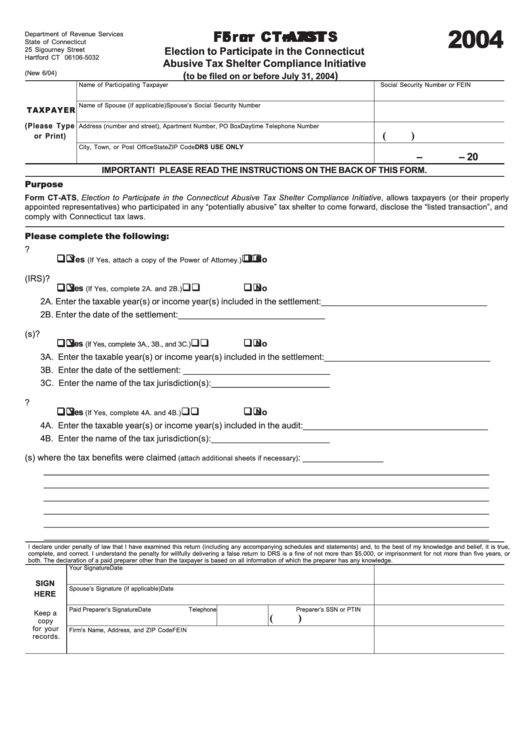

Form Ct-Ats - Election To Participate In The Connecticut Abusive Tax Shelter Compliance Initiative - 2004

ADVERTISEMENT

2004

F F F F F or

or

or m CT

or

m CT

m CT

m CT- - - - - A A A A A TS

TS

TS

TS

or

m CT

TS

Department of Revenue Services

State of Connecticut

Election to Participate in the Connecticut

25 Sigourney Street

Hartford CT 06106-5032

Abusive Tax Shelter Compliance Initiative

(New 6/04)

(

)

to be filed on or before July 31, 2004

Name of Participating Taxpayer

Social Security Number or FEIN

Name of Spouse (if applicable)

Spouse’s Social Security Number

TAXPAYER

(Please Type

Address (number and street), Apartment Number, PO Box

Daytime Telephone Number

(

)

or Print)

DRS USE ONLY

City, Town, or Post Office

State

ZIP Code

–

– 20

IMPORTANT! PLEASE READ THE INSTRUCTIONS ON THE BACK OF THIS FORM.

Purpose

Form CT-ATS, Election to Participate in the Connecticut Abusive Tax Shelter Compliance Initiative, allows taxpayers (or their properly

appointed representatives) who participated in any “potentially abusive” tax shelter to come forward, disclose the “listed transaction”, and

comply with Connecticut tax laws.

Please complete the following:

1. Has a Power of Attorney been properly completed for the taxpayer?

Yes

No

(If Yes, attach a copy of the Power of Attorney.)

2. Has the taxpayer been audited or participated in a settlement of this transaction with the Internal Revenue Service (IRS)?

Yes

No

(If Yes, complete 2A. and 2B.)

2A. Enter the taxable year(s) or income year(s) included in the settlement: ___________________________________

2B. Enter the date of the settlement: _______________________________

3. Has the taxpayer been audited or participated in a settlement of this transaction with another tax jurisdiction(s)?

Yes

No

(If Yes, complete 3A., 3B., and 3C.)

3A. Enter the taxable year(s) or income year(s) included in the settlement: ___________________________________

3B. Enter the date of the settlement: _______________________________

3C. Enter the name of the tax jurisdiction(s): _________________________

4. Is the taxpayer currently under audit by the IRS or another tax jurisdiction?

Yes

No

(If Yes, complete 4A. and 4B.)

4A. Enter the taxable year(s) or income year(s) included in the audit: _______________________________________

4B. Enter the name of the tax jurisdiction(s): _________________________

5. Describe the transaction(s) where the tax benefits were claimed

: _________________

(attach additional sheets if necessary)

______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true,

complete, and correct. I understand the penalty for willfully delivering a false return to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or

both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Your Signature

Date

SIGN

Spouse’s Signature (if applicable)

Date

HERE

Paid Preparer’s Signature

Date

Telephone

Preparer’s SSN or PTIN

Keep a

(

)

copy

for your

Firm’s Name, Address, and ZIP Code

FEIN

records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2