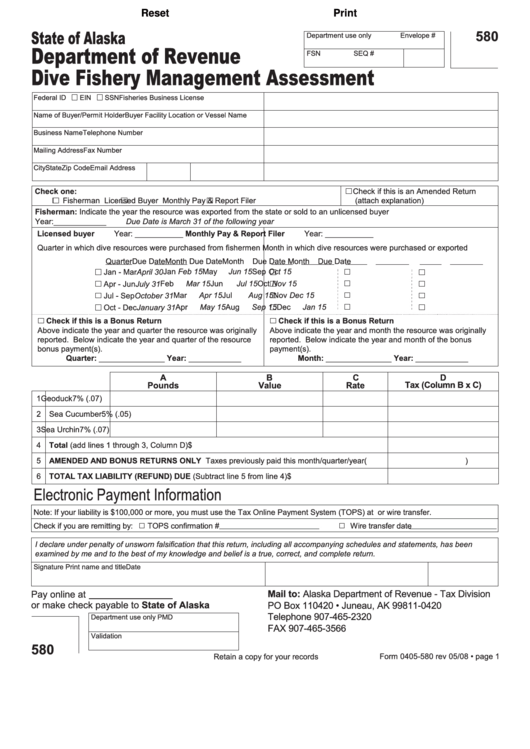

Reset

Print

State of Alaska

580

Department use only

Envelope #

Department of Revenue

FSN

SEQ #

Dive Fishery Management Assessment

Federal ID

EIN

SSN

Fisheries Business License

Name of Buyer/Permit Holder

Buyer Facility Location or Vessel Name

Business Name

Telephone Number

Mailing Address

Fax Number

City

State

Zip Code

Email Address

Check one:

Check if this is an Amended Return

Fisherman

Licensed Buyer

Monthly Pay & Report Filer

(attach explanation)

Fisherman: Indicate the year the resource was exported from the state or sold to an unlicensed buyer

Year:____________

Due Date is March 31 of the following year

Licensed buyer

Year: ___________

Monthly Pay & Report Filer

Year: ___________

Quarter in which dive resources were purchased from fishermen

Month in which dive resources were purchased or exported

Quarter

Due Date

Month

Due Date

Month

Due Date

Month

Due Date

Jan

Feb 15

May

Jun 15

Sep

Oct 15

Jan - Mar

April 30

Feb

Mar 15

Jun

Jul 15

Oct

Nov 15

Apr - Jun

July 31

Jul - Sep

Mar

Apr 15

Jul

Aug 15

Nov

Dec 15

October 31

Apr

May 15

Aug

Sep 15

Dec

Jan 15

Oct - Dec

January 31

Check if this is a Bonus Return

Check if this is a Bonus Return

Above indicate the year and quarter the resource was originally

Above indicate the year and month the resource was originally

reported. Below indicate the year and quarter of the resource

reported. Below indicate the year and month of the bonus

bonus payment(s).

payment(s).

Quarter: _______________ Year: ____________

Month: _______________ Year: ____________

A

B

C

D

Tax (Column B x C)

Pounds

Value

Rate

1

Geoduck

7% (.07)

2

Sea Cucumber

5% (.05)

3

Sea Urchin

7% (.07)

4

Total (add lines 1 through 3, Column D)

$

5

AMENDED AND BONUS RETURNS ONLY Taxes previously paid this month/quarter/year

(

)

6

TOTAL TAX LIABILITY (REFUND) DUE (Subtract line 5 from line 4)

$

Electronic Payment Information

Note: If your liability is $100,000 or more, you must use the Tax Online Payment System (TOPS) at or wire transfer.

Check if you are remitting by:

TOPS confirmation #

Wire transfer date

I declare under penalty of unsworn falsification that this return, including all accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

Signature

Print name and title

Date

Pay online at

Mail to: Alaska Department of Revenue - Tax Division

or make check payable to State of Alaska

PO Box 110420 • Juneau, AK 99811-0420

Telephone 907-465-2320

Department use only PMD

FAX 907-465-3566

Validation

580

Form 0405-580 rev 05/08 • page 1

Retain a copy for your records

1

1