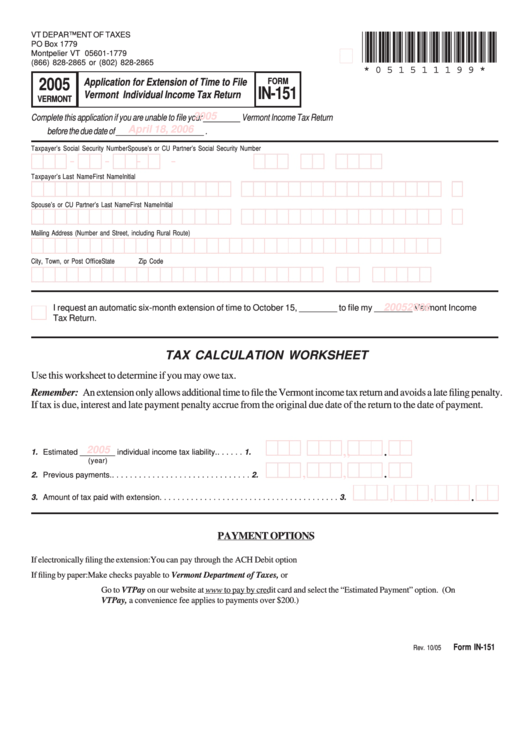

Form In-151 - Application For Extension Of Time To File Vermont Individual Income Tax Return - 2005

ADVERTISEMENT

*051511199*

VT DEPARTMENT OF TAXES

PO Box 1779

Montpelier VT 05601-1779

(866) 828-2865 or (802) 828-2865

* 0 5 1 5 1 1 1 9 9 *

2005

FORM

Application for Extension of Time to File

IN-151

Vermont Individual Income Tax Return

VERMONT

2005

Complete this application if you are unable to file your _________ Vermont Income Tax Return

April 18, 2006

before the due date of ______________________ .

Taxpayer’s Social Security Number

Spouse’s or CU Partner’s Social Security Number

-

-

-

-

Taxpayer’s Last Name

First Name

Initial

Spouse’s or CU Partner’s Last Name

First Name

Initial

Mailing Address (Number and Street, including Rural Route)

City, Town, or Post Office

State

Zip Code

2006

2005

I request an automatic six-month extension of time to October 15, ________ to file my ________ Vermont Income

Tax Return.

TAX CALCULATION WORKSHEET

Use this worksheet to determine if you may owe tax.

Remember: An extension only allows additional time to file the Vermont income tax return and avoids a late filing penalty.

If tax is due, interest and late payment penalty accrue from the original due date of the return to the date of payment.

,

,

.

2005

1. Estimated ________ individual income tax liability. . . . . . . 1.

(year)

,

,

.

2. Previous payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

,

,

.

3. Amount of tax paid with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

PAYMENT OPTIONS

If electronically filing the extension:

You can pay through the ACH Debit option

If filing by paper:

Make checks payable to Vermont Department of Taxes, or

Go to VTPay on our website at to pay by credit card and select the “Estimated Payment” option. (On

VTPay, a convenience fee applies to payments over $200.)

Form IN-151

Rev. 10/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1