Instructions For Form Nyc-114.9 - 2006 - Claim For Made In Nyc Film Production Credit - New York City

ADVERTISEMENT

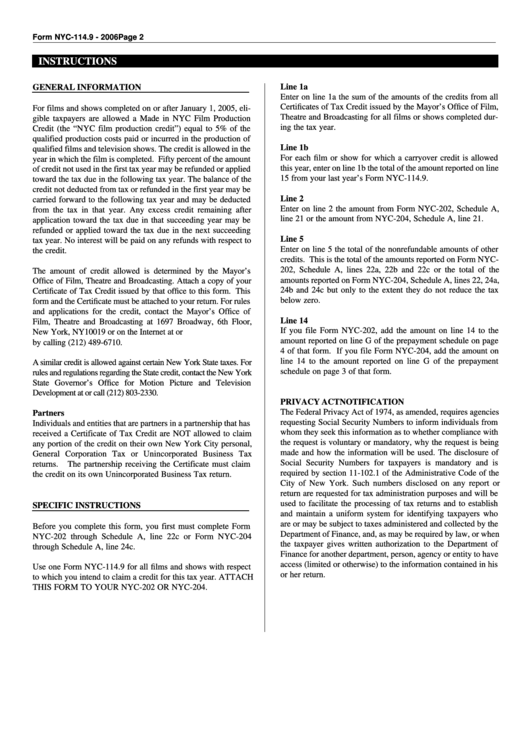

Form NYC-114.9 - 2006

Page 2

INSTRUCTIONS

Line 1a

GENERAL INFORMATION

Enter on line 1a the sum of the amounts of the credits from all

Certificates of Tax Credit issued by the Mayor’s Office of Film,

For films and shows completed on or after January 1, 2005, eli-

Theatre and Broadcasting for all films or shows completed dur-

gible taxpayers are allowed a Made in NYC Film Production

ing the tax year.

Credit (the “NYC film production credit”) equal to 5% of the

qualified production costs paid or incurred in the production of

Line 1b

qualified films and television shows. The credit is allowed in the

For each film or show for which a carryover credit is allowed

year in which the film is completed. Fifty percent of the amount

this year, enter on line 1b the total of the amount reported on line

of credit not used in the first tax year may be refunded or applied

15 from your last year’s Form NYC-114.9.

toward the tax due in the following tax year. The balance of the

credit not deducted from tax or refunded in the first year may be

Line 2

carried forward to the following tax year and may be deducted

Enter on line 2 the amount from Form NYC-202, Schedule A,

from the tax in that year. Any excess credit remaining after

line 21 or the amount from NYC-204, Schedule A, line 21.

application toward the tax due in that succeeding year may be

refunded or applied toward the tax due in the next succeeding

Line 5

tax year. No interest will be paid on any refunds with respect to

Enter on line 5 the total of the nonrefundable amounts of other

the credit.

credits. This is the total of the amounts reported on Form NYC-

202, Schedule A, lines 22a, 22b and 22c or the total of the

The amount of credit allowed is determined by the Mayor’s

amounts reported on Form NYC-204, Schedule A, lines 22, 24a,

Office of Film, Theatre and Broadcasting. Attach a copy of your

24b and 24c but only to the extent they do not reduce the tax

Certificate of Tax Credit issued by that office to this form. This

below zero.

form and the Certificate must be attached to your return. For rules

and applications for the credit, contact the Mayor’s Office of

Line 14

Film, Theatre and Broadcasting at 1697 Broadway, 6th Floor,

If you file Form NYC-202, add the amount on line 14 to the

New York, NY 10019 or on the Internet at or

amount reported on line G of the prepayment schedule on page

by calling (212) 489-6710.

4 of that form. If you file Form NYC-204, add the amount on

line 14 to the amount reported on line G of the prepayment

A similar credit is allowed against certain New York State taxes. For

schedule on page 3 of that form.

rules and regulations regarding the State credit, contact the New York

State Governor’s Office for Motion Picture and Television

Development at nyfilm@empire.state.ny.us or call (212) 803-2330.

PRIVACY ACT NOTIFICATION

The Federal Privacy Act of 1974, as amended, requires agencies

Partners

requesting Social Security Numbers to inform individuals from

Individuals and entities that are partners in a partnership that has

whom they seek this information as to whether compliance with

received a Certificate of Tax Credit are NOT allowed to claim

the request is voluntary or mandatory, why the request is being

any portion of the credit on their own New York City personal,

made and how the information will be used. The disclosure of

General Corporation Tax or Unincorporated Business Tax

Social Security Numbers for taxpayers is mandatory and is

returns.

The partnership receiving the Certificate must claim

required by section 11-102.1 of the Administrative Code of the

the credit on its own Unincorporated Business Tax return.

City of New York. Such numbers disclosed on any report or

return are requested for tax administration purposes and will be

used to facilitate the processing of tax returns and to establish

SPECIFIC INSTRUCTIONS

and maintain a uniform system for identifying taxpayers who

are or may be subject to taxes administered and collected by the

Before you complete this form, you first must complete Form

Department of Finance, and, as may be required by law, or when

NYC-202 through Schedule A, line 22c or Form NYC-204

the taxpayer gives written authorization to the Department of

through Schedule A, line 24c.

Finance for another department, person, agency or entity to have

access (limited or otherwise) to the information contained in his

Use one Form NYC-114.9 for all films and shows with respect

or her return.

to which you intend to claim a credit for this tax year. ATTACH

THIS FORM TO YOUR NYC-202 OR NYC-204.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1