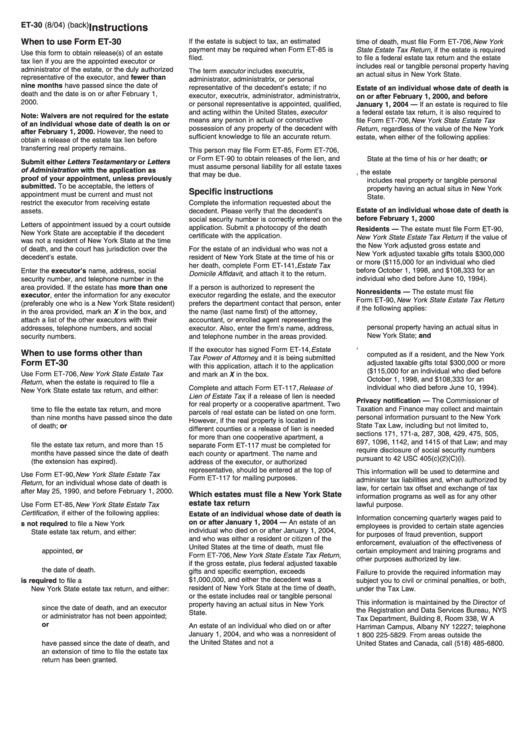

Instructions For Form Et-30 - Release(S) Of Estate Tax Lien - New York State Department Of Taxation And Finance

ADVERTISEMENT

ET-30 (8/04) (back)

Instructions

When to use Form ET-30

If the estate is subject to tax, an estimated

time of death, must file Form ET-706, New York

payment may be required when Form ET-85 is

State Estate Tax Return, if the estate is required

Use this form to obtain release(s) of an estate

filed.

to file a federal estate tax return and the estate

tax lien if you are the appointed executor or

includes real or tangible personal property having

administrator of the estate, or the duly authorized

The term executor includes executrix,

an actual situs in New York State.

representative of the executor, and fewer than

administrator, administratrix, or personal

nine months have passed since the date of

representative of the decedent’s estate; if no

Estate of an individual whose date of death is

death and the date is on or after February 1,

executor, executrix, administrator, administratrix,

on or after February 1, 2000, and before

2000.

or personal representative is appointed, qualified,

January 1, 2004 — If an estate is required to file

and acting within the United States, executor

a federal estate tax return, it is also required to

Note: Waivers are not required for the estate

means any person in actual or constructive

file Form ET-706, New York State Estate Tax

of an individual whose date of death is on or

possession of any property of the decedent with

Return , regardless of the value of the New York

after February 1, 2000. However, the need to

sufficient knowledge to file an accurate return.

estate, when either of the following applies:

obtain a release of the estate tax lien before

transferring real property remains.

This person may file Form ET-85, Form ET-706,

1. The individual was a resident of New York

or Form ET-90 to obtain releases of the lien, and

State at the time of his or her death; or

Submit either Letters Testamentary or Letters

must assume personal liability for all estate taxes

of Administration with the application as

2. In the case of a nonresident, the estate

that may be due.

proof of your appointment, unless previously

includes real property or tangible personal

submitted. To be acceptable, the letters of

property having an actual situs in New York

Specific instructions

appointment must be current and must not

State.

restrict the executor from receiving estate

Complete the information requested about the

Estate of an individual whose date of death is

assets.

decedent. Please verify that the decedent’s

before February 1, 2000

social security number is correctly entered on the

Letters of appointment issued by a court outside

application. Submit a photocopy of the death

Residents — The estate must file Form ET-90,

New York State are acceptable if the decedent

certificate with the application.

