2014 Minnesota Income Tax For Estates And Trusts (Fiduciary) Form M2 Instructions - Department Of Revenue Page 14

ADVERTISEMENT

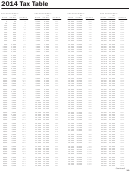

2014 Tax Table

(continued)

If line 9 of Form M2 is:

If line 9 of Form M2 is:

If line 9 of Form M2 is:

If line 9 of Form M2 is:

but

but

but

but

at least

your tax is:

at least

your tax is:

at least

your tax is:

at least

your tax is:

less than

less than

less than

less than

77,900

78,000

5,239

80,900

81,000

5,474

83,900

84,000

5,710

86,900

87,000

5,945

78,000

78,100

5,247

81,000

81,100

5,482

84,000

84,100

5,718

87,000

87,100

5,953

78,100

78,200

5,255

81,100

81,200

5,490

84,100

84,200

5,726

87,100

87,200

5,961

78,200

78,300

5,263

81,200

81,300

5,498

84,200

84,300

5,734

87,200

87,300

5,969

78,300

78,400

5,270

81,300

81,400

5,506

84,300

84,400

5,741

87,300

87,400

5,977

78,400

78,500

5,278

81,400

81,500

5,514

84,400

84,500

5,749

87,400

87,500

5,985

78,500

78,600

5,286

81,500

81,600

5,522

84,500

84,600

5,757

87,500

87,600

5,993

78,600

78,700

5,294

81,600

81,700

5,529

84,600

84,700

5,765

87,600

87,700

6,000

78,700

78,800

5,302

81,700

81,800

5,537

84,700

84,800

5,773

87,700

87,800

6,008

78,800

78,900

5,310

81,800

81,900

5,545

84,800

84,900

5,781

87,800

87,900

6,016

78,900

79,000

5,317

81,900

82,000

5,553

84,900

85,000

5,788

87,900

88,000

6,024

79,000

79,100

5,325

82,000

82,100

5,561

85,000

85,100

5,796

88,000

88,100

6,032

79,100

79,200

5,333

82,100

82,200

5,569

85,100

85,200

5,804

88,100

88,200

6,040

79,200

79,300

5,341

82,200

82,300

5,577

85,200

85,300

5,812

88,200

88,300

6,048

79,300

79,400

5,349

82,300

82,400

5,584

85,300

85,400

5,820

88,300

88,400

6,055

79,400

79,500

5,357

82,400

82,500

5,592

85,400

85,500

5,828

88,400

88,500

6,063

79,500

79,600

5,365

82,500

82,600

5,600

85,500

85,600

5,836

88,500

88,600

6,071

79,600

79,700

5,372

82,600

82,700

5,608

85,600

85,700

5,843

88,600

88,700

6,079

79,700

79,800

5,380

82,700

82,800

5,616

85,700

85,800

5,851

88,700

88,800

6,087

79,800

79,900

5,388

82,800

82,900

5,624

85,800

85,900

5,859

88,800

88,900

6,095

79,900

80,000

5,396

82,900

83,000

5,631

85,900

86,000

5,867

88,900

89,000

6,102

80,000

80,100

5,404

83,000

83,100

5,639

86,000

86,100

5,875

89,000

89,100

6,110

80,100

80,200

5,412

83,100

83,200

5,647

86,100

86,200

5,883

89,100

89,200

6,118

80,200

80,300

5,420

83,200

83,300

5,655

86,200

86,300

5,891

89,200

89,300

6,126

80,300

80,400

5,427

83,300

83,400

5,663

86,300

86,400

5,898

89,300

89,400

6,134

80,400

80,500

5,435

83,400

83,500

5,671

86,400

86,500

5,906

89,400

89,500

6,142

80,500

80,600

5,443

83,500

83,600

5,679

86,500

86,600

5,914

89,500

89,600

6,150

80,600

80,700

5,451

83,600

83,700

5,686

86,600

86,700

5,922

89,600

89,700

6,157

80,700

80,800

5,459

83,700

83,800

5,694

86,700

86,800

5,930

89,700

89,800

6,165

80,800

80,900

5,467

83,800

83,900

5,702

86,800

86,900

5,938

89,800

89,900

6,173

89,900

90,000

6,181

90,000 & over

If line 9 of Form M2

Enter on line 10

is:

of your Form M2:

of the

but not

amount over—

over—

over—

$

0

$18,040

- - - - - -

5.35%

$

0

18,040

71,680

$ 965.14 + 7.05%

18,040

71,680

127,120

4,746.76 + 7.85%

71,680

127,120

- - - - - - - -

9,098.80 + 9.85%

127,120

Common Problems Using Software Packages

If you use tax preparation soft ware, be careful to buy packages acceptable to the Department of Revenue. Forms produced by the soft ware must

meet requirements and be approved before being sold or provided to consumers.

If you are considering any company’s tax preparation soft ware, ask to see the vendor’s approval letter for the forms you will be using. Keep in

mind that we usually won’t know if they are approved until late January. It is also important to test the soft ware before fi ling forms prepared

with it. We do not, however, approve the operation or accuracy of any soft ware.

Below are common problems found on fi duciary returns submitted using soft ware packages:

• Verify that the program uses updated tax tables. Tax tables are required to be updated every year for infl ation. Be sure that the amount

on line 9 of your Form M2 is the same amount shown in the tax tables.

— Fiscal year fi lers must use the table based on the beginning year of the return.

— If you are an Electing Small Business Trust (ESBT), verify that the soft ware package uses the tax table when determining the tax. Th e

ESBT is taxed at the highest tax rate only for federal purposes.

• Look for a payment voucher if you have tax due on line 20 of Form M2. If you owe tax, your soft ware package is required to include a

payment voucher when you print out a copy of your return. If you are paying your tax by check, you must complete and send this payment

voucher with your check to ensure your payment is credited properly.

• Verify that estimated tax payments were made. Some soft ware programs may insert the amount of estimated tax payments that should

14

have been paid, not the amount of tax actually paid.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15