Form 12256 - Withdrawal Of Request For Collection Due Process Hearing

ADVERTISEMENT

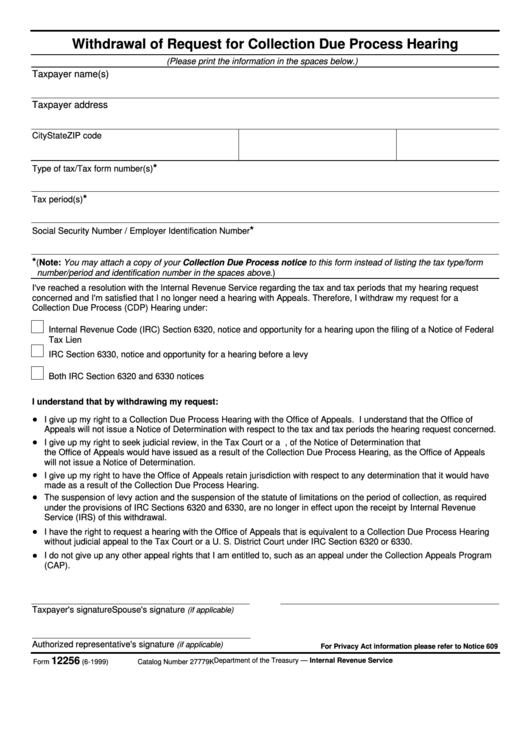

Withdrawal of Request for Collection Due Process Hearing

(Please print the information in the spaces below.)

Taxpayer name(s)

Taxpayer address

City

State

ZIP code

*

Type of tax/Tax form number(s)

*

Tax period(s)

*

Social Security Number / Employer Identification Number

*

(Note: You may attach a copy of your Collection Due Process notice to this form instead of listing the tax type/form

number/period and identification number in the spaces above.)

I've reached a resolution with the Internal Revenue Service regarding the tax and tax periods that my hearing request

concerned and I'm satisfied that I no longer need a hearing with Appeals. Therefore, I withdraw my request for a

Collection Due Process (CDP) Hearing under:

Internal Revenue Code (IRC) Section 6320, notice and opportunity for a hearing upon the filing of a Notice of Federal

Tax Lien

IRC Section 6330, notice and opportunity for a hearing before a levy

Both IRC Section 6320 and 6330 notices

I understand that by withdrawing my request:

•

I give up my right to a Collection Due Process Hearing with the Office of Appeals. I understand that the Office of

Appeals will not issue a Notice of Determination with respect to the tax and tax periods the hearing request concerned.

•

I give up my right to seek judicial review, in the Tax Court or a U.S. District Court, of the Notice of Determination that

the Office of Appeals would have issued as a result of the Collection Due Process Hearing, as the Office of Appeals

will not issue a Notice of Determination.

•

I give up my right to have the Office of Appeals retain jurisdiction with respect to any determination that it would have

made as a result of the Collection Due Process Hearing.

•

The suspension of levy action and the suspension of the statute of limitations on the period of collection, as required

under the provisions of IRC Sections 6320 and 6330, are no longer in effect upon the receipt by Internal Revenue

Service (IRS) of this withdrawal.

•

I have the right to request a hearing with the Office of Appeals that is equivalent to a Collection Due Process Hearing

without judicial appeal to the Tax Court or a U. S. District Court under IRC Section 6320 or 6330.

•

I do not give up any other appeal rights that I am entitled to, such as an appeal under the Collection Appeals Program

(CAP).

Taxpayer's signature

Spouse's signature

(if applicable)

Authorized representative's signature

(if applicable)

For Privacy Act information please refer to Notice 609

12256

Department of the Treasury — Internal Revenue Service

publish.no.irs.gov

Form

(6-1999)

Catalog Number 27779K

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1