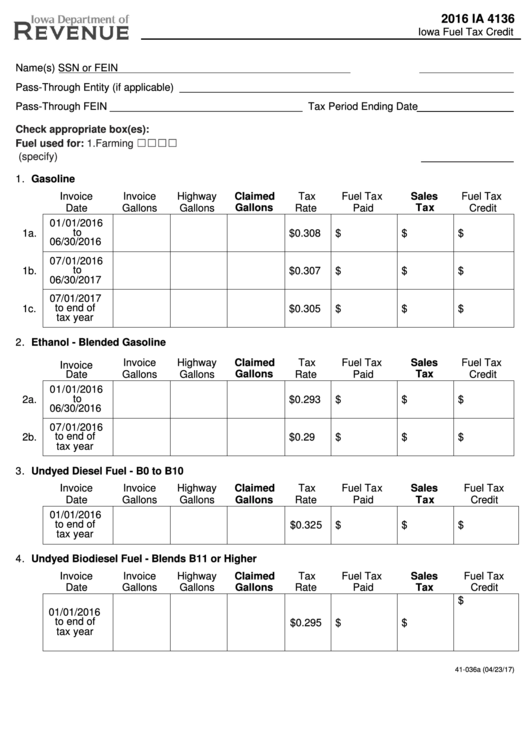

Form Ia 4136 - Iowa Fuel Tax Credit - 2016

ADVERTISEMENT

2016 IA 4136

Iowa Fuel Tax Credit

https://tax.iowa.gov

Name(s)

SSN or FEIN

Pass-Through Entity (if applicable) ___________________________________________________________

Pass-Through FEIN __________________________________ Tax Period Ending Date

Check appropriate box(es):

Fuel used for: 1.Farming ☐ 2.Commercial ☐ 3.Commercial Fishing ☐ 4.Other ☐

(specify)

1. Gasoline

Invoice

Invoice

Highway

Claimed

Tax

Fuel Tax

Sales

Fuel Tax

Date

Gallons

Gallons

Gallons

Rate

Paid

Tax

Credit

01/01/2016

to

1a.

$0.308

$

$

$

06/30/2016

07/01/2016

to

1b.

$0.307

$

$

$

06/30/2017

07/01/2017

to end of

1c.

$0.305

$

$

$

tax year

2. Ethanol - Blended Gasoline

Invoice

Highway

Claimed

Tax

Fuel Tax

Sales

Fuel Tax

Invoice

Gallons

Gallons

Gallons

Rate

Paid

Tax

Credit

Date

01/01/2016

to

2a.

$0.293

$

$

$

06/30/2016

07/01/2016

to end of

2b.

$0.29

$

$

$

tax year

3. Undyed Diesel Fuel - B0 to B10

Invoice

Invoice

Highway

Claimed

Tax

Fuel Tax

Sales

Fuel Tax

Date

Gallons

Gallons

Gallons

Rate

Paid

Tax

Credit

01/01/2016

to end of

$0.325

$

$

$

tax year

4. Undyed Biodiesel Fuel - Blends B11 or Higher

Invoice

Invoice

Highway

Claimed

Tax

Fuel Tax

Sales

Fuel Tax

Date

Gallons

Gallons

Gallons

Rate

Paid

Tax

Credit

$

01/01/2016

to end of

$0.295

$

$

tax year

41-036a (04/23/17)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2