2014 Minnesota Income Tax For Estates And Trusts (Fiduciary) Form M2 Instructions - Department Of Revenue

ADVERTISEMENT

2014 Minnesota Income Tax for Estates and Trusts

(Fiduciary) Form M2 Instructions

Filing Requirements

What’s New for 2014

For trusts that became irrevocable or were

fi rst administered in Minnesota before

Minnesota Internship Credit

An estate or trust with $600 or

January 1, 1996: A resident trust means any

Beginning in tax year 2014, eligible

more of gross income assignable to

trust administered in Minnesota.

Greater Minnesota businesses can

Minnesota, or that has a nonresi-

qualify for an internship credit

To be considered a resident trust adminis-

dent alien as a benefi ciary, must fi le

governed by the academic board. See

tered in Minnesota, you must meet two of

Form M2, regardless if it is consid-

page 10 for additional details.

the following three criteria:

ered a resident.

• A majority of the discretionary invest-

ment decisions are made in Minnesota,

When required, the trustee of a trust or the

Questions?

• Th e majority of discretionary distribution

personal representative of an estate is re-

decisions are made in Minnesota, and

You can fi nd forms and information,

sponsible for fi ling the Minnesota Form M2,

• Th e trust’s offi cial books and records are

including answers to frequently asked

Income Tax Return for Estates and Trusts

kept in Minnesota.

questions and options for fi ling and pay-

(Fiduciaries) and for paying the tax.

ing electronically, on our website at:

Bankruptcy estates. If the fi duciary of a

[M.S. 290.01, subd. 7b]

bankruptcy estate of a Minnesota resident

Before You File

fi led a federal return, a Minnesota return

must also be fi led. Use Form M1, Individual

Send us an e-mail at:

Complete a Federal Return

Income Tax Return, to determine the Min-

businessincome.tax@state.mn.us

nesota tax and attach it to Form M2. File it

Before you complete Form M2, complete

in the same way you fi le federal returns.

Call us at 651-556-3075

federal Form 1041, U.S. Income Tax Return

Resident estates. An estate is considered

for Estates and Trusts, and supporting

Need Forms?

a Minnesota estate if:

schedules. You will need to reference them.

Forms and other tax information are

Complete

• the decedent was a resident of Min nesota

available on our website at

If you are a:

federal Form:

at the time of death, or

.

• the personal representative or fi du ciary

Charitable remainder (enter

was appointed by a Minnesota court—or

We’ll provide information in another

zero on Form M2, lines 1 and 9) . . . . 1041A

the court administration was performed

format upon request to persons with

or charitable lead trust . . . . . . . . . . . .or 5227

in Minnesota—in other than an ancillary

disabilities.

pro ceeding.

Designated or qualifi ed settlement

fund (under IRC section 468B) . . . . 1120-SF

Contents

File the fi rst Form M2 cov ering the period

from the date of the decedent’s death to the

Qualifi ed funeral trust . . . . . . . . . 1041-QFT

What’s new . . . . . . . . . . . . . . . . . . . . . .1

end of the tax year. Be sure to check the box

Electing small business trust (ESBT) . . 1041

General information . . . . . . . . . . . . 1–3

to indicate it is the fi duciary’s initial return.

Filing requirements . . . . . . . . . . . . .1

Minnesota Tax ID Number

File subsequent returns for later years until

Before you fi le . . . . . . . . . . . . . . . . .1

the end of the estate’s ad ministration period.

Your Minnesota tax ID is the seven-digit

Due dates and extensions. . . . . . . .2

number you’re assigned when you register

Resident trusts. Th e defi nition of a

Payment options . . . . . . . . . . . . . . .2

with the department. It’s important to in-

M2 line instructions . . . . . . . . . . . . 4–9

resident trust diff ers depending on the

clude your Minnesota tax ID on your return

date—before or aft er December 31, 1995—

Allocation of adjustments. . . . . . . . . . .9

so that any payments you make are properly

the trust becomes irrevocable or is fi rst

KF line instructions . . . . . . . . . . . . 9–10

credited to your account.

administered in Minnesota.

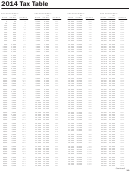

Tax tables. . . . . . . . . . . . . . . . . . . 11–14

If you don’t have a Minnesota tax ID, you

For trusts that became irrevocable or were

must apply for one. To apply online, go to

fi rst administered in Minnesota aft er De-

and click on “Reg-

cember 31, 1995: A resident trust means a

ister for a Minnesota tax ID number” from

trust, except a grantor type trust, that either:

the e-Services menu. To apply by phone, call

1 was created by a will of a decedent who

651-282-5225 or 1-800-657-3605.

at his or her death was a Minnesota resi-

dent, or

2 is an irrevocable trust, and at the time

the trust became irrevocable, the grantor

was a Minnesota resident. A trust is

considered irrevocable if the grantor is

not treated as the owner as defi ned in sec-

1

tions 671 to 678 of the IRC.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15