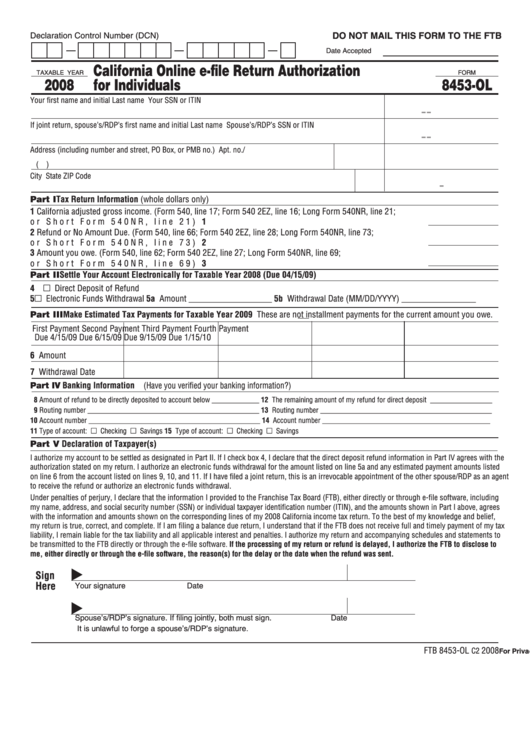

DO NOT MAIL THIS FORM TO THE FTB

Declaration Control Number (DCN)

Date Accepted

California Online e-file Return Authorization

TAXABLE YEAR

FORM

2008

for Individuals

8453-OL

Your first name and initial

Last name

Your SSN or ITIN

-

-

If joint return, spouse’s/RDP’s first name and initial

Last name

Spouse’s/RDP’s SSN or ITIN

-

-

Address (including number and street, PO Box, or PMB no.)

Apt. no./Ste.no. Daytime telephone number

(

)

City

State

ZIP Code

-

Part I Tax Return Information (whole dollars only)

1 California adjusted gross income. (Form 540, line 17; Form 540 2EZ, line 16; Long Form 540NR, line 21;

or Short Form 540NR, line 21). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1

2 Refund or No Amount Due. (Form 540, line 66; Form 540 2EZ, line 28; Long Form 540NR, line 73;

or Short Form 540NR, line 73). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2

3 Amount you owe. (Form 540, line 62; Form 540 2EZ, line 27; Long Form 540NR, line 69;

or Short Form 540NR, line 69). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

Part II Settle Your Account Electronically for Taxable Year 2008 (Due 04/15/09)

4 m Direct Deposit of Refund

5 m Electronic Funds Withdrawal 5a Amount ___________________ 5b Withdrawal Date (MM/DD/YYYY) _________________

Part III Make Estimated Tax Payments for Taxable Year 2009 These are not installment payments for the current amount you owe.

First Payment

Second Payment

Third Payment

Fourth Payment

Due 4/15/09

Due 6/15/09

Due 9/15/09

Due 1/15/10

6 Amount

7 Withdrawal Date

Part IV Banking Information (Have you verified your banking information?)

8 Amount of refund to be directly deposited to account below _____________ 12 The remaining amount of my refund for direct deposit _________________

9 Routing number _______________________________________________ 13 Routing number _______________________________________________

10 Account number _______________________________________________ 14 Account number ______________________________________________

11 Type of account: m Checking

m Savings

15 Type of account: m Checking

m Savings

Part V Declaration of Taxpayer(s)

I authorize my account to be settled as designated in Part II. If I check box 4, I declare that the direct deposit refund information in Part IV agrees with the

authorization stated on my return. I authorize an electronic funds withdrawal for the amount listed on line 5a and any estimated payment amounts listed

on line 6 from the account listed on lines 9, 10, and 11. If I have filed a joint return, this is an irrevocable appointment of the other spouse/RDP as an agent

to receive the refund or authorize an electronic funds withdrawal.

Under penalties of perjury, I declare that the information I provided to the Franchise Tax Board (FTB), either directly or through e-file software, including

my name, address, and social security number (SSN) or individual taxpayer identification number (ITIN), and the amounts shown in Part I above, agrees

with the information and amounts shown on the corresponding lines of my 2008 California income tax return. To the best of my knowledge and belief,

my return is true, correct, and complete. If I am filing a balance due return, I understand that if the FTB does not receive full and timely payment of my tax

liability, I remain liable for the tax liability and all applicable interest and penalties. I authorize my return and accompanying schedules and statements to

be transmitted to the FTB directly or through the e-file software. If the processing of my return or refund is delayed, I authorize the FTB to disclose to

me, either directly or through the e-file software, the reason(s) for the delay or the date when the refund was sent.

Sign

Here

Your signature

Date

Spouse’s/RDP’s signature. If filing jointly, both must sign.

Date

It is unlawful to forge a spouse’s/RDP’s signature.

FTB 8453-OL

2008

C2

For Privacy Notice, get form FTB 1131.

1

1