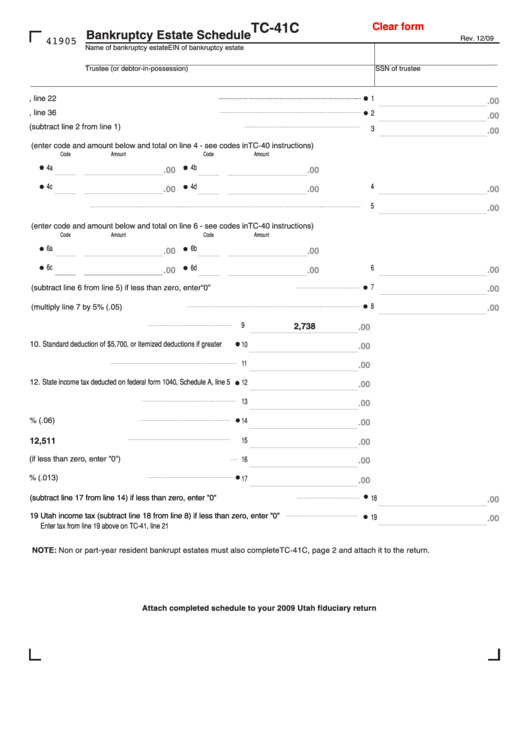

Clear form

TC-41C

Bankruptcy Estate Schedule

Rev. 12/09

41905

Name of bankruptcy estate

EIN of bankruptcy estate

Trustee (or debtor-in-possession)

SSN of trustee

1. Federal total income from federal form 1040, line 22

1

.00

2. Federal adjustments from federal form 1040, line 36

2

.00

3. Federal adjusted gross income (subtract line 2 from line 1)

3

.00

4. Additions to income (enter code and amount below and total on line 4 - see codes in TC-40 instructions)

Code

Amount

Code

Amount

4b

4a

.00

.00

4c

4d

4

.00

.00

.00

5

5. Add lines 3 and 4

.00

6. Deductions from income (enter code and amount below and total on line 6 - see codes in TC-40 instructions)

Code

Amount

Code

Amount

6a

6b

.00

.00

6c

6d

6

.00

.00

.00

7

7. Utah taxable income (subtract line 6 from line 5) if less than zero, enter “0”

.00

8

8. Tax calculation (multiply line 7 by 5% (.05)

.00

9. Personal exemption deduction

9

2,738

.00

10. Standard deduction of $5,700, or itemized deductions if greater

10

.00

11. Add lines 9 and 10

11

.00

12. State income tax deducted on federal form 1040, Schedule A, line 5

12

.00

13. Subtract line 12 from line 11

13

.00

14. Multiply line 13 by 6% (.06)

14

.00

15. Base phase-out amount

15

12,511

.00

16. Subtract line 15 from line 7 (if less than zero, enter "0")

16

.00

17. Multiply line 16 by 1.3% (.013)

17

.00

18. Taxpayer tax credit (subtract line 17 from line 14) if less than zero, enter "0"

18

.00

19 Utah income tax (subtract line 18 from line 8) if less than zero, enter "0"

19

.00

Enter tax from line 19 above on TC-41, line 21

NOTE: Non or part-year resident bankrupt estates must also complete TC-41C, page 2 and attach it to the return.

Attach completed schedule to your 2009 Utah fiduciary return

1

1 2

2