Maine Revenue Services 2009 Certified Media Production Residency Affidavit

ADVERTISEMENT

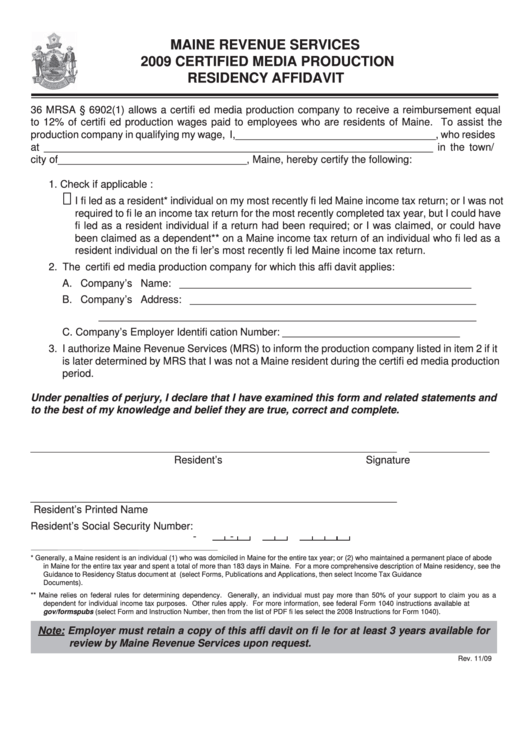

MAINE REVENUE SERVICES

2009 CERTIFIED MEDIA PRODUCTION

RESIDENCY AFFIDAVIT

36 MRSA § 6902(1) allows a certifi ed media production company to receive a reimbursement equal

to 12% of certifi ed production wages paid to employees who are residents of Maine. To assist the

production company in qualifying my wage, I,___________________________________, who resides

at ____________________________________________________________________ in the town/

city of_________________________________, Maine, hereby certify the following:

1. Check if applicable :

I fi led as a resident* individual on my most recently fi led Maine income tax return; or I was not

required to fi le an income tax return for the most recently completed tax year, but I could have

fi led as a resident individual if a return had been required; or I was claimed, or could have

been claimed as a dependent** on a Maine income tax return of an individual who fi led as a

resident individual on the fi ler’s most recently fi led Maine income tax return.

2. The certifi ed media production company for which this affi davit applies:

A. Company’s Name: ___________________________________________________

B. Company’s Address: __________________________________________________

__________________________________________________________________

C. Company’s Employer Identifi cation Number: _______________________________

3. I authorize Maine Revenue Services (MRS) to inform the production company listed in item 2 if it

is later determined by MRS that I was not a Maine resident during the certifi ed media production

period.

Under penalties of perjury, I declare that I have examined this form and related statements and

to the best of my knowledge and belief they are true, correct and complete.

________________________________________________________________

______________

Resident’s Signature

Date

________________________________________________________________

Resident’s Printed Name

Resident’s Social Security Number:

-

-

*

Generally, a Maine resident is an individual (1) who was domiciled in Maine for the entire tax year; or (2) who maintained a permanent place of abode

in Maine for the entire tax year and spent a total of more than 183 days in Maine. For a more comprehensive description of Maine residency, see the

Guidance to Residency Status document at (select Forms, Publications and Applications, then select Income Tax Guidance

Documents).

**

Maine relies on federal rules for determining dependency. Generally, an individual must pay more than 50% of your support to claim you as a

dependent for individual income tax purposes. Other rules apply. For more information, see federal Form 1040 instructions available at

gov/formspubs (select Form and Instruction Number, then from the list of PDF fi les select the 2008 Instructions for Form 1040).

Note: Employer must retain a copy of this affi davit on fi le for at least 3 years available for

review by Maine Revenue Services upon request.

Rev. 11/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1