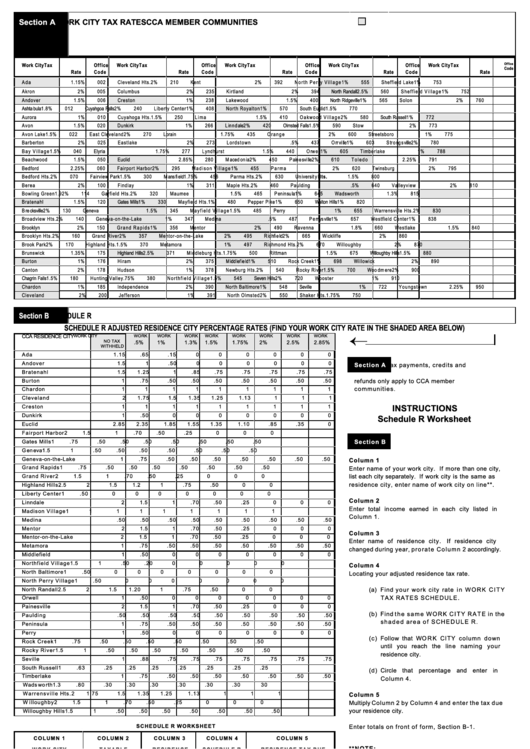

Work City Tax Rates - Cca Member Communities

ADVERTISEMENT

Section A

WORK CITY TAX RATES

CCA MEMBER COMMUNITIES

Office

Wo rk City

Tax

Office

Wo rk City

Tax

Office

Wo rk City

Tax

Office

Wo rk City

Tax

Office

Wo rk City

Tax

Code

Rate

C ode

Rate

Co de

Rate

C ode

Rate

C ode

Rate

A d a

1.15%

002

Cleveland Hts.

2%

210

Kent

2%

392

N o rt h P e rr y V illa g e

1%

555

Sheffiel d Lake

1%

753

Akron

2%

005

Columbus

2%

235

Kirtl a nd

2%

394

Nort h Rand all

2.5%

560

S h ef fie ld V illa g e

1%

752

Andover

1.5%

006

Creston

1%

238

Lakewood

1.5%

400

Nort h Rid g eville

1%

565

Solon

2%

760

Ashta bula

1.8%

012

Cuya hg oa Falls

2%

240

Liberty Center

1%

408

North Royal t on

1%

570

So uth Eu clid

1.5%

770

Aurora

1%

010

Cuyahoga Hts.

1.5%

250

L im a

1.5%

410

O a k wo od V illa g e

2%

580

South Russell

1%

772

Avon

1.5%

020

Dunk irk

1%

266

Lin nd ale

2%

420

O lm ste d Falls

1.5%

590

Stow

2%

773

Avon Lake

1.5%

022

East Cleveland

2%

270

Lo rain

1.75%

435

O r an g e

2%

600

Streets boro

1%

775

Barberton

2%

025

Eastlake

2%

273

Lordstown

.5%

437

O rr ville

1%

603

Str ong sville

2%

780

B a y V illa g e

1.5%

040

Elyria

1.75%

277

Lyndhurst

1.5%

440

O rw ell

1%

605

Timberlake

1%

788

Beachwood

1.5%

050

Eu clid

2.85%

280

M ac ed on ia

2%

450

Pain esville

2%

610

T o le d o

2.25%

791

Bed ford

2.25%

060

Fairport Harbor

2%

295

M a d is on V illa g e

1%

455

P a rm a

2%

620

Tw insburg

2%

795

Un iversit y Hts.

Bedford Hts.

2%

070

Fairview Park

1.5%

300

M ansfield

1.75%

456

Parma Hts.

2%

630

1.5%

800

Berea

2%

100

Findlay

1%

311

Maple Hts.

2%

460

Paulding

.5%

640

Vall e yview

2%

810

Bowling Green

1.92%

114

Garfield Hts.

2%

320

Maumee

1.5%

465

Penin sula

1%

645

Wad sworth

1.3%

815

Bratenahl

1.5%

120

G ate s M ills

1%

330

Mayfiel d Hts.

1%

480

Pepper Pike

1%

650

W alto n Hills

1%

820

Bre cksville

2%

130

G ene va

1.5%

345

M a yf ie ld V illa g e

1.5%

485

Perry

1%

655

Warrensville Hts.

2%

830

Broadview Hts.

2%

140

Geneva-on-the-Lake

1%

347

Medina

.5%

487

Perr ys ville

1%

657

Westfiel d Center

1%

838

Bro oklyn

2%

150

G r an d R ap id s

1%

356

Mentor

2%

490

Ravenna

1.8%

660

Westlake

1.5%

840

Brooklyn Hts.

2%

160

Grand River

2%

357

Mentor-on-the-Lake

2%

495

Ric hfield

2%

665

Wickliffe

2%

860

Brook Park

2%

170

Highland Hts.

1.5%

370

Meta mora

1%

497

Richmond Hts.

2%

670

Willoughby

2%

870

Brunswick

1.35%

175

Hig hlan d Hills

2.5%

371

Middleburg Hts.

1.75%

500

Rittman

1.5%

675

W illoug hby H ills

1.5%

880

Burton

1%

176

Hiram

2%

375

M id d lef ie ld

1%

510

Rock Creek

1%

698

Willowick

2%

890

Canton

2%

178

Hudson

1%

378

Newburg Hts.

2%

540

Rocky River

1.5%

700

Woo dm ere

2%

900

Chag rin Falls

1.5%

180

Hunting Valley

.75%

380

N o rt hf ie ld V illa g e

1.5%

545

Seve n Hills

2%

720

Wooster

1%

910

Chardon

1%

185

Independence

2%

390

North B altimore

1%

548

Seville

1%

722

Youngstown

2.25%

950

Cleveland

2%

200

Jefferson

1%

391

North Olmsted

2%

550

Shaker Hts.

