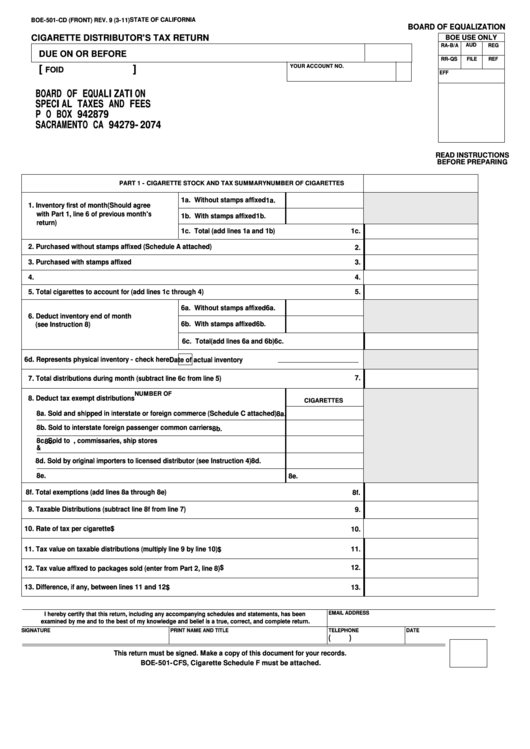

STATE OF CALIFORNIA

BOE-501-CD (FRONT) REV. 9 (3-11)

BOARD OF EQUALIZATION

CIGARETTE DISTRIBUTOR'S TAX RETURN

BOE USE ONLY

AUD

RA-B/A

REG

DUE ON OR BEFORE

FILE

RR-QS

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

SPECIAL TAXES AND FEES

P O BOX 942879

SACRAMENTO CA 94279-2074

READ INSTRUCTIONS

BEFORE PREPARING

PART 1 - CIGARETTE STOCK AND TAX SUMMARY

NUMBER OF CIGARETTES

1a. Without stamps affixed

1a.

1. Inventory first of month (Should agree

with Part 1, line 6 of previous month's

1b. With stamps affixed

1b.

return)

1c. Total (add lines 1a and 1b)

1c.

2. Purchased without stamps affixed (Schedule A attached)

2.

3. Purchased with stamps affixed

3.

4.

4.

5. Total cigarettes to account for (add lines 1c through 4)

5.

6a. Without stamps affixed

6a.

6. Deduct inventory end of month

6b. With stamps affixed

6b.

(see Instruction 8)

6c.

6c. Total (add lines 6a and 6b)

6d. Represents physical inventory - check here

Date of actual inventory

7. Total distributions during month (subtract line 6c from line 5)

7.

NUMBER OF

8. Deduct tax exempt distributions

CIGARETTES

8a. Sold and shipped in interstate or foreign commerce (Schedule C attached)

8a.

8b. Sold to interstate foreign passenger common carriers

8b.

8c. Sold to U.S. Military exchanges, commissaries, ship stores

8c.

& U.S. Veterans Admin.

8d.

8d. Sold by original importers to licensed distributor (see Instruction 4)

8e.

8e.

8f. Total exemptions (add lines 8a through 8e)

8f.

9. Taxable Distributions (subtract line 8f from line 7)

9.

10. Rate of tax per cigarette

$

10.

11. Tax value on taxable distributions (multiply line 9 by line 10)

11.

$

12.

$

12. Tax value affixed to packages sold (enter from Part 2, line 8)

13. Difference, if any, between lines 11 and 12

13.

$

EMAIL ADDRESS

I hereby certify that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

SIGNATURE

PRINT NAME AND TITLE

TELEPHONE

DATE

(

)

This return must be signed. Make a copy of this document for your records.

BOE-501-CFS, Cigarette Schedule F must be attached.

1

1 2

2