Form 500cp - Automatic Extension Voucher - Department Of Taxation

ADVERTISEMENT

Quick As A Click

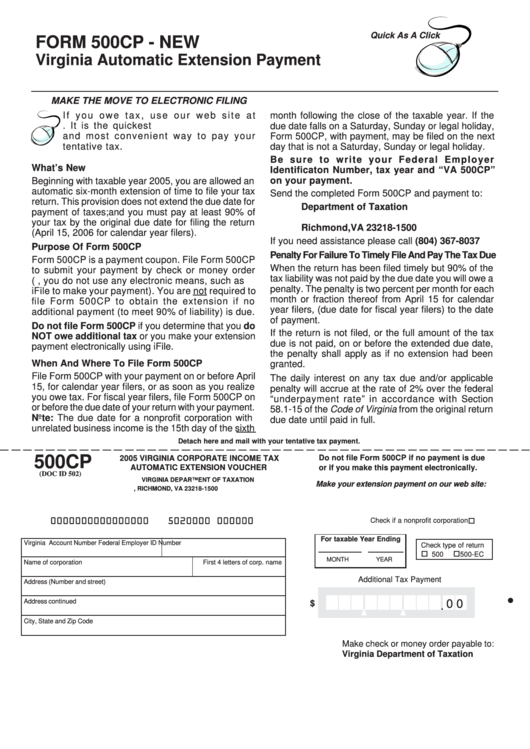

FORM 500CP - NEW

Virginia Automatic Extension Payment

MAKE THE MOVE TO ELECTRONIC FILING

I f y o u o w e t a x , u s e o u r w e b s i t e a t

month following the close of the taxable year. If the

. It is the quickest

due date falls on a Saturday, Sunday or legal holiday,

and most convenient way to pay your

Form 500CP, with payment, may be filed on the next

tentative tax.

day that is not a Saturday, Sunday or legal holiday.

Be sure to write your Federal Employer

What’s New

Identificaton Number, tax year and “VA 500CP”

on your payment.

Beginning with taxable year 2005, you are allowed an

automatic six-month extension of time to file your tax

Send the completed Form 500CP and payment to:

return. This provision does not extend the due date for

Department of Taxation

payment of taxes;and you must pay at least 90% of

P.O. Box 1500

your tax by the original due date for filing the return

Richmond,VA 23218-1500

(April 15, 2006 for calendar year filers).

If you need assistance please call (804) 367-8037

Purpose Of Form 500CP

Penalty For Failure To Timely File And Pay The Tax Due

Form 500CP is a payment coupon. File Form 500CP

When the return has been filed timely but 90% of the

to submit your payment by check or money order

tax liability was not paid by the due date you will owe a

(i.e., you do not use any electronic means, such as

penalty. The penalty is two percent per month for each

iFile to make your payment). You are not required to

month or fraction thereof from April 15 for calendar

file Form 500CP to obtain the extension if no

year filers, (due date for fiscal year filers) to the date

additional payment (to meet 90% of liability) is due.

of payment.

Do not file Form 500CP if you determine that you do

If the return is not filed, or the full amount of the tax

NOT owe additional tax or you make your extension

due is not paid, on or before the extended due date,

payment electronically using iFile.

the penalty shall apply as if no extension had been

When And Where To File Form 500CP

granted.

File Form 500CP with your payment on or before April

The daily interest on any tax due and/or applicable

15, for calendar year filers, or as soon as you realize

penalty will accrue at the rate of 2% over the federal

you owe tax. For fiscal year filers, file Form 500CP on

“underpayment rate” in accordance with Section

or before the due date of your return with your payment.

58.1-15 of the Code of Virginia from the original return

Note: The due date for a nonprofit corporation with

due date until paid in full.

unrelated business income is the 15th day of the sixth

Detach here and mail with your tentative tax payment.

500CP

Do not file Form 500CP if no payment is due

2005 VIRGINIA CORPORATE INCOME TAX

AUTOMATIC EXTENSION VOUCHER

or if you make this payment electronically.

(DOC ID 502)

VIRGINIA DEPARTMENT OF TAXATION

Make your extension payment on our web site:

P.O. BOX 1500, RICHMOND, VA 23218-1500

0000000000000000

5020000 000000

Check if a nonprofit corporation

For taxable Year Ending

Virginia Account Number

Federal Employer ID Number

Check type of return

500

500-EC

MONTH

YEAR

Name of corporation

First 4 letters of corp. name

Additional Tax Payment

Address (Number and street)

•

0 0

.

Address continued

$

City, State and Zip Code

Make check or money order payable to:

Virginia Department of Taxation

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1