Form Wv/mft-511b - Exporter Schedule Of Disbursements - 2003

ADVERTISEMENT

WEST VIRGINIA STATE TAX DEPARTMENT

WV/MFT-511 B

Org. (5/03)

INTERNAL AUDITING DIVISION

P O BOX 2991

Charleston, WV 25330-2991

(304) 558-8500

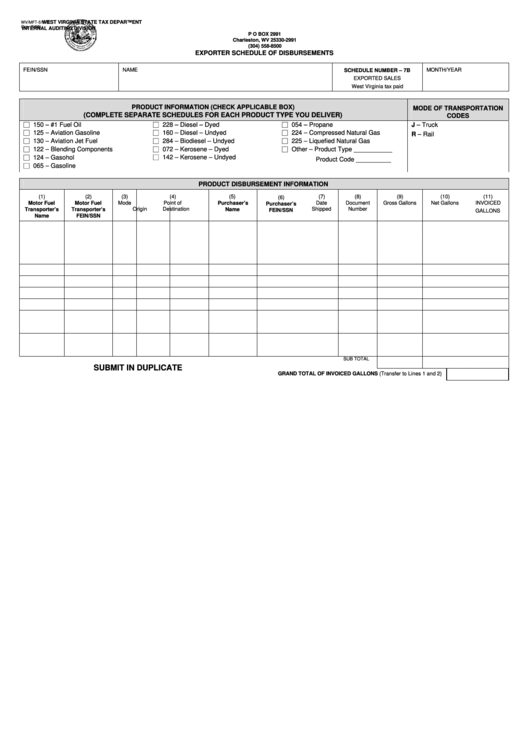

EXPORTER SCHEDULE OF DISBURSEMENTS

FEIN/SSN

NAME

MONTH/YEAR

SCHEDULE NUMBER – 7B

EXPORTED SALES

West Virginia tax paid

PRODUCT INFORMATION (CHECK APPLICABLE BOX)

MODE OF TRANSPORTATION

(COMPLETE SEPARATE SCHEDULES FOR EACH PRODUCT TYPE YOU DELIVER)

CODES

□ 150 – #1 Fuel Oil

□ 228 – Diesel – Dyed

□ 054 – Propane

J – Truck

□ 125 – Aviation Gasoline

□ 160 – Diesel – Undyed

□ 224 – Compressed Natural Gas

R – Rail

□ 130 – Aviation Jet Fuel

□ 284 – Biodiesel – Undyed

□ 225 – Liquefied Natural Gas

□ 122 – Blending Components

□ 072 – Kerosene – Dyed

□ Other – Product Type ___________

□ 124 – Gasohol

□ 142 – Kerosene – Undyed

Product Code __________

□ 065 – Gasoline

PRODUCT DISBURSEMENT INFORMATION

(1)

(2)

(3)

(4)

(5)

(7)

(8)

(9)

(10)

(11)

(6)

Motor Fuel

Motor Fuel

Mode

Point of

Purchaser’s

Date

Document

Gross Gallons

Net Gallons

INVOICED

Purchaser’s

Origin

Destination

Shipped

Number

Transporter’s

Transporter’s

Name

FEIN/SSN

GALLONS

Name

FEIN/SSN

SUB TOTAL

SUBMIT IN DUPLICATE

GRAND TOTAL OF INVOICED GALLONS (Transfer to Lines 1 and 2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2