25-102

b.

PRINT FORM

RESET FORM

(Rev.1-10/16)

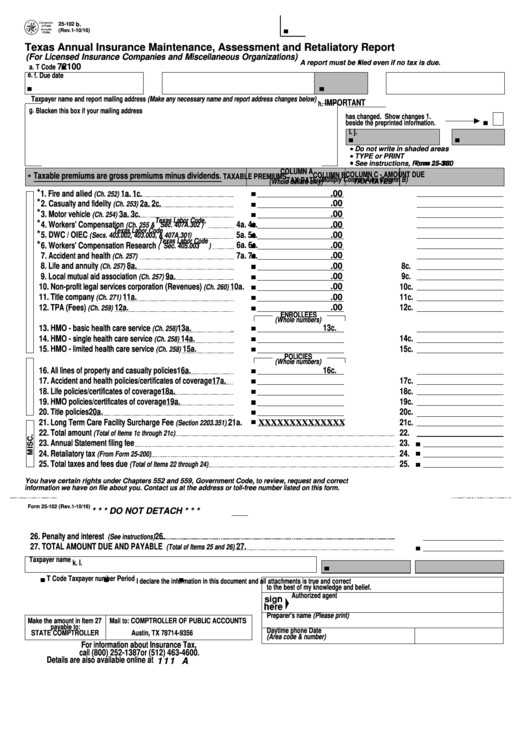

Texas Annual Insurance Maintenance, Assessment and Retaliatory Report

(For Licensed Insurance Companies and Miscellaneous Organizations)

A report must be filed even if no tax is due.

72100

a. T Code

e.

c.Taxpayer number

d. Filing period

f. Due date

Taxpayer name and report mailing address (Make any necessary name and report address changes below)

IMPORTANT

h.

g.

Blacken this box if your mailing address

has changed. Show changes

1.

beside the preprinted information.

i.

j.

Do not write in shaded areas

TYPE or PRINT

See instructions, Form 25-300

Form 25-300

COLUMN A

COLUMN C - AMOUNT DUE

* Taxable premiums are gross premiums minus dividends.

COLUMN B

TAXABLE PREMIUMS

(Multiply Column A by Column B)

TAX RATE

(Whole dollars only)

TAX RATES

* 1. Fire and allied

1a.

1c.

.00

(Ch. 252)

* 2. Casualty and fidelity

2a.

2c.

.00

(Ch. 253)

*

3. Motor vehicle

3a.

3c.

.00

(Ch. 254)

Texas Labor Code,

*

4. Workers' Compensation

4a.

4c.

.00

(Ch. 255 &

Sec. 407A.302 )

Texas Labor Code

*

5. DWC / OIEC

5a.

5c.

.00

(Secs. 403.002, 403.003, & 407A.301

)

Texas Labor Code

*

6. Workers' Compensation Research

6a.

6c.

.00

(

Sec. 405.003

)

7. Accident and health

7a.

7c.

.00

(Ch. 257)

8. Life and annuity

8a.

8c.

.00

(Ch. 257)

9. Local mutual aid association

9a.

9c.

.00

(Ch. 257)

10. Non-profit legal services corporation (Revenues)

10a.

10c.

.00

(Ch. 260)

11. Title company

11a.

11c.

.00

(Ch. 271)

12. TPA (Fees)

12a.

12c.

.00

(Ch. 259)

ENROLLEES

(Whole numbers)

13. HMO - basic health care service

13a.

13c.

(Ch. 258)

14. HMO - single health care service

14a.

14c.

(Ch. 258)

15. HMO - limited health care service

15a.

15c.

(Ch. 258)

POLICIES

(Whole numbers)

16. All lines of property and casualty policies

16a.

16c.

17. Accident and health policies/certificates of coverage

17a.

17c.

18. Life policies/certificates of coverage

18a.

18c.

19. HMO policies/certificates of coverage

19a.

19c.

20. Title policies

20a.

20c.

21. Long Term Care Facility Surcharge Fee

21a.

21c.

(Section 2203.351)

XXXXXXXXXXXXXX

22. Total amount

22.

(Total of Items 1c through 21c)

23. Annual Statement filing fee

23.

24. Retaliatory tax

24.

(From Form 25-200)

25. Total taxes and fees due

25.

(Total of Items 22 through 24)

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct

information we have on file about you. Contact us at the address or toll-free number listed on this form.

Form 25-102 (Rev.1-10/16)

* * * DO NOT DETACH * * *

26. Penalty and interest

26.

(See instructions)

27. TOTAL AMOUNT DUE AND PAYABLE

27.

(Total of Items 25 and 26)

Taxpayer name

k.

l.

T Code

Taxpayer number

Period

I declare the information in this document and all attachments is true and correct

to the best of my knowledge and belief.

Authorized agent

Preparer's name (Please print)

Make the amount in Item 27

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

payable to:

P.O. Box 149356

Daytime phone

Date

STATE COMPTROLLER

Austin, TX 78714-9356

(Area code & number)

For information about Insurance Tax,

call (800) 252-1387or (512) 463-4600.

Details are also available online at

111 A

1

1