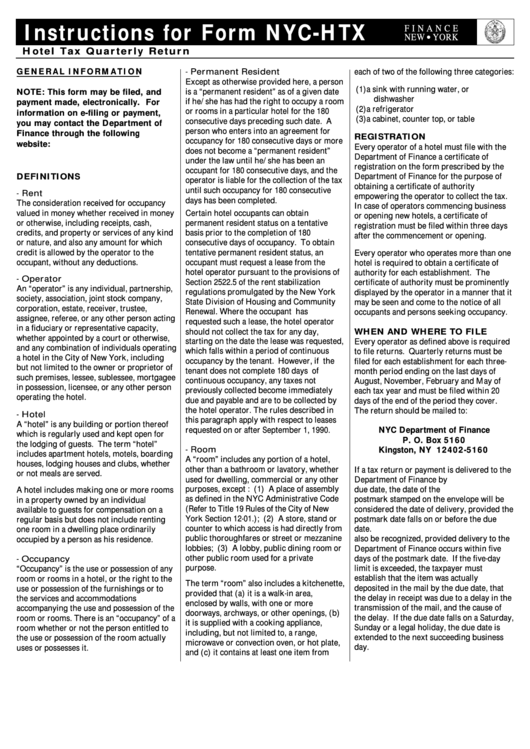

Instr Uctions For For M Nyc-Htx - Hotel Tax Quarterly Return

ADVERTISEMENT

Instr uctions for For m NYC-HTX

F I N A N C E

NEW YORK

H o t e l T a x Q u a r t e r l y R e t u r n

GE N E R A L IN F O R M A T I O N

- Permanent Resident

each of two of the following three categories:

Except as otherwise provided here, a person

(1) a sink with running water, or

is a “permanent resident” as of a given date

NOTE: This form may be filed, and

dishwasher

if he/she has had the right to occupy a room

payment made, electronically. For

(2) a refrigerator

or rooms in a particular hotel for the 180

information on e-filing or payment,

(3) a cabinet, counter top, or table

consecutive days preceding such date. A

you may contact the Department of

person who enters into an agreement for

Finance through the following

REGISTRATION

occupancy for 180 consecutive days or more

website:

Every operator of a hotel must file with the

does not become a “permanent resident”

Department of Finance a certificate of

under the law until he/she has been an

registration on the form prescribed by the

occupant for 180 consecutive days, and the

Department of Finance for the purpose of

DEFINITIONS

operator is liable for the collection of the tax

obtaining a certificate of authority

until such occupancy for 180 consecutive

- Rent

empowering the operator to collect the tax.

days has been completed.

The consideration received for occupancy

In case of operators commencing business

valued in money whether received in money

Certain hotel occupants can obtain

or opening new hotels, a certificate of

or otherwise, including receipts, cash,

permanent resident status on a tentative

registration must be filed within three days

credits, and property or services of any kind

basis prior to the completion of 180

after the commencement or opening.

or nature, and also any amount for which

consecutive days of occupancy. To obtain

credit is allowed by the operator to the

tentative permanent resident status, an

Every operator who operates more than one

occupant, without any deductions.

occupant must request a lease from the

hotel is required to obtain a certificate of

hotel operator pursuant to the provisions of

authority for each establishment. The

- Operator

Section 2522.5 of the rent stabilization

certificate of authority must be prominently

An “operator” is any individual, partnership,

regulations promulgated by the New York

displayed by the operator in a manner that it

society, association, joint stock company,

State Division of Housing and Community

may be seen and come to the notice of all

corporation, estate, receiver, trustee,

Renewal. Where the occupant has

occupants and persons seeking occupancy.

assignee, referee, or any other person acting

requested such a lease, the hotel operator

in a fiduciary or representative capacity,

should not collect the tax for any day,

WHEN AND WHERE TO FILE

whether appointed by a court or otherwise,

starting on the date the lease was requested,

Every operator as defined above is required

and any combination of individuals operating

which falls within a period of continuous

to file returns. Quarterly returns must be

a hotel in the City of New York, including

occupancy by the tenant. However, if the

filed for each establishment for each three-

but not limited to the owner or proprietor of

tenant does not complete 180 days of

month period ending on the last days of

such premises, lessee, sublessee, mortgagee

continuous occupancy, any taxes not

August, November, February and May of

in possession, licensee, or any other person

previously collected become immediately

each tax year and must be filed within 20

operating the hotel.

due and payable and are to be collected by

days of the end of the period they cover.

the hotel operator. The rules described in

The return should be mailed to:

- Hotel

this paragraph apply with respect to leases

A “hotel” is any building or portion thereof

requested on or after September 1, 1990.

NYC Department of Finance

which is regularly used and kept open for

P. O. Box 5160

the lodging of guests. The term “hotel”

- Room

Kingston, NY 12402-5160

includes apartment hotels, motels, boarding

A “room” includes any portion of a hotel,

houses, lodging houses and clubs, whether

other than a bathroom or lavatory, whether

If a tax return or payment is delivered to the

or not meals are served.

used for dwelling, commercial or any other

Department of Finance by U.S. mail after the

purposes, except : (1) A place of assembly

due date, the date of the U.S. Postal Service

A hotel includes making one or more rooms

as defined in the NYC Administrative Code

postmark stamped on the envelope will be

in a property owned by an individual

(Refer to Title 19 Rules of the City of New

considered the date of delivery, provided the

available to guests for compensation on a

York Section 12-01.); (2) A store, stand or

postmark date falls on or before the due

regular basis but does not include renting

counter to which access is had directly from

date. Non-U.S. Postal Service postmarks will

one room in a dwelling place ordinarily

public thoroughfares or street or mezzanine

also be recognized, provided delivery to the

occupied by a person as his residence.

lobbies; (3) A lobby, public dining room or

Department of Finance occurs within five

other public room used for a private

days of the postmark date. If the five-day

- Occupancy

purpose.

limit is exceeded, the taxpayer must

“Occupancy” is the use or possession of any

establish that the item was actually

room or rooms in a hotel, or the right to the

The term “room” also includes a kitchenette,

deposited in the mail by the due date, that

use or possession of the furnishings or to

provided that (a) it is a walk-in area,

the delay in receipt was due to a delay in the

the services and accommodations

enclosed by walls, with one or more

transmission of the mail, and the cause of

accompanying the use and possession of the

doorways, archways, or other openings, (b)

the delay. If the due date falls on a Saturday,

room or rooms. There is an “occupancy” of a

it is supplied with a cooking appliance,

Sunday or a legal holiday, the due date is

room whether or not the person entitled to

including, but not limited to, a range,

extended to the next succeeding business

the use or possession of the room actually

microwave or convection oven, or hot plate,

day.

uses or possesses it.

and (c) it contains at least one item from

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4