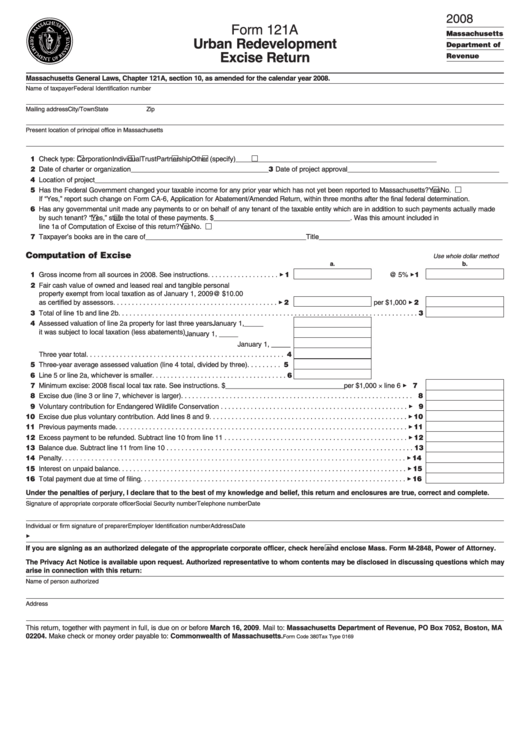

Form 121a - Urban Redevelopment Excise Return - 2008

ADVERTISEMENT

2008

Form 121A

Massachusetts

Urban Redevelopment

Department of

Excise Return

Revenue

Massachusetts General Laws, Chapter 121A, section 10, as amended for the calendar year 2008.

Name of taxpayer

Federal Identification number

Mailing address

City/Town

State

Zip

Present location of principal office in Massachusetts

11 Check type:

Corporation

Individual

Trust

Partnership

Other (specify)_____________________________________________________

12 Date of charter or organization____________________________________ 3 Date of project approval ________________________________________

14 Location of project _____________________________________________________________________________________________________________

15 Has the Federal Government changed your taxable income for any prior year which has not yet been reported to Massachusetts?

Yes

No.

If “Yes,” report such change on Form CA-6, Application for Abatement/Amended Return, within three months after the final federal determination.

16 Has any governmental unit made any payments to or on behalf of any tenant of the taxable entity which are in addition to such payments actually made

by such tenant?

Yes

No. If “Yes,” state the total of these payments. $____________________________________ . Was this amount included in

line 1a of Computation of Excise of this return?

Yes

No.

17 Taxpayer’s books are in the care of __________________________________________ Title ________________________________________________

Computation of Excise

Use whole dollar method

a.

b.

11 Gross income from all sources in 2008. See instructions . . . . . . . . . . . . . . . . . . . 3 1

@ 5% 31

12 Fair cash value of owned and leased real and tangible personal

property exempt from local taxation as of January 1, 2009

@ $10.00

3 2

as certified by assessors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

per $1,000 3 2

13 Total of line 1b and line 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Assessed valuation of line 2a property for last three years

January 1, _____

it was subject to local taxation (less abatements)

January 1, _____

January 1, _____

Three year total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15 Three-year average assessed valuation (line 4 total, divided by three) . . . . . . . . . 5

16 Line 5 or line 2a, whichever is smaller. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Minimum excise: 2008 fiscal local tax rate. See instructions. $ _______________________________ per $1,000 × line 6 3 17

18 Excise due (line 3 or line 7, whichever is larger). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Voluntary contribution for Endangered Wildlife Conservation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 19

10 Excise due plus voluntary contribution. Add lines 8 and 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 10

11 Previous payments made . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 11

12 Excess payment to be refunded. Subtract line 10 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

13 Balance due. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Interest on unpaid balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

16 Total payment due at time of filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 16

Under the penalties of perjury, I declare that to the best of my knowledge and belief, this return and enclosures are true, correct and complete.

Signature of appropriate corporate officer

Social Security number

Telephone number

Date

Individual or firm signature of preparer

Employer Identification number

Address

Date

3

If you are signing as an authorized delegate of the appropriate corporate officer, check here

and enclose Mass. Form M-2848, Power of Attorney.

The Privacy Act Notice is available upon request. Authorized representative to whom contents may be disclosed in discussing questions which may

arise in connection with this return:

Name of person authorized

Address

This return, together with payment in full, is due on or before March 16, 2009. Mail to: Massachusetts Department of Revenue, PO Box 7052, Boston, MA

02204. Make check or money order payable to: Commonwealth of Massachusetts.

Form Code 380 Tax Type 0169

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1