any point for subsequent delivery or distribution, or

will also receive the School District Income Tax With-

when performed by such individual under the age of

holding Tables. Employers should use the same wage

eighteen under an arrangement where newspapers or

base for withholding School District tax as they use for

magazines are to be sold by him at a fixed price, his

withholding Ohio tax and should use the same number

compensation being based on the retention of the ex-

of exemptions.

cess of such price over the amount at which newspa-

Quarterly payments are due if the combined Ohio and

pers or magazines are charged to him;

School District liability was not more than $2000 dur-

(6) Services not in the course of the employer’s trade or

ing the twelve-month period ending on the thirtieth day

business to the extent paid in any medium other than

of June of the preceding calendar year.

cash.

Monthly payments are due if the combined Ohio and

3. WHO IS AN EMPLOYEE FOR SCHOOL DISTRICT

School District liability was more than $2000 during the

WITHHOLDING PURPOSES?

twelve- month period ending on the thirtieth day of June

of the preceding calendar year.

Every individual who resides in a school district which has

enacted a tax and who performs services subject to either

Partial weekly payments are not required for School

the control and/or will of an employer, whether as to what

District withholding tax.

shall be done and/or how it shall be done, is an employee

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2