Washington State Estate And Transfer Tax Return Form - Washington Department Of Revenue

ADVERTISEMENT

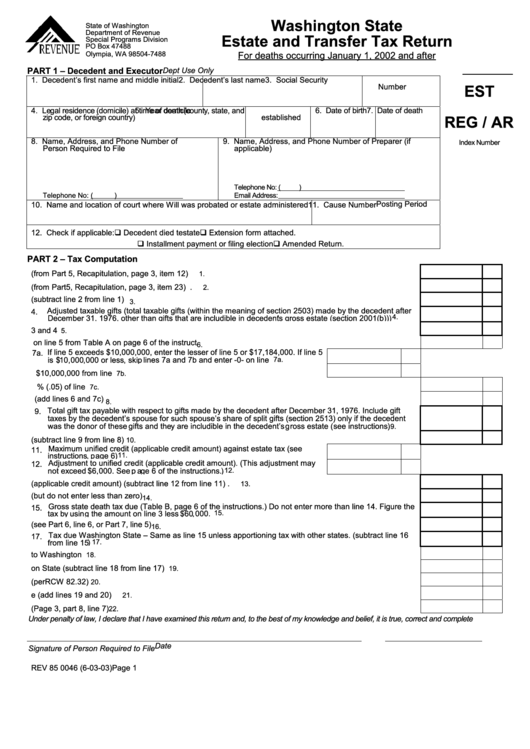

Washington State

State of Washington

Department of Revenue

Estate and Transfer Tax Return

Special Programs Division

PO Box 47488

For deaths occurring January 1, 2002 and after

Olympia, WA 98504-7488

PART 1 – Decedent and Executor

Dept Use Only

1. Decedent’s first name and middle initial

2. Decedent’s last name

3. Social Security

Number

EST

4. Legal residence (domicile) at time of death (county, state, and

5. Year domicile

6. Date of birth

7. Date of death

zip code, or foreign country)

established

REG / AR

8. Name, Address, and Phone Number of

9. Name, Address, and Phone Number of Preparer (if

Index Number

Person Required to File

applicable)

Telephone No: (

)

Telephone No: (

)

Email Address:

Posting Period

10. Name and location of court where Will was probated or estate administered

11. Cause Number

12. Check if applicable:

! Decedent died testate

! Extension form attached.

! Installment payment or filing election

! Amended Return.

PART 2 – Tax Computation

1.

Total gross estate less exclusion (from Part 5, Recapitulation, page 3, item 12) ............................................

1.

2.

Total allowable deductions (from Part 5, Recapitulation, page 3, item 23) .....................................................

2.

3.

Taxable estate (subtract line 2 from line 1) ....................................................................................................

3.

Adjusted taxable gifts (total taxable gifts (within the meaning of section 2503) made by the decedent after

4.

4.

December 31, 1976, other than gifts that are includible in decedent’s gross estate (section 2001(b))) ..........

5.

Add lines 3 and 4 ............................................................................................................................................

5.

6.

Tentative tax on the amount on line 5 from Table A on page 6 of the instructions..........................................

6.

7a. If line 5 exceeds $10,000,000, enter the lesser of line 5 or $17,184,000. If line 5

is $10,000,000 or less, skip lines 7a and 7b and enter -0- on line 7c...................

7a.

b. Subtract $10,000,000 from line 7a. ......................................................................

7b.

c. Enter 5% (.05) of line 7b .................................................................................................................................

7c.

8. Total tentative tax (add lines 6 and 7c) ...........................................................................................................

8.

9. Total gift tax payable with respect to gifts made by the decedent after December 31, 1976. Include gift

taxes by the decedent’s spouse for such spouse’s share of split gifts (section 2513) only if the decedent

was the donor of these gifts and they are includible in the decedent’s gross estate (see instructions)...........

9.

10. Gross estate tax (subtract line 9 from line 8) ..................................................................................................

10.

11. Maximum unified credit (applicable credit amount) against estate tax (see

instructions, page 6)..........................................................................................

11.

12. Adjustment to unified credit (applicable credit amount). (This adjustment may

not exceed $6,000. See page 6 of the instructions.) ............................................

12.

13. Allowable unified credit (applicable credit amount) (subtract line 12 from line 11) ..........................................

13.

14. Subtract line 13 from line 10 (but do not enter less than zero)........................................................................

14.

15. Gross state death tax due (Table B, page 6 of the instructions.) Do not enter more than line 14. Figure the

15.

tax by using the amount on line 3 less $60,000. .............................................................................................

16. State death taxes allocable to other states (see Part 6, line 6, or Part 7, line 5)....................................................

16.

17. Tax due Washington State – Same as line 15 unless apportioning tax with other states. (subtract line 16

from line 15) ....................................................................................................................................................

17.

18. Tax previously paid to Washington State........................................................................................................

18.

19. Balance due Washington State (subtract line 18 from line 17) .......................................................................

19.

20. Interest (per RCW 82.32)................................................................................................................................

20.

21. Total tax and interest due (add lines 19 and 20) .............................................................................................

21.

22. Washington State GST Tax (Page 3, part 8, line 7) ........................................................................................

22.

Under penalty of law, I declare that I have examined this return and, to the best of my knowledge and belief, it is true, correct and complete

Date

Signature of Person Required to File

REV 85 0046 (6-03-03)

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3