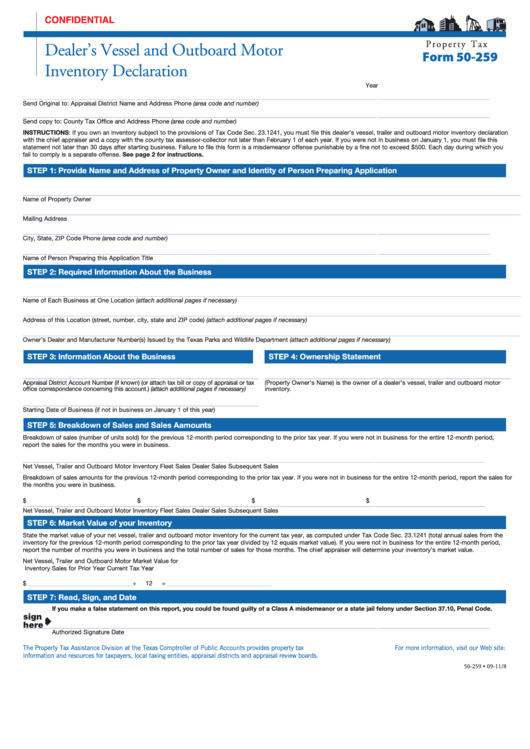

CONFIDENTIAL

P r o p e r t y T a x

Dealer’s Vessel and Outboard Motor

Form 50-259

Inventory Declaration

__________________________________________

Year

____________________________________________________________________________________________________________________________________

__________________________________________

Send Original to: Appraisal District Name and Address

Phone (area code and number)

____________________________________________________________________________________________________________________________________

__________________________________________

Send copy to: County Tax Office and Address

Phone (area code and number)

INSTRUCTIONS: If you own an inventory subject to the provisions of Tax Code Sec. 23.1241, you must file this dealer’s vessel, trailer and outboard motor inventory declaration

with the chief appraiser and a copy with the county tax assessor-collector not later than February 1 of each year. If you were not in business on January 1, you must file this

statement not later than 30 days after starting business. Failure to file this form is a misdemeanor offense punishable by a fine not to exceed $500. Each day during which you

fail to comply is a separate offense. See page 2 for instructions.

STEP 1: Provide Name and Address of Property Owner and Identity of Person Preparing Application

__________________________________________________________________________________________________________________________________________________________________________________________

Name of Property Owner

__________________________________________________________________________________________________________________________________________________________________________________________

Mailing Address

____________________________________________________________________________________________________________________________________

__________________________________________

City, State, ZIP Code

Phone (area code and number)

____________________________________________________________________________________________________________________________________

__________________________________________

Name of Person Preparing this Application

Title

STEP 2: Required Information About the Business

__________________________________________________________________________________________________________________________________________________________________________________________

Name of Each Business at One Location (attach additional pages if necessary)

__________________________________________________________________________________________________________________________________________________________________________________________

Address of this Location (street, number, city, state and ZIP code) (attach additional pages if necessary)

__________________________________________________________________________________________________________________________________________________________________________________________

Owner’s Dealer and Manufacturer Number(s) Issued by the Texas Parks and Wildlife Department (attach additional pages if necessary)

STEP 3: Information About the Business

STEP 4: Ownership Statement

________________________________________________________________________________________

____________________________________________________________________________________________

Appraisal District Account Number (if known) (or attach tax bill or copy of appraisal or tax

(Property Owner’s Name) is the owner of a dealer’s vessel, trailer and outboard motor

office correspondence concerning this account.) (attach additional pages if necessary)

inventory.

________________________________________________________________________________________

Starting Date of Business (if not in business on January 1 of this year)

STEP 5: Breakdown of Sales and Sales Aamounts

Breakdown of sales (number of units sold) for the previous 12-month period corresponding to the prior tax year. If you were not in business for the entire 12-month period,

report the sales for the months you were in business.

___________________________________________________

______________________________________

________________________________________

_________________________________________

Net Vessel, Trailer and Outboard Motor Inventory

Fleet Sales

Dealer Sales

Subsequent Sales

Breakdown of sales amounts for the previous 12-month period corresponding to the prior tax year. If you were not in business for the entire 12-month period, report the sales for

the months you were in business.

$

$

$

$

___________________________________________________

______________________________________

________________________________________

_________________________________________

Net Vessel, Trailer and Outboard Motor Inventory

Fleet Sales

Dealer Sales

Subsequent Sales

STEP 6: Market Value of your Inventory

State the market value of your net vessel, trailer and outboard motor inventory for the current tax year, as computed under Tax Code Sec. 23.1241 (total annual sales from the

inventory for the previous 12-month period corresponding to the prior tax year divided by 12 equals market value). If you were not in business for the entire 12-month period,

report the number of months you were in business and the total number of sales for those months. The chief appraiser will determine your inventory’s market value.

Net Vessel, Trailer and Outboard Motor

Market Value for

Inventory Sales for Prior Year

Current Tax Year

$

÷

12

=

_______________________________________

_______________________________________

STEP 7: Read, Sign, and Date

If you make a false statement on this report, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal Code.

____________________________________________________________________________________________________________________________________

__________________________________________

Authorized Signature

Date

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our Web site:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-259 • 09-11/8

1

1 2

2