1.75%

750

Section B

SCHEDULE R

SCHEDULE R ADJUSTED RESIDENCE CITY PERCENTAGE RATES (FIND YOUR WORK CITY RATE IN THE SHADED AREA BELOW)

CCA RESIDENCE CITY

WORK CITY

WORK

WORK

WORK

WORK

WORK

WORK

WORK

WORK

NO TAX

.5%

1%

1.3%

1.5%

1.75%

2%

2.5%

2.85%

WITHHELD

Ada

1.15

.65

.15

0

0

0

0

0

0

Andover

1.5

1

.50

0

0

0

0

0

0

Section A

Tax payments, credits and

Bratenahl

1.5

1.25

1

.85

.75

.75

.75

.75

.75

Burton

1

.75

.50

.50

.50

.50

.50

.50

.50

refun ds only apply to C CA mem ber

communities.

Chardon

1

1

1

1

1

1

1

1

1

Cleveland

2

1.75

1.5

1.35

1.25

1.13

1

1

1

Creston

1

1

1

1

1

1

1

1

1

INSTRUCTIONS

Dunkirk

1

.50

0

0

0

0

0

0

0

Schedule R Worksheet

Euc lid

2.85

2.35

1.85

1.55

1.35

1.10

.85

.35

0

Fairport Harbor

2

1.5

1

.70

.50

.25

0

0

0

Ga tes Mills

1

.75

.50

.50

.50

.50

.50

.50

.50

Section B

G en eva

1.5

1

.50

.50

.50

.50

.50

.50

.50

Ge neva-on -the-La ke

1

.75

.50

.50

.50

.50

.50

.50

.50

Column 1

Grand Rapids

1

.75

.50

.50

.50

.50

.50

.50

.50

Enter name of your work city. If more than on e city,

Grand River

2

1.5

1

.70

.50

.25

0

0

0

list eac h c ity s eparately. If work city is th e sam e as

residence city, enter name of work city on line**.

High land H ills

2.5

2

1.5

1.2

1

.75

.50

0

0

Liberty Center

1

.50

0

0

0

0

0

0

0

Column 2

Linnd ale

2

1.5

1

.70

.50

.25

0

0

0

En ter total incom e earne d in ea ch city lis ted in

Madison Village

1

1

1

1

1

1

1

1

1

Column 1.

Medina

.50

.50

.50

.50

.50

.50

.50

.50

.50

Mentor

2

1.5

1

.70

.50

.25

0

0

0

Column 3

Mentor -on-the -Lake

2

1.5

1

.70

.50

.25

0

0

0

En ter nam e of res idenc e city.

If res idenc e city

Metam ora

1

.75

.50

.50

.50

.50

.50

.50

.50

ch anged during year, p ror at e C olu m n 2 ac cording ly.

Middle field

1

.50

0

0

0

0

0

0

0

Northfield Village

1.5

1

.50

.20

0

0

0

0

0

Column 4

North Baltim ore

1

.50

0

0

0

0

0

0

0

Loc ating your ad justed resid enc e tax rate.

North Perry Village

1

.50

0

0

0

0

0

0

0

Nor th Ran dall

2.5

2

1.5

1.20

1

.75

.50

0

0

(a) Find your work city rate in W O R K C IT Y

TAX RATES SCHEDULE.

Or well

1

.50

0

0

0

0

0

0

0

Paine sville

2

1.5

1

.70

.50

.25

0

0

0

(b) Find th e s am e W O R K C IT Y R A T E in the

Paulding

.50

.50

.50

.50

.50

.50

.50

.50

.50

s had ed ar ea of S CH E D U LE R .

Penin sula

1

.75

.50

.50

.50

.50

.50

.50

.50

Perry

1

.50

0

0

0

0

0

0

0

(c) Follow that W O R K CITY column down

Rock Creek

1

.75

.50

.50

.50

.50

.50

.50

.50

un til you reac h th e lin e naming your

Rocky River

1.5

1

.50

.50

.50

.50

.50

.50

.50

res iden ce cit y.

Seville

1

.88

.75

.75

.75

.75

.75

.75

.75

South Rus sell

1

.63

.25

.25

.25

.25

.25

.25

.25

(d) C irc le that perc entage and enter in

T im berlake

1

.75

.50

.50

.50

.50

.50

.50

.50

Column 4.

W ads wo rth

1.3

.80

.30

.30

.30

.30

.30

.30

30

W arr ens vi ll e H ts.

2

1.75

1.5

1.35

1.25

1.13

1

1

1

Column 5

W illoughby

2

1.5

1

.70

.50

.25

0

0

0

Multiply Column 2 by Column 4 and enter the tax due

your res iden ce cit y.

W illough by Hills

1.5

1

.50

.50

.50

.50

.50

.50

.50

SCHEDULE R W ORKSHEE T

Enter totals on front of form, Section B-1.

C O L U M N 1

C O L U M N 2

C O L U M N 3

C O L U M N 4

C O L U M N 5

**NOTE:

W O R K C I T Y

T A XA BL E

R E S ID E N C E

SCHEDU L E R

R E S ID E N C E T AX D U E

In co m e earned in sam e city yo u liv e in with

IN CO M E

C I T Y

T A X R A T E

C OL U M N 2 T I M E S

e m p lo y ment tax withheld correctly is not

FROM ABO VE

C O L U M N 4

subject to residence tax.

%

*** If your w ork c ity is n ot list ed in Sec tion A, you

%

can find the work city tax rate by dividing c ity tax

%

with held by taxable wages as shown on your W -2

f or m .

* *

TO TALS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1