Instructions For Form 5309

ADVERTISEMENT

3

Form 5309 (Rev. 5-2010)

Page

Paperwork Reduction Act Notice.

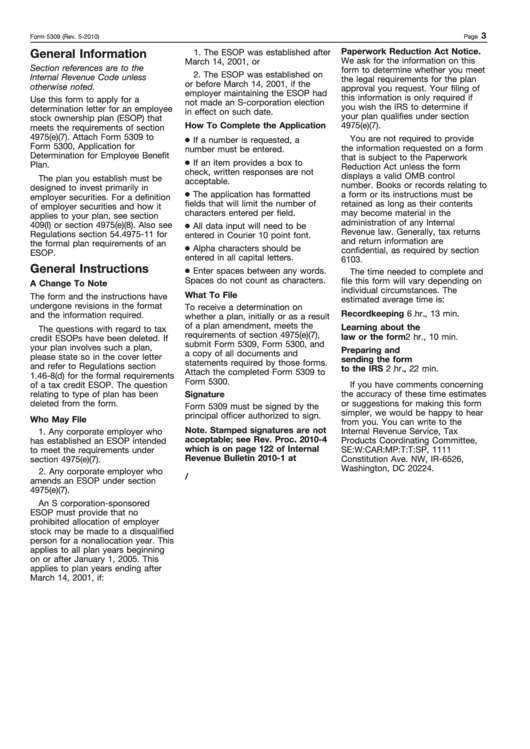

General Information

1. The ESOP was established after

We ask for the information on this

March 14, 2001, or

Section references are to the

form to determine whether you meet

2. The ESOP was established on

Internal Revenue Code unless

the legal requirements for the plan

or before March 14, 2001, if the

otherwise noted.

approval you request. Your filing of

employer maintaining the ESOP had

this information is only required if

Use this form to apply for a

not made an S-corporation election

you wish the IRS to determine if

determination letter for an employee

in effect on such date.

your plan qualifies under section

stock ownership plan (ESOP) that

How To Complete the Application

4975(e)(7).

meets the requirements of section

4975(e)(7). Attach Form 5309 to

You are not required to provide

If a number is requested, a

Form 5300, Application for

the information requested on a form

number must be entered.

Determination for Employee Benefit

that is subject to the Paperwork

If an item provides a box to

Plan.

Reduction Act unless the form

check, written responses are not

displays a valid OMB control

The plan you establish must be

acceptable.

number. Books or records relating to

designed to invest primarily in

The application has formatted

a form or its instructions must be

employer securities. For a definition

fields that will limit the number of

retained as long as their contents

of employer securities and how it

characters entered per field.

may become material in the

applies to your plan, see section

administration of any Internal

409(I) or section 4975(e)(8). Also see

All data input will need to be

Revenue law. Generally, tax returns

Regulations section 54.4975-11 for

entered in Courier 10 point font.

and return information are

the formal plan requirements of an

Alpha characters should be

confidential, as required by section

ESOP.

entered in all capital letters.

6103.

General Instructions

Enter spaces between any words.

The time needed to complete and

Spaces do not count as characters.

file this form will vary depending on

A Change To Note

individual circumstances. The

What To File

The form and the instructions have

estimated average time is:

undergone revisions in the format

To receive a determination on

Recordkeeping

6 hr., 13 min.

and the information required.

whether a plan, initially or as a result

of a plan amendment, meets the

Learning about the

The questions with regard to tax

requirements of section 4975(e)(7),

law or the form

2 hr., 10 min.

credit ESOPs have been deleted. If

submit Form 5309, Form 5300, and

your plan involves such a plan,

Preparing and

a copy of all documents and

please state so in the cover letter

sending the form

statements required by those forms.

and refer to Regulations section

to the IRS

2 hr., 22 min.

Attach the completed Form 5309 to

1.46-8(d) for the formal requirements

Form 5300.

of a tax credit ESOP. The question

If you have comments concerning

the accuracy of these time estimates

relating to type of plan has been

Signature

deleted from the form.

or suggestions for making this form

Form 5309 must be signed by the

simpler, we would be happy to hear

principal officer authorized to sign.

Who May File

from you. You can write to the

Note. Stamped signatures are not

Internal Revenue Service, Tax

1. Any corporate employer who

acceptable; see Rev. Proc. 2010-4

Products Coordinating Committee,

has established an ESOP intended

which is on page 122 of Internal

to meet the requirements under

SE:W:CAR:MP:T:T:SP, 1111

Revenue Bulletin 2010-1 at

Constitution Ave. NW, IR-6526,

section 4975(e)(7).

Washington, DC 20224.

2. Any corporate employer who

/irb10-01.pdf.

amends an ESOP under section

4975(e)(7).

An S corporation-sponsored

ESOP must provide that no

prohibited allocation of employer

stock may be made to a disqualified

person for a nonallocation year. This

applies to all plan years beginning

on or after January 1, 2005. This

applies to plan years ending after

March 14, 2001, if:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1