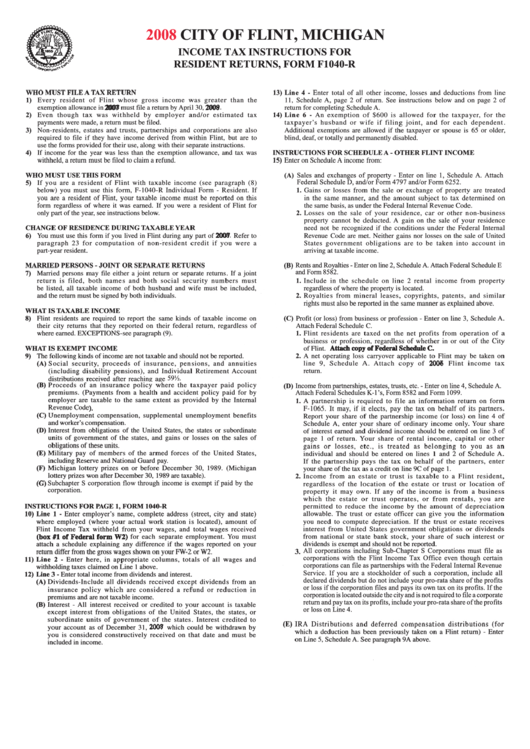

Income Tax Instructions For Resident Returns, Form F1040-R - City Of Flint, Michigan

ADVERTISEMENT

2008

CITY OF FLINT, MICHIGAN

INCOME TAX INSTRUCTIONS FOR

RESIDENT RETURNS, FORM F1040-R

2007

2008

2007

2008

2008

2009.

2007

2007

2007

2008

2008

2008

2007

2008

2007

2008

Sales and exchanges of property - Enter on line 1, Schedule A. Attach

Federal Schedule D, and/or Form 4797 and/or Form 6252.

2007

2007

2008.

2007

2007

2007

2007

2007

Rents and Royalties - Enter on line 2, Schedule A. Attach Federal Schedule E

and Form 8582.

Attach copy of Federal Schedule C.

Attach copy of Federal Schedule C.

Attach copy of Federal Schedule C.

2006

Attach copy of Federal Schedule C.

Attach copy of Federal Schedule C.

Attach copy of Federal Schedule C.

2006

Attach copy of Federal Schedule C.

2007

2006

2006

2006

2006

2006

59½.

Income from partnerships, estates, trusts, etc. - Enter on line 4, Schedule A.

Attach Federal Schedules K-1’s, Form 8582 and Form 1099.

). ).

).

).

).

).

).

Subchapter S corporation flow through income is exempt if paid by the

corporation.

(box #1 of Federal form W2)

(box #1 of Federal form W2)

(box #1 of Federal form W2)

(box #1 of Federal form W2)

(box #1 of Federal form W2)

(box #1 of Federal form W2)

All corporations including Sub-Chapter S Corporations must file as

(box #1 of Federal form W2)

corporations with the Flint Income Tax Office even though certain

corporations can file as partnerships with the Federal Internal Revenue

Service. If you are a stockholder of such a corporation, include all

declared dividends but do not include your pro-rata share of the profits

or loss if the corporation files and pays its own tax on its profits. If the

corporation is located outside the city and is not required to file a corporate

return and pay tax on its profits, include your pro-rata share of the profits

or loss on Line 4.

2007

2008

2007

2007

2007

2007

2007

2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2