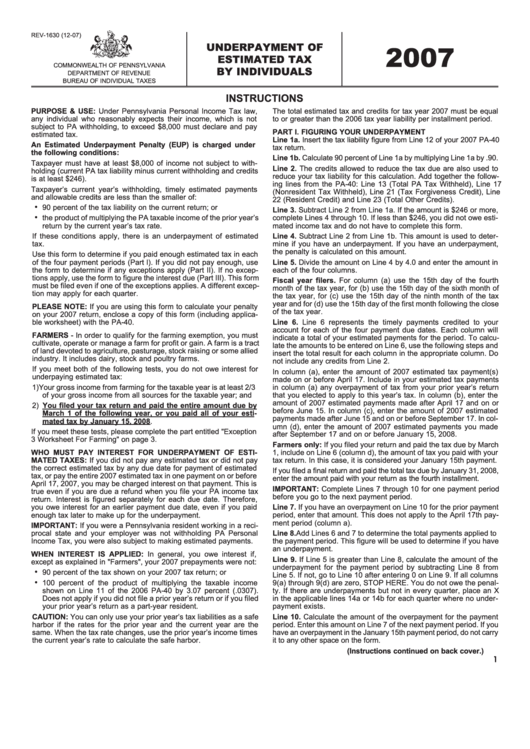

Instructions For Form Rev-1630 - Underpayment Of Estimated Tax Dy Individuals - 2007

ADVERTISEMENT

REV-1630 (12-07)

UNDERPAYMENT OF

2007

ESTIMATED TAX

COMMONWEALTH OF PENNSYLVANIA

BY INDIVIDUALS

DEPARTMENT OF REVENUE

BUREAU OF INDIVIDUAL TAXES

INSTRUCTIONS

PURPOSE & USE: Under Pennsylvania Personal Income Tax law,

The total estimated tax and credits for tax year 2007 must be equal

any individual who reasonably expects their income, which is not

to or greater than the 2006 tax year liability per installment period.

subject to PA withholding, to exceed $8,000 must declare and pay

PART l. FIGURING YOUR UNDERPAYMENT

estimated tax.

Line 1a. Insert the tax liability figure from Line 12 of your 2007 PA-40

An Estimated Underpayment Penalty (EUP) is charged under

tax return.

the following conditions:

Line 1b. Calculate 90 percent of Line 1a by multiplying Line 1a by .90.

Taxpayer must have at least $8,000 of income not subject to with-

Line 2. The credits allowed to reduce the tax due are also used to

holding (current PA tax liability minus current withholding and credits

reduce your tax liability for this calculation. Add together the follow-

is at least $246).

ing lines from the PA-40: Line 13 (Total PA Tax Withheld), Line 17

Taxpayer’s current year’s withholding, timely estimated payments

(Nonresident Tax Withheld), Line 21 (Tax Forgiveness Credit), Line

and allowable credits are less than the smaller of:

22 (Resident Credit) and Line 23 (Total Other Credits).

•

90 percent of the tax liability on the current return; or

Line 3. Subtract Line 2 from Line 1a. If the amount is $246 or more,

•

the product of multiplying the PA taxable income of the prior year’s

complete Lines 4 through 10. If less than $246, you did not owe esti-

return by the current year’s tax rate.

mated income tax and do not have to complete this form.

If these conditions apply, there is an underpayment of estimated

Line 4. Subtract Line 2 from Line 1b. This amount is used to deter-

tax.

mine if you have an underpayment. If you have an underpayment,

the penalty is calculated on this amount.

Use this form to determine if you paid enough estimated tax in each

of the four payment periods (Part l). If you did not pay enough, use

Line 5. Divide the amount on Line 4 by 4.0 and enter the amount in

the form to determine if any exceptions apply (Part II). If no excep-

each of the four columns.

tions apply, use the form to figure the interest due (Part III). This form

Fiscal year filers. For column (a) use the 15th day of the fourth

must be filed even if one of the exceptions applies. A different excep-

month of the tax year, for (b) use the 15th day of the sixth month of

tion may apply for each quarter.

the tax year, for (c) use the 15th day of the ninth month of the tax

year and for (d) use the 15th day of the first month following the close

PLEASE NOTE: If you are using this form to calculate your penalty

of the tax year.

on your 2007 return, enclose a copy of this form (including applica-

ble worksheet) with the PA-40.

