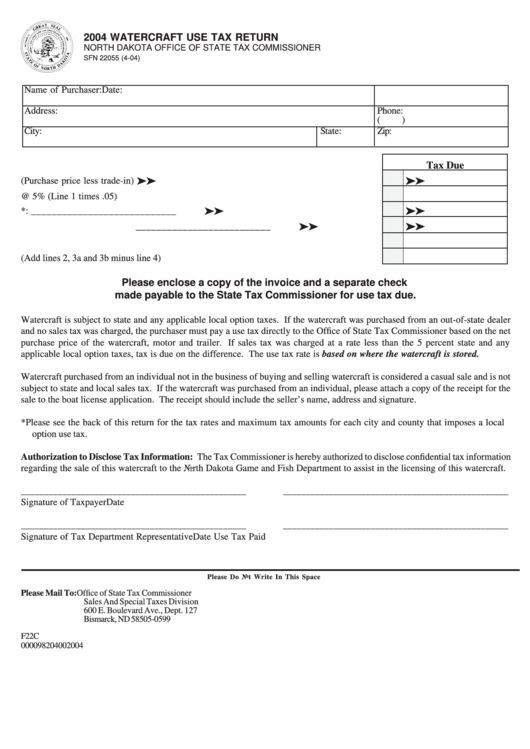

2004 WATERCRAFT USE TAX RETURN

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

SFN 22055 (4-04)

Name of Purchaser:

Date:

Address:

Phone:

(

)

City:

State:

Zip:

Tax Due

! ! ! ! !

1. Net Taxable Purchase (Purchase price less trade-in) ............................................................

2. State Tax Due @ 5% (Line 1 times .05) ................................................................................

! ! ! ! !

3. Local Option Taxes*:

a. Enter Name of City

____________________________

! ! ! ! !

b. Enter Name of County __________________________

4. Less Tax Paid To Other State ................................................................................................

5. Total Tax Due (Add lines 2, 3a and 3b minus line 4) ..............................................................

Please enclose a copy of the invoice and a separate check

made payable to the State Tax Commissioner for use tax due.

Watercraft is subject to state and any applicable local option taxes. If the watercraft was purchased from an out-of-state dealer

and no sales tax was charged, the purchaser must pay a use tax directly to the Office of State Tax Commissioner based on the net

purchase price of the watercraft, motor and trailer. If sales tax was charged at a rate less than the 5 percent state and any

applicable local option taxes, tax is due on the difference. The use tax rate is based on where the watercraft is stored.

Watercraft purchased from an individual not in the business of buying and selling watercraft is considered a casual sale and is not

subject to state and local sales tax. If the watercraft was purchased from an individual, please attach a copy of the receipt for the

sale to the boat license application. The receipt should include the seller’s name, address and signature.

* Please see the back of this return for the tax rates and maximum tax amounts for each city and county that imposes a local

option use tax.

Authorization to Disclose Tax Information: The Tax Commissioner is hereby authorized to disclose confidential tax information

regarding the sale of this watercraft to the North Dakota Game and Fish Department to assist in the licensing of this watercraft.

_________________________________________________

_________________________________________________

Signature of Taxpayer

Date

_________________________________________________

_________________________________________________

Signature of Tax Department Representative

Date Use Tax Paid

Please Do Not Write In This Space

Please Mail To: Office of State Tax Commissioner

Sales And Special Taxes Division

600 E. Boulevard Ave., Dept. 127

Bismarck, ND 58505-0599

F22C

000098204002004

1

1 2

2