New York State Estate Tax Return , if the value of

was not a resident of New York State at the time

the New York adjusted gross estate and

of death, and the court has jurisdiction over the

For the estate of an individual who was not a

New York adjusted taxable gifts totals $300,000

decedent’s estate.

resident of New York State at the time of his or

or more ($115,000 for an individual who died

her death, complete Form ET-141, Estate Tax

before October 1, 1998, and $108,333 for an

Enter the executor’s name, address, social

Domicile Affidavit , and attach it to the return.

individual who died before June 10, 1994).

security number, and telephone number in the

area provided. If the estate has more than one

If a person is authorized to represent the

Nonresidents — The estate must file

executor, enter the information for any executor

executor regarding the estate, and the executor

Form ET-90, New York State Estate Tax Return ,

(preferably one who is a New York State resident)

prefers the department contact that person, enter

if the following applies:

in the area provided, mark an X in the box, and

the name (last name first) of the attorney,

1. The estate includes real property or tangible

attach a list of the other executors with their

accountant, or enrolled agent representing the

personal property having an actual situs in

addresses, telephone numbers, and social

executor. Also, enter the firm’s name, address,

New York State; and

security numbers.

and telephone number in the areas provided.

2. The New York adjusted gross estate,

If the executor has signed Form ET-14, Estate

When to use forms other than

computed as if a resident, and the New York

Tax Power of Attorney , and it is being submitted

Form ET-30

adjusted taxable gifts total $300,000 or more

with this application, attach it to the application

($115,000 for an individual who died before

Use Form ET-706, New York State Estate Tax

and mark an X in the box.

October 1, 1998, and $108,333 for an

Return , when the estate is required to file a

Complete and attach Form ET-117, Release of

individual who died before June 10, 1994).

New York State estate tax return, and either:

Lien of Estate Tax , if a release of lien is needed

Privacy notification — The Commissioner of

1. The estate has not obtained an extension of

for real property or a cooperative apartment. Two

Taxation and Finance may collect and maintain

time to file the estate tax return, and more

parcels of real estate can be listed on one form.

personal information pursuant to the New York

than nine months have passed since the date

However, if the real property is located in

State Tax Law, including but not limited to,

of death; or

different counties or a release of lien is needed

sections 171, 171-a, 287, 308, 429, 475, 505,

2. The estate obtained an extension of time to

for more than one cooperative apartment, a

697, 1096, 1142, and 1415 of that Law; and may

file the estate tax return, and more than 15

separate Form ET-117 must be completed for

require disclosure of social security numbers

months have passed since the date of death

each county or apartment. The name and

pursuant to 42 USC 405(c)(2)(C)(i).

(the extension has expired).

address of the executor, or authorized

representative, should be entered at the top of

This information will be used to determine and

Use Form ET-90, New York State Estate Tax

Form ET-117 for mailing purposes.

administer tax liabilities and, when authorized by

Return, for an individual whose date of death is

law, for certain tax offset and exchange of tax

after May 25, 1990, and before February 1, 2000.

Which estates must file a New York State

information programs as well as for any other

estate tax return

Use Form ET-85, New York State Estate Tax

lawful purpose.

Certification , if either of the following applies:

Estate of an individual whose date of death is

Information concerning quarterly wages paid to

on or after January 1, 2004 — An estate of an

1. The estate is not required to file a New York

employees is provided to certain state agencies

individual who died on or after January 1, 2004,

State estate tax return, and either:

for purposes of fraud prevention, support

and who was either a resident or citizen of the

a. no executor or administrator has been

enforcement, evaluation of the effectiveness of

United States at the time of death, must file

appointed, or

certain employment and training programs and

Form ET-706, New York State Estate Tax Return,

other purposes authorized by law.

b. more than nine months have passed since

if the gross estate, plus federal adjusted taxable

the date of death.

gifts and specific exemption, exceeds

Failure to provide the required information may

$1,000,000, and either the decedent was a

2. The estate is required to file a

subject you to civil or criminal penalties, or both,

resident of New York State at the time of death,

New York State estate tax return, and either:

under the Tax Law.

or the estate includes real or tangible personal

a. fewer than nine months have passed

This information is maintained by the Director of

property having an actual situs in New York

since the date of death, and an executor

the Registration and Data Services Bureau, NYS

State.

or administrator has not been appointed;

Tax Department, Building 8, Room 338, W A

or

An estate of an individual who died on or after

Harriman Campus, Albany NY 12227; telephone

January 1, 2004, and who was a nonresident of

b. more than nine but less than 15 months

1 800 225-5829. From areas outside the

the United States and not a U.S. citizen at the

have passed since the date of death, and

United States and Canada, call (518) 485-6800.

an extension of time to file the estate tax

return has been granted.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1