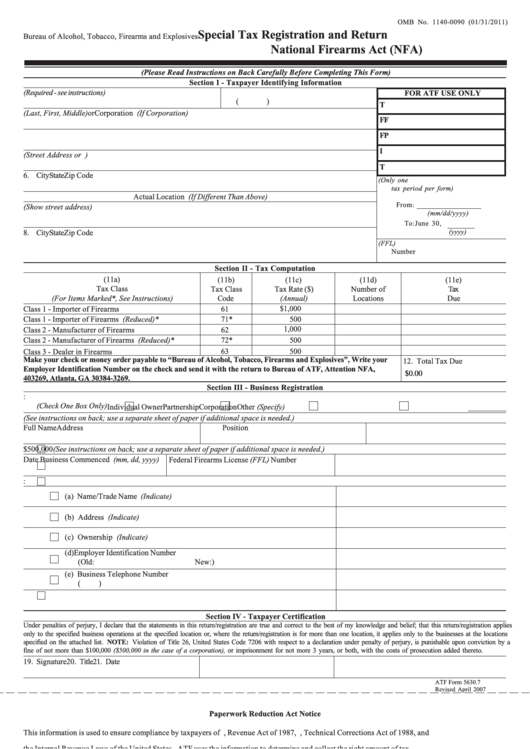

OMB No. 1140-0090 (01/31/2011)

U.S. Department of Justice

Special Tax Registration and Return

Bureau of Alcohol, Tobacco, Firearms and Explosives

National Firearms Act (NFA)

(Please Read Instructions on Back Carefully Before Completing This Form)

Section I - Taxpayer Identifying Information

1. Employer Identification Number (Required - see instructions) 2. Business Telephone Number

FOR ATF USE ONLY

(

)

T

3. Name (Last, First, Middle)

or

Corporation (If Corporation)

FF

4. Trade Name

FP

I

5. Mailing Address (Street Address or P.O. Box Number)

T

6. City

State

Zip Code

9. Tax Period Covering (Only one

tax period per form)

Actual Location (If Different Than Above)

From:

7. Physical Address of Principal Place of Business (Show street address)

(mm/dd/yyyy)

To: June 30,

(yyyy)

8. City

State

Zip Code

10. Federal Firearms License (FFL)

Number

Section II - Tax Computation

(11a)

(11b)

(11c)

(11d)

(11e)

Tax Class

Tax Class

Tax Rate ($)

Number of

Tax

(For Items Marked*, See Instructions)

Code

(Annual)

Locations

Due

$1,000

Class 1 - Importer of Firearms

61

Class 1 - Importer of Firearms (Reduced)*

71*

500

1,000

Class 2 - Manufacturer of Firearms

62

Class 2 - Manufacturer of Firearms (Reduced)*

72*

500

Class 3 - Dealer in Firearms

63

500

Make your check or money order payable to “Bureau of Alcohol, Tobacco, Firearms and Explosives”, Write your

12. Total Tax Due

Employer Identification Number on the check and send it with the return to Bureau of ATF, Attention NFA, P.O. Box

$0.00

403269, Atlanta, GA 30384-3269.

Section III - Business Registration

13. Ownership Information:

(Check One Box Only)

Individual Owner

Partnership

Corporation

Other (Specify)

14. Ownership Responsibility (See instructions on back; use a separate sheet of paper if additional space is needed.)

Full Name

Address

Position

15.

Gross Receipts less than $500,000 (See instructions on back; use a separate sheet of paper if additional space is needed.)

Federal Firearms License (FFL) Number

Date Business Commenced (mm, dd, yyyy)

16.

New Business

17.

Existing Business With Change In:

(a) Name/Trade Name (Indicate)

(b) Address (Indicate)

(c) Ownership (Indicate)

(d) Employer Identification Number

(Old:

New:

)

(e) Business Telephone Number

(

)

18.

Discontinued Business

Section IV - Taxpayer Certification

Under penalties of perjury, I declare that the statements in this return/registration are true and correct to the best of my knowledge and belief; that this return/registration applies

only to the specified business operations at the specified location or, where the return/registration is for more than one location, it applies only to the businesses at the locations

specified on the attached list. NOTE: Violation of Title 26, United States Code 7206 with respect to a declaration under penalty of perjury, is punishable upon conviction by a

fine of not more than $100,000 ($500,000 in the case of a corporation), or imprisonment for not more 3 years, or both, with the costs of prosecution added thereto.

19. Signature

20. Title

21. Date

ATF Form 5630.7

Revised April 2007

Paperwork Reduction Act Notice

This information is used to ensure compliance by taxpayers of P.L. 100-203, Revenue Act of 1987, P.L. 100-647, Technical Corrections Act of 1988, and

the Internal Revenue Laws of the United States. ATF uses the information to determine and collect the right amount of tax.

The estimated average burden associated with this collection of information is 15 minutes per respondent or recordkeeper, depending on individual

circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be addressed to Reports

Management Officer, Document Services, Bureau of Alcohol, Tobacco, Firearms and Explosives, Washington, DC 20226.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB

control number.

1

1