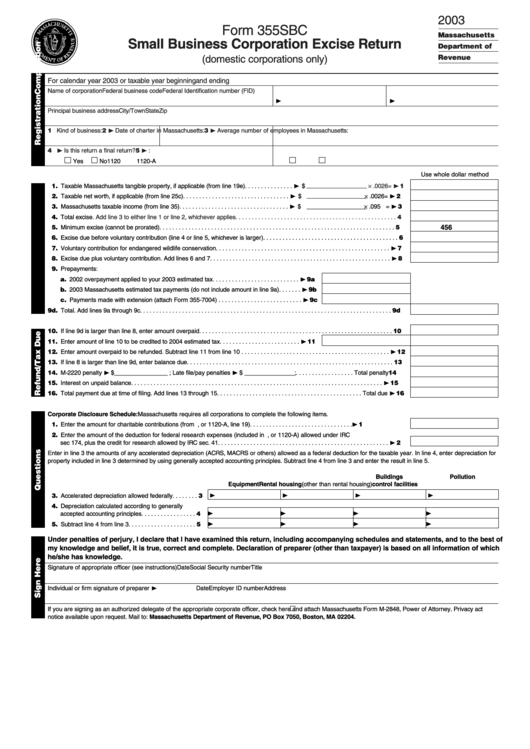

Form 355sbc - Small Business Corporation Excise Return - 2003

ADVERTISEMENT

2003

Form 355SBC

Massachusetts

Small Business Corporation Excise Return

Department of

Revenue

(domestic corporations only)

For calendar year 2003 or taxable year beginning

and ending

Name of corporation

Federal business code

Federal Identification number (FID)

❿

❿

Principal business address

City/Town

State

Zip

2 ❿!Date of charter in Massachusetts:

3 ❿!Average number of employees in Massachusetts:

1 Kind of business:

4 ❿!Is this return a final return?

5 ❿!U.S. tax return filed:

Yes

No

1120

1120-A

Use whole dollar method

× .0026 = ❿ 1

11. Taxable Massachusetts tangible property, if applicable (from line 19e). . . . . . . . . . . . . . . ❿ $

× .0026 = ❿ 2

12. Taxable net worth, if applicable (from line 25c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ $

×

13. Massachusetts taxable income (from line 35) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ $

= ❿ 3

.0950

14. Total excise.

Add line 3 to either line 1 or line 2, whichever applies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

456

15. Minimum excise (cannot be prorated) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16. Excise due before voluntary contribution (line 4 or line 5, whichever is larger) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17. Voluntary contribution for endangered wildlife conservation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 7

18. Excise due plus voluntary contribution. Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 8

19. Prepayments:

a. 2002 overpayment applied to your 2003 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 9a

b. 2003 Massachusetts estimated tax payments (do not include amount in line 9a) . . . . . . . ❿ 9b

c. Payments made with extension (attach Form 355-7004) . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 9c

9d. Total. Add lines 9a through 9c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9d

10. If line 9d is larger than line 8, enter amount overpaid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11. Enter amount of line 10 to be credited to 2004 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 11

12. Enter amount overpaid to be refunded. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 12

13. If line 8 is larger than line 9d, enter balance due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14. M-2220 penalty ❿!$ ________________ ; Late file/pay penalties ❿!$ _______________ ; . . . . . . . . . . . . . . . . . . Total penalty 14

15. Interest on unpaid balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 15

16. Total payment due at time of filing. Add lines 13 through 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total due ❿ 16

Corporate Disclosure Schedule: Massachusetts requires all corporations to complete the following items.

11. Enter the amount for charitable contributions (from U.S. Form 1120, or 1120-A, line 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 1

12. Enter the amount of the deduction for federal research expenses (included in U.S. 1120, or 1120-A) allowed under IRC

sec 174, plus the credit for research allowed by IRC sec. 41 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 2

Enter in line 3 the amounts of any accelerated depreciation (ACRS, MACRS or others) allowed as a federal deduction for the taxable year. In line 4, enter depreciation for

property included in line 3 determined by using generally accepted accounting principles. Subtract line 4 from line 3 and enter the result in line 5.

Buildings

Pollution

Equipment

Rental housing

(other than rental housing)

control facilities

❿

❿

❿

❿

13. Accelerated depreciation allowed federally . . . . . . . . 3

14. Depreciation calculated according to generally

❿

❿

❿

❿

accepted accounting principles . . . . . . . . . . . . . . . . . 4

❿

❿

❿

❿

15. Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . 5

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of

my knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which

he/she has knowledge.

Signature of appropriate officer (see instructions)

Date

Social Security number

Title

Individual or firm signature of preparer ❿

Date

Employer ID number

Address

If you are signing as an authorized delegate of the appropriate corporate officer, check here

and attach Massachusetts Form M-2848, Power of Attorney. Privacy act

notice available upon request. Mail to: Massachusetts Department of Revenue, PO Box 7050, Boston, MA 02204.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2