Form 200f - Request To Change Franchise Tax Filing Period

ADVERTISEMENT

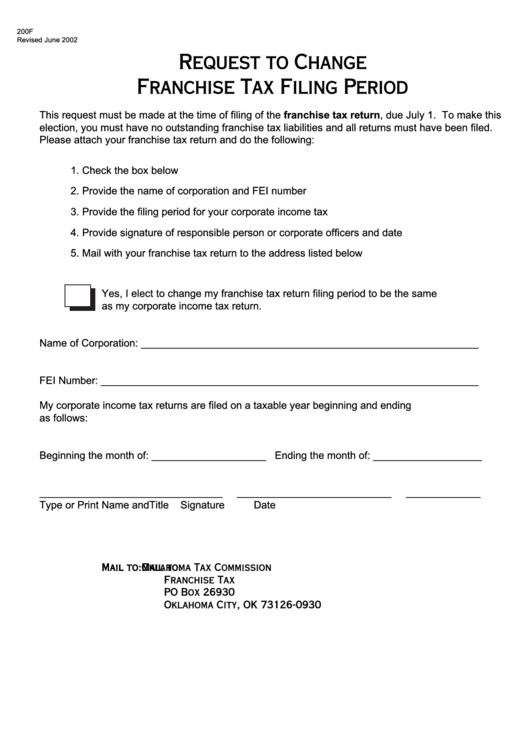

200F

Revised June 2002

Request to Change

Franchise Tax Filing Period

This request must be made at the time of filing of the franchise tax return, due July 1. To make this

election, you must have no outstanding franchise tax liabilities and all returns must have been filed.

Please attach your franchise tax return and do the following:

1. Check the box below

2. Provide the name of corporation and FEI number

3. Provide the filing period for your corporate income tax

4. Provide signature of responsible person or corporate officers and date

5. Mail with your franchise tax return to the address listed below

Yes, I elect to change my franchise tax return filing period to be the same

as my corporate income tax return.

Name of Corporation: ___________________________________________________________

FEI Number: __________________________________________________________________

My corporate income tax returns are filed on a taxable year beginning and ending

as follows:

Beginning the month of: ____________________ Ending the month of: ___________________

________________________________

___________________________

_____________

Type or Print Name andTitle

Signature

Date

Mail to:

Mail to:

Mail to:

Mail to:

Mail to:

Oklahoma Tax Commission

Franchise Tax

PO Box 26930

Oklahoma City, OK 73126-0930

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1