Form 0405-611 - 2006 Alaska Corporation Net Income Tax Return Instructions - Alaska

ADVERTISEMENT

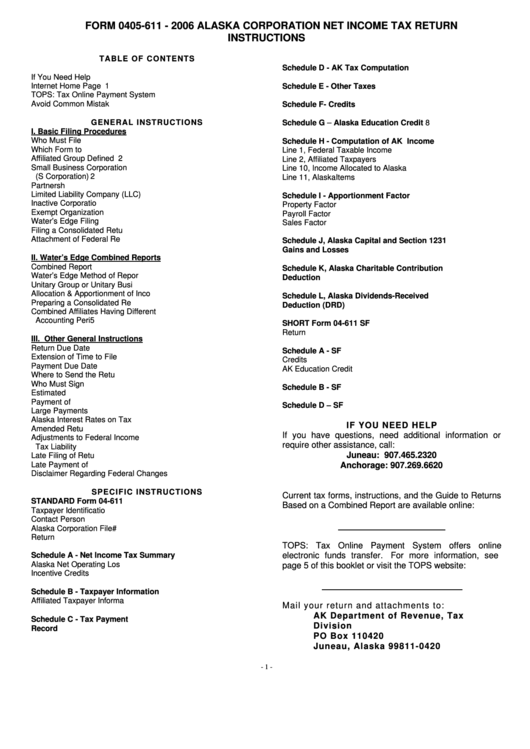

FORM 0405-611 - 2006 ALASKA CORPORATION NET INCOME TAX RETURN

INSTRUCTIONS

TABLE OF CONTENTS

Schedule D - AK Tax Computation ....................................7

If You Need Help .................................................................. 1

Internet Home Page ............................................................. 1

Schedule E - Other Taxes ...................................................7

TOPS: Tax Online Payment System .................................. 1

Avoid Common Mistakes...................................................... 2

Schedule F - Credits............................................................7

GENERAL INSTRUCTIONS

Schedule G – Alaska Education Credit .............................8

I. Basic Filing Procedures

Who Must File ...................................................................... 2

Schedule H - Computation of AK Income

Which Form to Use............................................................... 2

Line 1, Federal Taxable Income ...........................................8

Affiliated Group Defined ....................................................... 2

Line 2, Affiliated Taxpayers ..................................................8

Small Business Corporation

Line 10, Income Allocated to Alaska .....................................8

(S Corporation) ................................................................... 2

Line 11, Alaska Items ...........................................................8

Partnership ........................................................................... 3

Limited Liability Company (LLC)........................................... 3

Schedule I - Apportionment Factor

Inactive Corporation ............................................................. 3

Property Factor......................................................................9

Exempt Organization ............................................................ 3

Payroll Factor ........................................................................9

Water’s Edge Filing .............................................................. 3

Sales Factor ..........................................................................9

Filing a Consolidated Return ................................................ 3

Attachment of Federal Return .............................................. 3

Schedule J, Alaska Capital and Section 1231

Gains and Losses................................................................9

II. Water’s Edge Combined Reports

Combined Report ................................................................. 4

Schedule K, Alaska Charitable Contribution

Water’s Edge Method of Reporting....................................... 4

Deduction ............................................................................9

Unitary Group or Unitary Business ....................................... 4

Allocation & Apportionment of Income.................................. 4

Schedule L, Alaska Dividends-Received

Preparing a Consolidated Return ......................................... 4

Deduction (DRD)..................................................................9

Combined Affiliates Having Different

Accounting Periods............................................................. 5

SHORT Form 04-611 SF

Return Data...........................................................................9

III. Other General Instructions

Return Due Date .................................................................. 5

Schedule A - SF

Extension of Time to File ...................................................... 5

Credits...................................................................................10

Payment Due Date ............................................................... 5

AK Education Credit ..............................................................10

Where to Send the Return.................................................... 5

Who Must Sign ..................................................................... 5

Schedule B - SF ..................................................................10

Estimated Tax ...................................................................... 5

Payment of Tax .................................................................... 5

Schedule D – SF ..................................................................10

Large Payments ................................................................... 5

Alaska Interest Rates on Tax Due ........................................ 6

IF YOU NEED HELP

Amended Returns................................................................. 6

If you have questions, need additional information or

Adjustments to Federal Income

require other assistance, call:

Tax Liability ........................................................................ 6

Juneau: 907.465.2320

Late Filing of Return ............................................................. 6

Late Payment of Tax ............................................................ 6

Anchorage: 907.269.6620

Disclaimer Regarding Federal Changes ............................... 6

SPECIFIC INSTRUCTIONS

Current tax forms, instructions, and the Guide to Returns

STANDARD Form 04-611

Based on a Combined Report are available online:

Taxpayer Identification ......................................................... 6

Contact Person..................................................................... 6

Alaska Corporation File # ..................................................... 6

Return Data .......................................................................... 6

TOPS: Tax Online Payment System offers online

electronic funds transfer.

For more information, see

Schedule A - Net Income Tax Summary

Alaska Net Operating Loss................................................... 6

page 5 of this booklet or visit the TOPS website:

Incentive Credits................................................................... 7

https://

Schedule B - Taxpayer Information

Affiliated Taxpayer Information ............................................. 7

Mail your return and attachments to:

AK Department of Revenue, Tax

Schedule C - Tax Payment

Division

Record ................................................................................. 7

PO Box 110420

Juneau, Alaska 99811-0420

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10