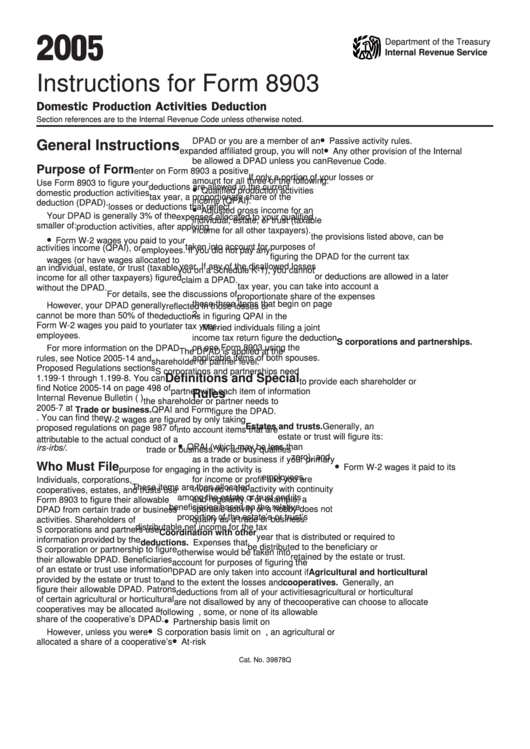

Instructions For Form 8903 - Domestic Production Activities Deduction - Internal Revenue Service - 2005

ADVERTISEMENT

05

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form 8903

Domestic Production Activities Deduction

Section references are to the Internal Revenue Code unless otherwise noted.

•

DPAD or you are a member of an

Passive activity rules.

General Instructions

•

expanded affiliated group, you will not

Any other provision of the Internal

be allowed a DPAD unless you can

Revenue Code.

Purpose of Form

enter on Form 8903 a positive

If only a portion of your losses or

amount for all three of the following.

Use Form 8903 to figure your

•

deductions are allowed in the current

Qualified production activities

domestic production activities

tax year, a proportionate share of the

income (QPAI).

deduction (DPAD).

•

losses or deductions that reflect

Adjusted gross income for an

Your DPAD is generally 3% of the

expenses allocated to your qualified

individual, estate, or trust (taxable

smaller of:

production activities, after applying

income for all other taxpayers).

•

the provisions listed above, can be

1. Your qualified production

Form W-2 wages you paid to your

taken into account for purposes of

activities income (QPAI), or

employees. If you did not pay any

figuring the DPAD for the current tax

2. Your adjusted gross income for

wages (or have wages allocated to

year. If any of the disallowed losses

an individual, estate, or trust (taxable

you on a Schedule K-1), you cannot

or deductions are allowed in a later

income for all other taxpayers) figured

claim a DPAD.

tax year, you can take into account a

without the DPAD.

For details, see the discussions of

proportionate share of the expenses

these three items that begin on page

However, your DPAD generally

reflected in those losses or

2.

cannot be more than 50% of the

deductions in figuring QPAI in the

Form W-2 wages you paid to your

later tax year.

Married individuals filing a joint

employees.

income tax return figure the deduction

S corporations and partnerships.

For more information on the DPAD

on one Form 8903 using the

The DPAD is applied at the

applicable items of both spouses.

rules, see Notice 2005-14 and

shareholder or partner level.

Proposed Regulations sections

S corporations and partnerships need

Definitions and Special

1.199-1 through 1.199-8. You can

to provide each shareholder or

find Notice 2005-14 on page 498 of

partner with each item of information

Rules

Internal Revenue Bulletin (I.R.B.)

the shareholder or partner needs to

2005-7 at

Trade or business. QPAI and Form

figure the DPAD.

irb05-07.pdf. You can find the

W-2 wages are figured by only taking

Estates and trusts. Generally, an

proposed regulations on page 987 of

into account items that are

estate or trust will figure its:

I.R.B. 2005-47 at

attributable to the actual conduct of a

•

QPAI (which may be less than

irs-irbs/irb05-47.pdf.

trade or business. An activity qualifies

zero), and

as a trade or business if your primary

•

Who Must File

Form W-2 wages it paid to its

purpose for engaging in the activity is

employees.

for income or profit and you are

Individuals, corporations,

These items are then allocated

involved in the activity with continuity

cooperatives, estates, and trusts use

among the estate or trust and its

and regularity. For example, a

Form 8903 to figure their allowable

beneficiaries based on the relative

sporadic activity or a hobby does not

DPAD from certain trade or business

proportion of the estate’s or trust’s

qualify as a trade or business.

activities. Shareholders of

distributable net income for the tax

S corporations and partners use

Coordination with other

year that is distributed or required to

information provided by the

deductions. Expenses that

be distributed to the beneficiary or

S corporation or partnership to figure

otherwise would be taken into

retained by the estate or trust.

their allowable DPAD. Beneficiaries

account for purposes of figuring the

of an estate or trust use information

DPAD are only taken into account if

Agricultural and horticultural

provided by the estate or trust to

and to the extent the losses and

cooperatives. Generally, an

figure their allowable DPAD. Patrons

deductions from all of your activities

agricultural or horticultural

of certain agricultural or horticultural

are not disallowed by any of the

cooperative can choose to allocate

cooperatives may be allocated a

following provisions.

all, some, or none of its allowable

•

share of the cooperative’s DPAD.

Partnership basis limit on losses.

DPAD to its patrons. For this

•

However, unless you were

S corporation basis limit on losses.

purpose, an agricultural or

•

allocated a share of a cooperative’s

At-risk rules.

horticultural cooperative is an

Cat. No. 39878Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7