Form 0405-597.13 - Fishery Resource Landing Tax - Alaska Department Of Revenue - 2006

ADVERTISEMENT

Reset

597

Business name

Federal EIN or SSN

Estimated Payment Vouchers

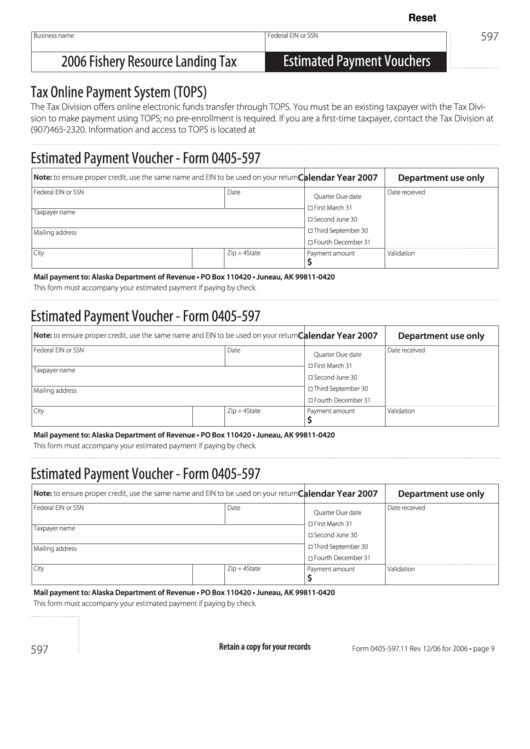

2006 Fishery Resource Landing Tax

Tax Online Payment System (TOPS)

The Tax Division offers online electronic funds transfer through TOPS. You must be an existing taxpayer with the Tax Divi-

sion to make payment using TOPS; no pre-enrollment is required. If you are a first-time taxpayer, contact the Tax Division at

(907)465-2320. Information and access to TOPS is located at

Estimated Payment Voucher - Form 0405-597

Calendar Year 2007

Department use only

Note: to ensure proper credit, use the same name and EIN to be used on your return

Federal EIN or SSN

Date

Date received

Quarter

Due date

First

March 31

Taxpayer name

Second

June 30

Third

September 30

Mailing address

Fourth

December 31

City

State

Zip + 4

Payment amount

Validation

$

Mail payment to: Alaska Department of Revenue • PO Box 110420 • Juneau, AK 99811-0420

This form must accompany your estimated payment if paying by check.

Estimated Payment Voucher - Form 0405-597

Calendar Year 2007

Department use only

Note: to ensure proper credit, use the same name and EIN to be used on your return

Federal EIN or SSN

Date

Date received

Quarter

Due date

First

March 31

Taxpayer name

Second

June 30

Third

September 30

Mailing address

Fourth

December 31

City

State

Zip + 4

Payment amount

Validation

$

Mail payment to: Alaska Department of Revenue • PO Box 110420 • Juneau, AK 99811-0420

This form must accompany your estimated payment if paying by check.

Estimated Payment Voucher - Form 0405-597

Calendar Year 2007

Department use only

Note: to ensure proper credit, use the same name and EIN to be used on your return

Federal EIN or SSN

Date

Date received

Quarter

Due date

First

March 31

Taxpayer name

Second

June 30

Third

September 30

Mailing address

Fourth

December 31

City

State

Zip + 4

Payment amount

Validation

$

Mail payment to: Alaska Department of Revenue • PO Box 110420 • Juneau, AK 99811-0420

This form must accompany your estimated payment if paying by check.

Retain a copy for your records

597

Form 0405-597.11 Rev 12/06 for 2006 • page 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2