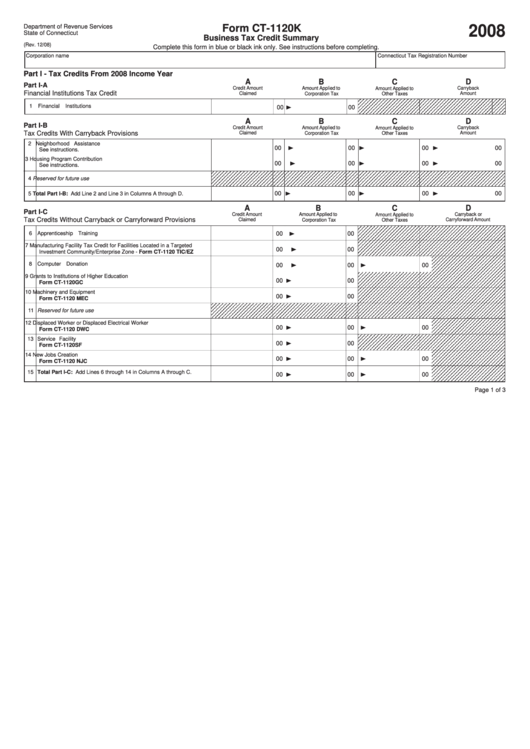

Form Ct-1120k - Business Tax Credit Summary - 2008

ADVERTISEMENT

Department of Revenue Services

Form CT-1120K

2008

State of Connecticut

Business Tax Credit Summary

(Rev. 12/08)

Complete this form in blue or black ink only. See instructions before completing.

Corporation name

Connecticut Tax Registration Number

Part I - Tax Credits From 2008 Income Year

A

B

C

D

Part I-A

Credit Amount

Amount Applied to

Carryback

Amount Applied to

Financial Institutions Tax Credit

Claimed

Amount

Corporation Tax

Other Taxes

1

Financial Institutions

00

00

A

B

D

C

Part I-B

Credit Amount

Amount Applied to

Amount Applied to

Carryback

Tax Credits With Carryback Provisions

Claimed

Corporation Tax

Other Taxes

Amount

2

Neighborhood Assistance

00

00

00

00

See instructions.

3

Housing Program Contribution

00

00

00

00

See instructions.

4

Reserved for future use

5

Total Part I-B: Add Line 2 and Line 3 in Columns A through D.

00

00

00

00

A

B

C

D

Part I-C

Credit Amount

Carryback or

Amount Applied to

Amount Applied to

Tax Credits Without Carryback or Carryforward Provisions

Claimed

Corporation Tax

Other Taxes

Carryforward Amount

6

Apprenticeship Training

00

00

7

Manufacturing Facility Tax Credit for Facilities Located in a Targeted

00

00

Investment Community/Enterprise Zone - Form CT-1120 TIC/EZ

8

Computer Donation

00

00

00

9

Grants to Institutions of Higher Education

00

00

Form CT-1120GC

10 Machinery and Equipment

00

00

Form CT-1120 MEC

11 Reserved for future use

12 Displaced Worker or Displaced Electrical Worker

00

00

00

Form CT-1120 DWC

13 Service Facility

00

00

Form CT-1120SF

14 New Jobs Creation

00

00

00

Form CT-1120 NJC

15 Total Part I-C: Add Lines 6 through 14 in Columns A through C.

00

00

00

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3