Line 6. Line 6 represents the timely payments credited to your

account for each of the four payment due dates. Each column will

FARMERS - In order to qualify for the farming exemption, you must

indicate a total of your estimated payments for the period. To calcu-

cultivate, operate or manage a farm for profit or gain. A farm is a tract

late the amounts to be entered on Line 6, use the following steps and

of land devoted to agriculture, pasturage, stock raising or some allied

insert the total result for each column in the appropriate column. Do

industry. It includes dairy, stock and poultry farms.

not include any credits from Line 2.

If you meet both of the following tests, you do not owe interest for

In column (a), enter the amount of 2007 estimated tax payment(s)

underpaying estimated tax:

made on or before April 17. Include in your estimated tax payments

1) Your gross income from farming for the taxable year is at least 2/3

in column (a) any overpayment of tax from your prior year’s return

of your gross income from all sources for the taxable year; and

that you elected to apply to this year’s tax. In column (b), enter the

amount of 2007 estimated payments made after April 17 and on or

2) You filed your tax return and paid the entire amount due by

before June 15. In column (c), enter the amount of 2007 estimated

March 1 of the following year, or you paid all of your esti-

payments made after June 15 and on or before September 17. In col-

mated tax by January 15, 2008.

umn (d), enter the amount of 2007 estimated payments you made

If you meet these tests, please complete the part entitled "Exception

after September 17 and on or before January 15, 2008.

3 Worksheet For Farming" on page 3.

Farmers only: If you filed your return and paid the tax due by March

WHO MUST PAY INTEREST FOR UNDERPAYMENT OF ESTI-

1, include on Line 6 (column d), the amount of tax you paid with your

MATED TAXES: If you did not pay any estimated tax or did not pay

tax return. In this case, it is considered your January 15th payment.

the correct estimated tax by any due date for payment of estimated

If you filed a final return and paid the total tax due by January 31, 2008,

tax, or pay the entire 2007 estimated tax in one payment on or before

enter the amount paid with your return as the fourth installment.

April 17, 2007, you may be charged interest on that payment. This is

IMPORTANT: Complete Lines 7 through 10 for one payment period

true even if you are due a refund when you file your PA income tax

before you go to the next payment period.

return. Interest is figured separately for each due date. Therefore,

you owe interest for an earlier payment due date, even if you paid

Line 7. If you have an overpayment on Line 10 for the prior payment

enough tax later to make up for the underpayment.

period, enter that amount. This does not apply to the April 17th pay-

ment period (column a).

IMPORTANT: If you were a Pennsylvania resident working in a reci-

procal state and your employer was not withholding PA Personal

Line 8. Add Lines 6 and 7 to determine the total payments applied to

Income Tax, you were also subject to making estimated payments.

the payment period. This figure will be used to determine if you have

an underpayment.

WHEN INTEREST IS APPLIED: In general, you owe interest if,

Line 9. If Line 5 is greater than Line 8, calculate the amount of the

except as explained in "Farmers", your 2007 prepayments were not:

underpayment for the payment period by subtracting Line 8 from

•

90 percent of the tax shown on your 2007 tax return; or

Line 5. If not, go to Line 10 after entering 0 on Line 9. If all columns

•

100 percent of the product of multiplying the taxable income

9(a) through 9(d) are zero, STOP HERE. You do not owe the penal-

shown on Line 11 of the 2006 PA-40 by 3.07 percent (.0307).

ty. If there are underpayments but not in every quarter, place an X

Does not apply if you did not file a prior year’s return or if you filed

in the applicable lines 14a or 14b for each quarter where no under-

your prior year’s return as a part-year resident.

payment exists.

CAUTION: You can only use your prior year’s tax liabilities as a safe

Line 10. Calculate the amount of the overpayment for the payment

harbor if the rates for the prior year and the current year are the

period. Enter this amount on Line 7 of the next payment period. If you

same. When the tax rate changes, use the prior year’s income times

have an overpayment in the January 15th payment period, do not carry

the current year’s rate to calculate the safe harbor.

it to any other space on the form.

(Instructions continued on back cover.)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2