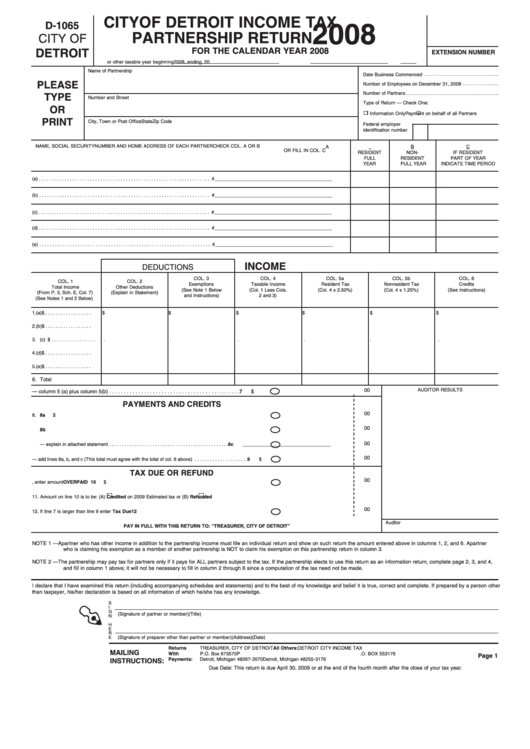

Form D-1065 - City Of Detroit Income Tax Partnership Return - 2008

ADVERTISEMENT

CITY OF DETROIT INCOME TAX

D-1065

2008

PARTNERSHIP RETURN

CITY OF

FOR THE CALENDAR YEAR 2008

DETROIT

EXTENSION NUMBER

or other taxable year beginning

2008, ending

, 20

Name of Partnership

Date Business Commenced

PLEASE

Number of Employees on December 31, 2008

Number of Partners

TYPE

Number and Street

Type of Return — Check One:

OR

Information Only

Payment on behalf of all Partners

PRINT

City, Town or Post Office

State

Zip Code

Federal employer

identification number

NAME, SOCIAL SECURITY NUMBER AND HOME ADDRESS OF EACH PARTNER

CHECK COL. A OR B

A

B

C

OR FILL IN COL. C

RESIDENT

NON-

IF RESIDENT

FULL

RESIDENT

PART OF YEAR

YEAR

FULL YEAR

INDICATE TIME PERIOD

(a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .S.S. #____________________________________________

(b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .S.S. #____________________________________________

(c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .S.S. #____________________________________________

(d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .S.S. #____________________________________________

(e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .S.S. #____________________________________________

INCOME

DEDUCTIONS

COL. 3

COL. 4

COL. 5a

COL. 5b

COL. 6

COL. 1

COL. 2

Exemptions

Taxable Income

Resident Tax

Nonresident Tax

Credits

Total Income

Other Deductions

(See Note 1 Below

(Col. 1 Less Cols.

(Col. 4 x 2.50%)

(Col. 4 x 1.25%)

(See Instructions)

(From P. 3, Sch. E, Col. 7)

(Explain in Statement)

and Instructions)

2 and 3)

(See Notes 1 and 2 Below)

1. (a) $ . . . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . . . . . . . . .

$ . . . . . . . . . . . . . . . . . . . . . .

2. (b) $ . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

3. (c) $ . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

4. (d) $ . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

5. (e) $ . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . .

6. Total

AUDITOR RESULTS

00

7. Total Tax — column 5 (a) plus column 5(b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

$ . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PAYMENTS AND CREDITS

00

8. a. Tax paid with tenative return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8a

$ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

b. Payments and credits on 2008 Declaration of Estimated Detroit Income Tax . . . . . . . . . . . . . . . . . . . . . . . . 8b

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

c. Other credits — explain in attached statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c

_________________________________

00

9. Total — add lines 8a, b, and c (This total must agree with the total of col. 6 above) . . . . . . . . . . . . . . . . . . . . . 9

$ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

TAX DUE OR REFUND

00

10. If line 9 is larger than line 7, enter amount OVERPAID . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

$ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Amount on line 10 is to be: (A)

Credited on 2009 Estimated tax or (B)

Refunded

00

12. If line 7 is larger than line 9 enter Tax Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Auditor

PAY IN FULL WITH THIS RETURN TO: “TREASURER, CITY OF DETROIT”

NOTE 1 —

A partner who has other income in addition to the partnership income must file an individual return and show on such return the amount entered above in columns 1, 2, and 6. A partner

who is claiming his exemption as a member of another partnership is NOT to claim his exemption on this partnership return in column 3.

NOTE 2 —

The partnership may pay tax for partners only if it pays for ALL partners subject to the tax. If the partnership elects to use this return as an information return, complete page 2, 3, and 4,

and fill in column 1 above; it will not be necessary to fill in column 2 through 6 since a computation of the tax need not be made.

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct and complete. If prepared by a person other

than taxpayer, his/her declaration is based on all information of which he/she has any knowledge.

S

I

G

(Signature of partner or member)

(Title)

N

H

E

R

E

(Signature of preparer other than partner or member)

(Address)

(Date)

Returns

TREASURER, CITY OF DETROIT

All Others:

DETROIT CITY INCOME TAX

MAILING

With

P.O. Box 673570

P.O. BOX 553176

Page 1

Payments:

Detroit, Michigan 48267-3570

Detroit, Michigan 48255-3176

INSTRUCTIONS:

Due Date: This return is due April 30, 2009 or at the end of the fourth month after the close of your tax year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4