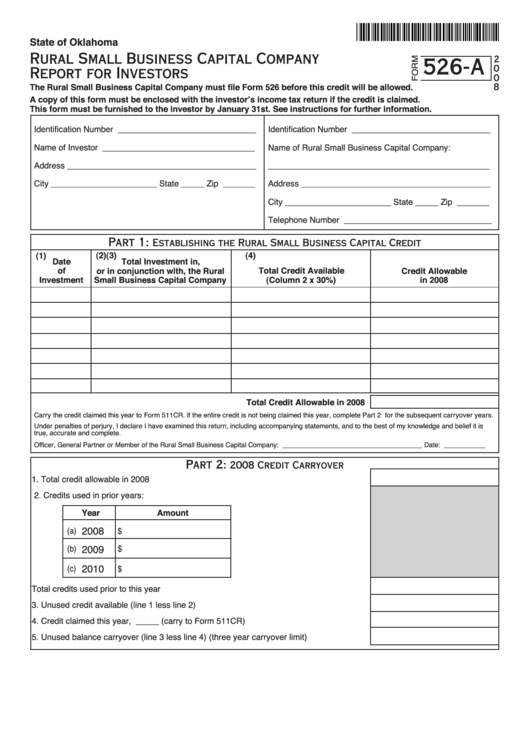

State of Oklahoma

Rural Small Business Capital Company

526-A

2

0

Report for Investors

0

8

The Rural Small Business Capital Company must file Form 526 before this credit will be allowed.

A copy of this form must be enclosed with the investor’s income tax return if the credit is claimed.

This form must be furnished to the investor by January 31st. See instructions for further information.

Identification Number ______________________________

Identification Number ______________________________

Name of Investor _________________________________

Name of Rural Small Business Capital Company:

Address _________________________________________

________________________________________________

City _______________________ State _____ Zip _______

Address _________________________________________

City _______________________ State _____ Zip _______

Telephone Number ________________________________

Part 1:

Establishing the Rural Small Business Capital Credit

(1)

(2)

(3)

(4)

Date

Total Investment in,

of

or in conjunction with, the Rural

Total Credit Available

Credit Allowable

Investment

Small Business Capital Company

(Column 2 x 30%)

in 2008

Total Credit Allowable in 2008

Carry the credit claimed this year to Form 511CR. If the entire credit is not being claimed this year, complete Part 2 for the subsequent carryover years.

Under penalties of perjury, I declare I have examined this return, including accompanying statements, and to the best of my knowledge and belief it is

true, accurate and complete.

Officer, General Partner or Member of the Rural Small Business Capital Company: _____________________________________ Date: ___________

Part 2:

2008 Credit Carryover

1.

Total credit allowable in 2008 ............................................................................... 1.

2.

Credits used in prior years:

Year

Amount

2008

(a)

$

(b)

2009

$

2010

(c)

$

Total credits used prior to this year . ......................................................... 2.

3.

Unused credit available (line 1 less line 2) ........................................................... 3.

4.

Credit claimed this year, _____ (carry to Form 511CR) ...................................... 4.

5.

Unused balance carryover (line 3 less line 4) (three year carryover limit) . ........... 5.

1

1