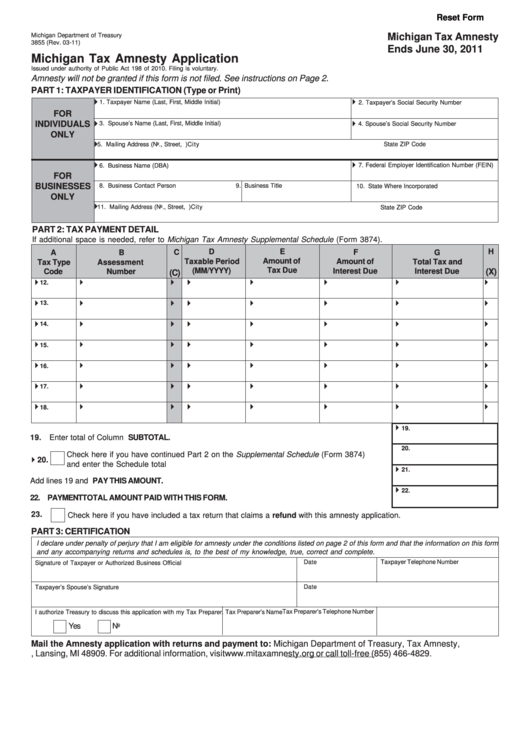

Reset Form

Michigan Department of Treasury

Michigan Tax Amnesty

3855 (Rev. 03-11)

Ends June 30, 2011

Michigan Tax Amnesty Application

Issued under authority of Public Act 198 of 2010. Filing is voluntary.

Amnesty will not be granted if this form is not filed. See instructions on Page 2.

PART 1: TAXPAYER IDENTIFICATION (Type or Print)

1. Taxpayer Name (Last, First, Middle Initial)

2. Taxpayer’s Social Security Number

FOR

INDIVIDUALS

3. Spouse’s Name (Last, First, Middle Initial)

4. Spouse’s Social Security Number

ONLY

State

ZIP Code

5. Mailing Address (No., Street, P.O. Box)

City

7. Federal Employer Identification Number (FEIN)

6. Business Name (DBA)

FOR

BUSINESSES

8. Business Contact Person

9. Business Title

10. State Where Incorporated

ONLY

11. Mailing Address (No., Street, P.O. Box)

City

State

ZIP Code

PART 2: TAX PAYMENT DETAIL

If additional space is needed, refer to Michigan Tax Amnesty Supplemental Schedule (Form 3874).

E

H

D

F

A

B

C

G

Amount of

Taxable Period

Amount of

Total Tax and

Tax Type

Assessment

Tax Due

(MM/YYYY)

Interest Due

Interest Due

Code

Number

(X)

(C)

12.

13.

14.

15.

16.

17.

18.

19.

19. Enter total of Column G. ................................................................................................ SUBTOTAL.

20.

Check here if you have continued Part 2 on the Supplemental Schedule (Form 3874)

20.

and enter the Schedule total here. ........................................................................................

21.

21. TOTAL. Add lines 19 and 20. .......................................................................... PAY THIS AMOUNT.

22.

22. PAYMENT. ....................................................................... TOTAL AMOUNT PAID WITH THIS FORM.

23.

Check here if you have included a tax return that claims a refund with this amnesty application.

PART 3: CERTIFICATION

I declare under penalty of perjury that I am eligible for amnesty under the conditions listed on page 2 of this form and that the information on this form

and any accompanying returns and schedules is, to the best of my knowledge, true, correct and complete.

Date

Taxpayer Telephone Number

Signature of Taxpayer or Authorized Business Official

Taxpayer’s Spouse’s Signature

Date

Tax Preparer’s Telephone Number

I authorize Treasury to discuss this application with my Tax Preparer.

Tax Preparer’s Name

Yes

No

Mail the Amnesty application with returns and payment to: Michigan Department of Treasury, Tax Amnesty,

P.O. Box 30710, Lansing, MI 48909. For additional information, visit or call toll-free (855) 466-4829.

1

1 2

2