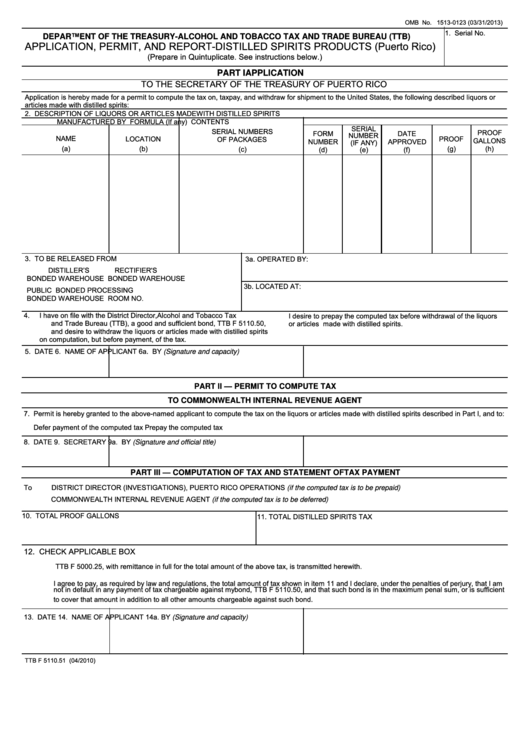

OMB No. 1513-0123 (03/31/2013)

1. Serial No.

DEPARTMENT OF THE TREASURY-ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TTB)

APPLICATION, PERMIT, AND REPORT-DISTILLED SPIRITS PRODUCTS (Puerto Rico)

(Prepare in Quintuplicate. See instructions below.)

PART I APPLICATION

TO THE SECRETARY OF THE TREASURY OF PUERTO RICO

Application is hereby made for a permit to compute the tax on, taxpay, and withdraw for shipment to the United States, the following described liquors or

articles made with distilled spirits:

2. DESCRIPTION OF LIQUORS OR ARTICLES MADE WITH DISTILLED SPIRITS

MANUFACTURED BY

FORMULA (If any)

CONTENTS

SERIAL

SERIAL NUMBERS

PROOF

FORM

DATE

NUMBER

NAME

LOCATION

PROOF

OF PACKAGES

GALLONS

NUMBER

APPROVED

(IF ANY)

(a)

(b)

(g)

(h)

(c)

(d)

(e)

(f)

3. TO BE RELEASED FROM

3a. OPERATED BY:

DISTILLER’S

RECTIFIER'S

BONDED WAREHOUSE

BONDED WAREHOUSE

3b. LOCATED AT:

PUBLIC

BONDED PROCESSING

BONDED WAREHOUSE

ROOM NO.

4.

I have on file with the District Director, Alcohol and Tobacco Tax

I desire to prepay the computed tax before withdrawal of the liquors

and Trade Bureau (TTB), a good and sufficient bond, TTB F 5110.50,

or articles made with distilled spirits.

and desire to withdraw the liquors or articles made with distilled spirits

on computation, but before payment, of the tax.

5. DATE

6. NAME OF APPLICANT

6a. BY (Signature and capacity)

PART II — PERMIT TO COMPUTE TAX

TO COMMONWEALTH INTERNAL REVENUE AGENT

7. Permit is hereby granted to the above-named applicant to compute the tax on the liquors or articles made with distilled spirits described in Part I, and to:

Defer payment of the computed tax

Prepay the computed tax

8. DATE

9. SECRETARY

9a. BY (Signature and official title)

PART III — COMPUTATION OF TAX AND STATEMENT OF TAX PAYMENT

To

DISTRICT DIRECTOR (INVESTIGATIONS), PUERTO RICO OPERATIONS (if the computed tax is to be prepaid)

COMMONWEALTH INTERNAL REVENUE AGENT (if the computed tax is to be deferred)

10. TOTAL PROOF GALLONS

11. TOTAL DISTILLED SPIRITS TAX

12. CHECK APPLICABLE BOX

TTB F 5000.25, with remittance in full for the total amount of the above tax, is transmitted herewith.

I agree to pay, as required by law and regulations, the total amount of tax shown in item 11 and I declare, under the penalties of perjury, that I am

not in default in any payment of tax chargeable against my bond, TTB F 5110.50, and that such bond is in the maximum penal sum, or is sufficient

to cover that amount in addition to all other amounts chargeable against such bond.

13. DATE

14. NAME OF APPLICANT

14a. BY (Signature and capacity)

TTB F 5110.51 (04/2010)

1

1 2

2