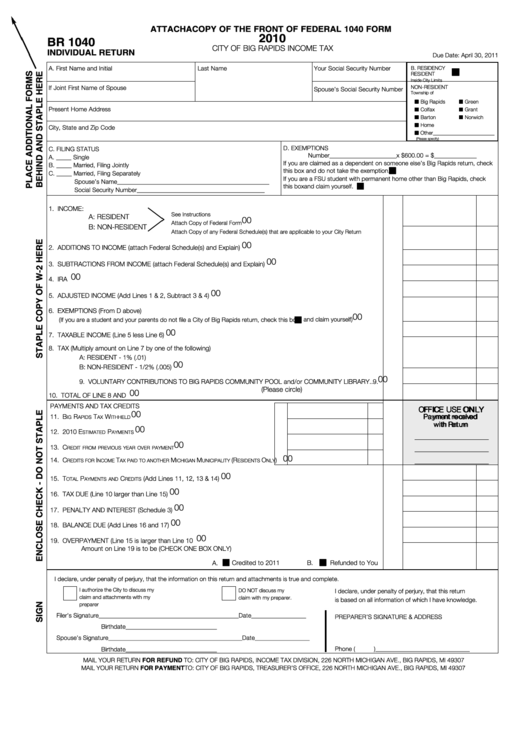

Form Br 1040 - Individual Return - City Of Big Rapids Income Tax - 2010

ADVERTISEMENT

ATTACH A COPY OF THE FRONT OF FEDERAL 1040 FORM

2010

BR 1040

CITY OF BIG RAPIDS INCOME TAX

INDIVIDUAL RETURN

Due Date: April 30, 2011

A. First Name and Initial

Last Name

Your Social Security Number

B. RESIDENCY

I I

RESIDENT

Inside City Limits

If Joint First Name of Spouse

NON-RESIDENT

Spouse’s Social Security Number

Township of

Big Rapids

Green

I I

I I

Present Home Address

Colfax

Grant

I I

I I

Barton

Norwich

I I

I I

Home

I I

City, State and Zip Code

Other_______________________

I I

(Please specify)

D. EXEMPTIONS

C. FILING STATUS

Number______________________x $600.00 = $______________

A. _____ Single

If you are claimed as a dependent on someone else’s Big Rapids return, check

B. _____ Married, Filing Jointly

this box and do not take the exemption.

I I

C. _____ Married, Filing Separately

If you are a FSU student with permanent home other than Big Rapids, check

Spouse’s Name__________________________________________________

this box and claim yourself.

I I

Social Security Number __________________________________________

1. INCOME:

See Instructions

A: RESIDENT

00

......................................................................

1.

Attach Copy of Federal Form

B: NON-RESIDENT

Attach Copy of any Federal Schedule(s) that are applicable to your City Return

00

2. ADDITIONS TO INCOME (attach Federal Schedule(s) and Explain) ..........................................................................

2.

00

3. SUBTRACTIONS FROM INCOME (attach Federal Schedule(s) and Explain)..............................................................

3.

00

4. IRA DEDUCTIONS ....................................................................................................................................................

4.

00

5. ADJUSTED INCOME (Add Lines 1 & 2, Subtract 3 & 4)............................................................................................

5.

6. EXEMPTIONS (From D above)

00

..............

6.

(If you are a student and your parents do not file a City of Big Rapids return, check this box

and claim yourself)

I I

00

7. TAXABLE INCOME (Line 5 less Line 6)......................................................................................................................

7.

8. TAX (Multiply amount on Line 7 by one of the following)

A: RESIDENT - 1% (.01)

00

B: NON-RESIDENT - 1/2% (.005) ................................................................................................................

8.

00

9. VOLUNTARY CONTRIBUTIONS TO BIG RAPIDS COMMUNITY POOL and/or COMMUNITY LIBRARY ..

9.

(Please circle)

00

10. TOTAL OF LINE 8 AND 9........................................................................................................................................

10.

PAYMENTS AND TAX CREDITS

O O F F F F I I C C E E U U S S E E O O N N L L Y Y

00

11. B

R

T

W

.............................................................................. 11.

P P a a y y m m e e n n t t r r e e c c e e i i v v e e d d

IG

APIDS

AX

ITHHELD

w w i i t t h h R R e e t t u u r r n n

00

12. 2010 E

P

............................................................................ 12.

STIMATED

AYMENTS

_____________________

00

13. C

...................................................... 13.

_____________________

REDIT FROM PREVIOUS YEAR OVER PAYMENT

00

14. C

I

T

M

M

(R

O

) .... 14.

_____________________

REDITS FOR

NCOME

AX PAID TO ANOTHER

ICHIGAN

UNICIPALITY

ESIDENTS

NLY

00

15. T

P

C

(Add Lines 11, 12, 13 & 14)........................................................................................

15.

OTAL

AYMENTS AND

REDITS

00

16. TAX DUE (Line 10 larger than Line 15) ....................................................................................................................

16.

00

17. PENALTY AND INTEREST (Schedule 3)..................................................................................................................

17.

00

18. BALANCE DUE (Add Lines 16 and 17) ..................................................................................................................

18.

00

19. OVERPAYMENT (Line 15 is larger than Line 10 ......................................................................................................

19.

Amount on Line 19 is to be (CHECK ONE BOX ONLY)

A.

Credited to 2011

B.

Refunded to You

I I

I I

I declare, under penalty of perjury, that the information on this return and attachments is true and complete.

I authorize the City to discuss my

DO NOT discuss my

I declare, under penalty of perjury, that this return

claim and attachments with my

claim with my preparer.

is based on all information of which I have knowledge.

preparer

Filer’s Signature ______________________________________________ Date __________________

PREPARER’S SIGNATURE & ADDRESS

Birthdate ______________________________

Spouse’s Signature ____________________________________________ Date __________________

Phone (

)_______________________________

Birthdate ______________________________

MAIL YOUR RETURN FOR REFUND TO: CITY OF BIG RAPIDS, INCOME TAX DIVISION, 226 NORTH MICHIGAN AVE., BIG RAPIDS, MI 49307

MAIL YOUR RETURN FOR PAYMENT TO: CITY OF BIG RAPIDS, TREASURER’S OFFICE, 226 NORTH MICHIGAN AVE., BIG RAPIDS, MI 49307

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2