Form Ri-1120 - Rhode Island Nonresident Income Tax Agreement

ADVERTISEMENT

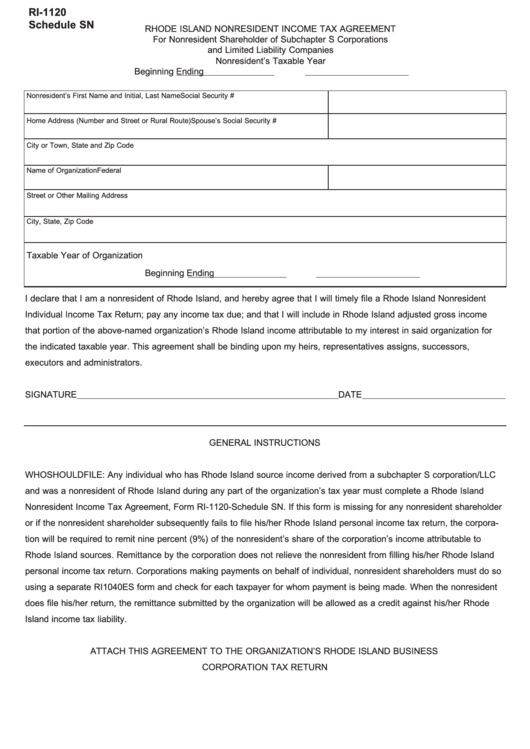

RI-1120

Schedule SN

RHODE ISLAND NONRESIDENT INCOME TAX AGREEMENT

For Nonresident Shareholder of Subchapter S Corporations

and Limited Liability Companies

Nonresident’s Taxable Year

Beginning

Ending

Nonresident’s First Name and Initial, Last Name

Social Security #

Home Address (Number and Street or Rural Route)

Spouse’s Social Security #

City or Town, State and Zip Code

Name of Organization

Federal I.D. Number

Street or Other Mailing Address

City, State, Zip Code

Taxable Year of Organization

Beginning

Ending

I declare that I am a nonresident of Rhode Island, and hereby agree that I will timely file a Rhode Island Nonresident

Individual Income Tax Return; pay any income tax due; and that I will include in Rhode Island adjusted gross income

that portion of the above-named organization’s Rhode Island income attributable to my interest in said organization for

the indicated taxable year. This agreement shall be binding upon my heirs, representatives assigns, successors,

executors and administrators.

SIGNATURE

DATE

GENERAL INSTRUCTIONS

WHO SHOULD FILE: Any individual who has Rhode Island source income derived from a subchapter S corporation/LLC

and was a nonresident of Rhode Island during any part of the organization’s tax year must complete a Rhode Island

Nonresident Income Tax Agreement, Form RI-1120-Schedule SN. If this form is missing for any nonresident shareholder

or if the nonresident shareholder subsequently fails to file his/her Rhode Island personal income tax return, the corpora-

tion will be required to remit nine percent (9%) of the nonresident’s share of the corporation’s income attributable to

Rhode Island sources. Remittance by the corporation does not relieve the nonresident from filling his/her Rhode Island

personal income tax return. Corporations making payments on behalf of individual, nonresident shareholders must do so

using a separate RI1040ES form and check for each taxpayer for whom payment is being made. When the nonresident

does file his/her return, the remittance submitted by the organization will be allowed as a credit against his/her Rhode

Island income tax liability.

ATTACH THIS AGREEMENT TO THE ORGANIZATION’S RHODE ISLAND BUSINESS

CORPORATION TAX RETURN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1