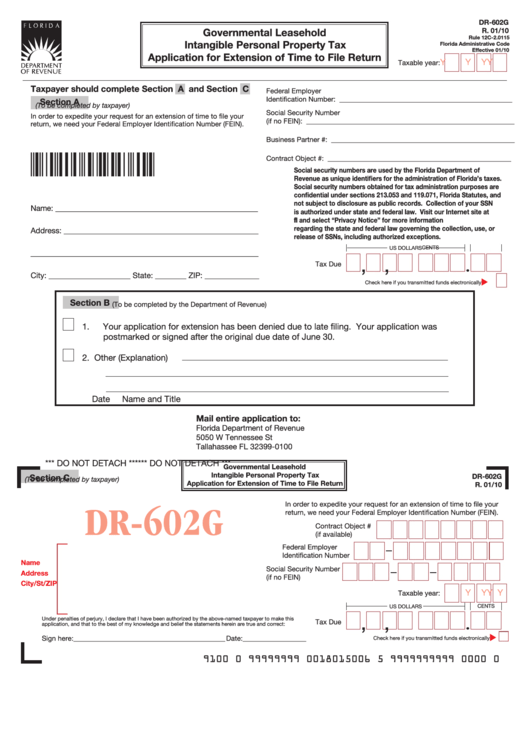

Form Dr-602g - Governmental Leasehold Intangible Personal Property Tax Application For Extension Of Time To File Return - Department Of Revenue - Florida

ADVERTISEMENT

DR-602G

Governmental Leasehold

R. 01/10

Rule 12C-2.0115

Intangible Personal Property Tax

Florida Administrative Code

Effective 01/10

Application for Extension of Time to File Return

Y

Y

Y

Y

Taxable year:

Taxpayer should complete Section A and Section C

Federal Employer

Identification Number: _________________________________________________

Section A

(To be completed by taxpayer)

Social Security Number

In order to expedite your request for an extension of time to file your

(if no FEIN): ___________________________________________________________

return, we need your Federal Employer Identification Number (FEIN).

Business Partner #: ____________________________________________________

Contract Object #: ____________________________________________________

Social security numbers are used by the Florida Department of

Revenue as unique identifiers for the administration of Florida’s taxes.

Social security numbers obtained for tax administration purposes are

confidential under sections 213.053 and 119.071, Florida Statutes, and

not subject to disclosure as public records. Collection of your SSN

Name: ____________________________________________________

is authorized under state and federal law. Visit our Internet site at

and select “Privacy Notice” for more information

regarding the state and federal law governing the collection, use, or

Address: __________________________________________________

release of SSNs, including authorized exceptions.

CENTS

US DOLLARS

____________________________________________________

,

,

Tax Due

City: _____________________

State: ________ ZIP: ______________

Check here if you transmitted funds electronically

Section B

(To be completed by the Department of Revenue)

1.

Your application for extension has been denied due to late filing. Your application was

postmarked or signed after the original due date of June 30.

2.

Other (Explanation)

Date

Name and Title

Mail entire application to:

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0100

*** DO NOT DETACh ***

*** DO NOT DETACh ***

Governmental Leasehold

Intangible Personal Property Tax

DR-602G

Section C

(To be completed by taxpayer)

Application for Extension of Time to File Return

R. 01/10

In order to expedite your request for an extension of time to file your

DR-602G

return, we need your Federal Employer Identification Number (FEIN).

Contract Object #

(if available)

Federal Employer

Identification Number

Name

Social Security Number

Address

(if no FEIN)

City/St/ZIP

Y

Y

Y

Y

Taxable year:

CENTS

US DOLLARS

,

,

Under penalties of perjury, I declare that I have been authorized by the above-named taxpayer to make this

Tax Due

application, and that to the best of my knowledge and belief the statements herein are true and correct:

Sign here:___________________________________________ Date:__________________

Check here if you transmitted funds electronically

9100 0 99999999 0018015006 5 9999999999 0000 0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1