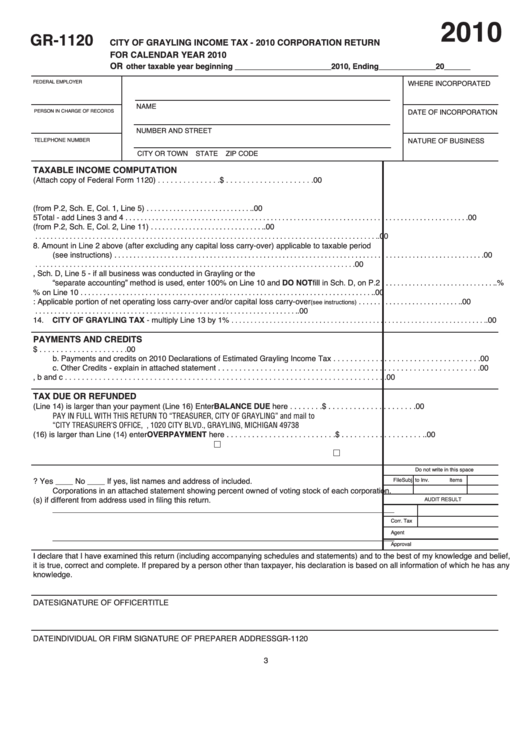

Form Gr-1120 - Corporation Return - City Of Grayling Income Tax - 2010

ADVERTISEMENT

2010

GR-1120

CITY OF GRAYLING INCOME TAX - 2010 CORPORATION RETURN

FOR CALENDAR YEAR 2010

OR

other taxable year beginning ______________________2010, Ending_____________20______

FEDERAL EMPLOYER I.D. NUMBER

WHERE INCORPORATED

NAME

PERSON IN CHARGE OF RECORDS

DATE OF INCORPORATION

NUMBER AND STREET

TELEPHONE NUMBER

NATURE OF BUSINESS

CITY OR TOWN

STATE

ZIP CODE

TAXABLE INCOME COMPUTATION

1.

Taxable income from Federal Form 1120 (Attach copy of Federal Form 1120) . . . . . . . . . . . . . . .$ . . . . . . . . . . . . . . . . . . . . .00

2.

Enter gain of loss from sale or exchange of property included in Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

3.

Result after excluding Line 2 from Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

4.

Enter items not deductible under Grayling Income Tax Ordinance (from P.2, Sch. E, Col. 1, Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

5

Total - add Lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

6.

Enter items not taxable under Grayling Income Tax Ordinance (from P.2, Sch. E, Col. 2, Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

7.

Total - Line 5 less Line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

8.

Amount in Line 2 above (after excluding any capital loss carry-over) applicable to taxable period

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

9.

Total income - add Lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

10.

Allocation percentage from P.2, Sch. D, Line 5 - if all business was conducted in Grayling or the

“separate accounting” method is used, enter 100% on Line 10 and DO NOT fill in Sch. D, on P.2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .%

11.

Total - multiply Line 9 by % on Line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

12.

Less: Applicable portion of net operating loss carry-over and/or capital loss carry-over

. . . . . . . . . . . . . . . . . . . . . . . . . . . .00

(see instructions)

13.

Total income subject to tax - Line 11 less Line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

14.

CITY OF GRAYLING TAX - multiply Line 13 by 1% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

PAYMENTS AND CREDITS

15.

a. Tax paid with tentative return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$ . . . . . . . . . . . . . . . . . . . . .00

b. Payments and credits on 2010 Declarations of Estimated Grayling Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

c. Other Credits - explain in attached statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

16.

Total - add Lines 15a, b and c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

TAX DUE OR REFUNDED

17.

If your tax (Line 14) is larger than your payment (Line 16) Enter BALANCE DUE here . . . . . . . .$ . . . . . . . . . . . . . . . . . . . . .00

P Y IN FULL WITH THIS RETURN TO “TRE SURER, CITY OF GR YLING” and mail to

“CITY TRE SURER’S OFFICE, P.O. BOX 549, 1020 CITY BLVD., GR YLING, MICHIG N 49738

18.

If Line (16) is larger than Line (14) enter OVERPAYMENT here . . . . . . . . . . . . . . . . . . . . . . . . . .$ . . . . . . . . . . . . . . . . . . . . .00

19.

Check this box if you wish to receive a refund

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

20.

Check this box if you wish the overpayment credited to your 2011 estimated tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .00

Do not write in this space

A.

Name and address of resident agent in Michigan_____________________________________

File

Subj. to Inv.

Items

B.

Is this a consolidated return? Yes ____ No ____ If yes, list names and address of included.

Corporations in an attached statement showing percent owned of voting stock of each corporation.

C.

List addresses of Grayling location(s) if different from address used in filing this return.

AUDIT RESULT

______________________________________________________________________________

N.C.

D.

Total amount of dividends paid to all stockholders during the taxable period.__________________

Corr. Tax

E.

List names and addresses of officers who are Grayling residents.

Agent

______________________________________________________________________________

Approval

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief,

it is true, correct and complete. If prepared by a person other than taxpayer, his declaration is based on all information of which he has any

knowledge.

DATE

SIGNATURE OF OFFICER

TITLE

DATE

INDIVIDUAL OR FIRM SIGNATURE OF PREPARER

ADDRESS

GR-1120

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2