Form Br - Business Income Tax Return 2005

ADVERTISEMENT

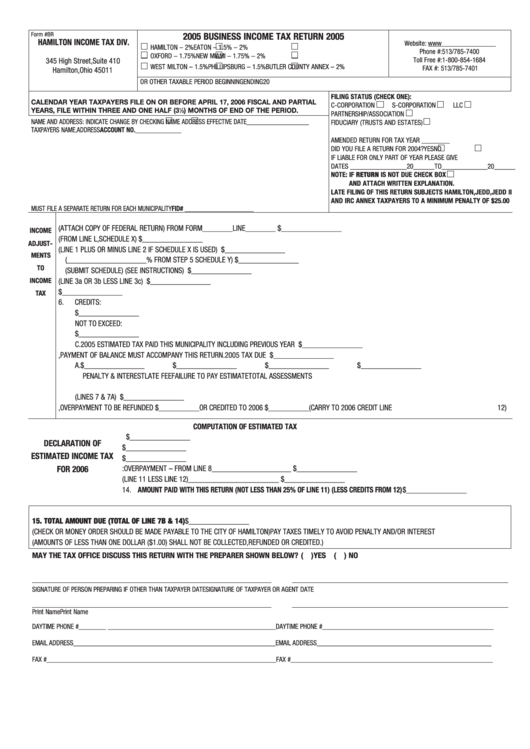

Form #BR

2005 BUSINESS INCOME TAX RETURN 2005

HAMILTON INCOME TAX DIV.

Website:

HAMILTON – 2%

EATON – 1.5%

J.E.D.D. – 2%

Phone #: 513/785-7400

OXFORD – 1.75%

NEW MIAMI – 1.75%

J.E.D.D. II – 2%

Toll Free #: 1-800-854-1684

345 High Street, Suite 410

WEST MILTON – 1.5%

PHILLIPSBURG – 1.5%

BUTLER COUNTY ANNEX – 2%

FAX #: 513/785-7401

Hamilton, Ohio 45011

OR OTHER TAXABLE PERIOD BEGINNING

ENDING

20

FILING STATUS (CHECK ONE):

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 17, 2006 FISCAL AND PARTIAL

C-CORPORATION

S-CORPORATION

LLC

YEARS, FILE WITHIN THREE AND ONE HALF (3

1

⁄

) MONTHS OF END OF THE PERIOD.

2

PARTNERSHIP/ASSOCIATION

NAME AND ADDRESS: INDICATE CHANGE BY CHECKING

NAME

ADDRESS EFFECTIVE DATE ___________________

FIDUCIARY (TRUSTS AND ESTATES)

TAXPAYERS NAME, ADDRESS

ACCOUNT NO. ______________

AMENDED RETURN FOR TAX YEAR ________

DID YOU FILE A RETURN FOR 2004?

YES

NO

IF LIABLE FOR ONLY PART OF YEAR PLEASE GIVE

DATES ________________20______TO_____________20______

NOTE: IF RETURN IS NOT DUE CHECK BOX

AND ATTACH WRITTEN EXPLANATION.

LATE FILING OF THIS RETURN SUBJECTS HAMILTON, JEDD, JEDD II

AND IRC ANNEX TAXPAYERS TO A MINIMUM PENALTY OF $25.00

MUST FILE A SEPARATE RETURN FOR EACH MUNICIPALITY

FID# _____________________

1.

ADJUSTED FEDERAL TAXABLE INCOME (ATTACH COPY OF FEDERAL RETURN) FROM FORM________LINE________ ................... $________________

INCOME

2.

ADJUSTMENTS (FROM LINE L, SCHEDULE X).................................................................................................................................... $________________

ADJUST-

3. a. ADJUSTED NET INCOME (LINE 1 PLUS OR MINUS LINE 2 IF SCHEDULE X IS USED) ........................................................................ $________________

MENTS

b. AMOUNT OF 3a APPORTIONED (_____________________% FROM STEP 5 SCHEDULE Y) ........................................................... $________________

TO

c. LESS ALLOCABLE LOSS PER PREVIOUS INCOME TAX RETURN (SUBMIT SCHEDULE) (SEE INSTRUCTIONS) ..................................... $________________

INCOME

4.

AMOUNT SUBJECT TO ___________________ MUNICIPAL INCOME TAX (LINE 3a OR 3b LESS LINE 3c) ..................................... $________________

5.

MUNICIPAL TAX-

OF AMOUNT ON LINE 4 .............................................................................. $________________

TAX

6.

CREDITS:

A. TAX PAID MUNICIPALITY_________________________________________________ $________________

NOT TO EXCEED:

B. LINE 5 MINUS LINE 6A ...........................................................................................................................................NET TAX DUE . $________________

C. 2005 ESTIMATED TAX PAID THIS MUNICIPALITY INCLUDING PREVIOUS YEAR OVERPAYMENT....................................................... $________________

7.

IF LINE 6B IS GREATER THAN LINE 6C, PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN. 2005 TAX DUE .......................... $________________

A. $________________

$________________

$________________

$________________

PENALTY & INTEREST

LATE FEE

FAILURE TO PAY ESTIMATE

TOTAL ASSESSMENTS

B. TOTAL TAX AND ASSESSMENTS DUE (LINES 7 & 7A) ................................................................................................................... $________________

8.

IF LINE 6C IS GREATER THAN 6B, OVERPAYMENT TO BE REFUNDED $___________OR CREDITED TO 2006 $___________(CARRY TO 2006 CREDIT LINE 12)

COMPUTATION OF ESTIMATED TAX

9. ESTIMATED INCOME SUBJECT TO TAX _______________________ $________________

DECLARATION OF

10.

OF AMOUNT SHOWN ON LINE 9 _______________ $________________

ESTIMATED INCOME TAX

11. BALANCE OF TAX DECLARED FOR ENTIRE YEAR ________________ $________________

12. CREDITS: OVERPAYMENT – FROM LINE 8 _____________________ $________________

FOR 2006

13. NET TAX DUE (LINE 11 LESS LINE 12) ________________________ $________________

14. AMOUNT PAID WITH THIS RETURN (NOT LESS THAN 25% OF LINE 11) (LESS CREDITS FROM 12)................... $________________

15. TOTAL AMOUNT DUE (TOTAL OF LINE 7B & 14)............................................................................................................................................. $________________

(CHECK OR MONEY ORDER SHOULD BE MADE PAYABLE TO THE CITY OF HAMILTON)

PAY TAXES TIMELY TO AVOID PENALTY AND/OR INTEREST

(AMOUNTS OF LESS THAN ONE DOLLAR ($1.00) SHALL NOT BE COLLECTED, REFUNDED OR CREDITED.)

MAY THE TAX OFFICE DISCUSS THIS RETURN WITH THE PREPARER SHOWN BELOW? (

)YES

(

) NO

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER OR AGENT

DATE

Print Name

Print Name

DAYTIME PHONE #________ _________________________________________________

DAYTIME PHONE # __________________________________________________

EMAIL ADDRESS___________________________________________________________

EMAIL ADDRESS ___________________________________________________

FAX #___________________________________________________________________

FAX # ___________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2