Instructions For Completing The Use Tax Return St-18b

ADVERTISEMENT

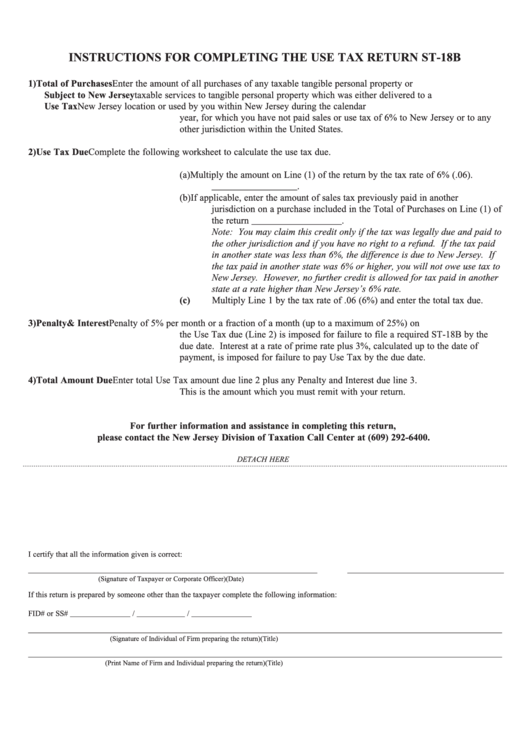

INSTRUCTIONS FOR COMPLETING THE USE TAX RETURN ST-18B

1) Total of Purchases

Enter the amount of all purchases of any taxable tangible personal property or

Subject to New Jersey

taxable services to tangible personal property which was either delivered to a

Use Tax

New Jersey location or used by you within New Jersey during the calendar

year, for which you have not paid sales or use tax of 6% to New Jersey or to any

other jurisdiction within the United States.

2) Use Tax Due

Complete the following worksheet to calculate the use tax due.

(a)

Multiply the amount on Line (1) of the return by the tax rate of 6% (.06).

__________________.

(b)

If applicable, enter the amount of sales tax previously paid in another

jurisdiction on a purchase included in the Total of Purchases on Line (1) of

the return ___________________.

Note: You may claim this credit only if the tax was legally due and paid to

the other jurisdiction and if you have no right to a refund. If the tax paid

in another state was less than 6%, the difference is due to New Jersey. If

the tax paid in another state was 6% or higher, you will not owe use tax to

New Jersey. However, no further credit is allowed for tax paid in another

state at a rate higher than New Jersey’s 6% rate.

(c)

Multiply Line 1 by the tax rate of .06 (6%) and enter the total tax due.

3) Penalty& Interest

Penalty of 5% per month or a fraction of a month (up to a maximum of 25%) on

the Use Tax due (Line 2) is imposed for failure to file a required ST-18B by the

due date. Interest at a rate of prime rate plus 3%, calculated up to the date of

payment, is imposed for failure to pay Use Tax by the due date.

4) Total Amount Due

Enter total Use Tax amount due line 2 plus any Penalty and Interest due line 3.

This is the amount which you must remit with your return.

For further information and assistance in completing this return,

please contact the New Jersey Division of Taxation Call Center at (609) 292-6400.

DETACH HERE

I certify that all the information given is correct:

________________________________________________________________________

_______________________________________

(Signature of Taxpayer or Corporate Officer)

(Date)

If this return is prepared by someone other than the taxpayer complete the following information:

FID# or SS# _______________ / ____________ / _______________

______________________________________________________________________________________________________________________

(Signature of Individual of Firm preparing the return)

(Title)

______________________________________________________________________________________________________________________

(Print Name of Firm and Individual preparing the return)

(Title)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1