Instructions For Form Uct-212i - Municipal Utilities, Gas Suppliers, And Local Gas Distributors Gross Earnings Tax Return - 2005

ADVERTISEMENT

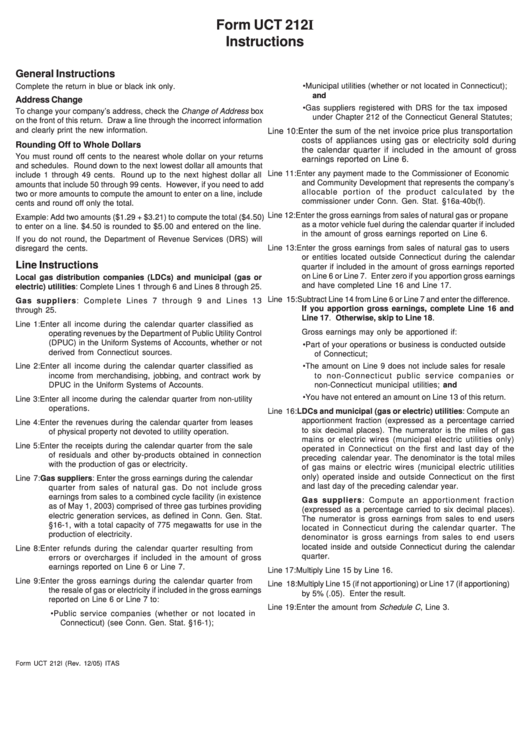

Form UCT 212I

Instructions

General Instructions

Complete the return in blue or black ink only.

• Municipal utilities (whether or not located in Connecticut);

and

Address Change

• Gas suppliers registered with DRS for the tax imposed

To change your company’s address, check the Change of Address box

under Chapter 212 of the Connecticut General Statutes;

on the front of this return. Draw a line through the incorrect information

and clearly print the new information.

Line 10: Enter the sum of the net invoice price plus transportation

costs of appliances using gas or electricity sold during

Rounding Off to Whole Dollars

the calendar quarter if included in the amount of gross

You must round off cents to the nearest whole dollar on your returns

earnings reported on Line 6.

and schedules. Round down to the next lowest dollar all amounts that

Line 11: Enter any payment made to the Commissioner of Economic

include 1 through 49 cents. Round up to the next highest dollar all

and Community Development that represents the company’s

amounts that include 50 through 99 cents. However, if you need to add

allocable portion of the product calculated by the

two or more amounts to compute the amount to enter on a line, include

commissioner under Conn. Gen. Stat. §16a-40b(f).

cents and round off only the total.

Line 12: Enter the gross earnings from sales of natural gas or propane

Example: Add two amounts ($1.29 + $3.21) to compute the total ($4.50)

as a motor vehicle fuel during the calendar quarter if included

to enter on a line. $4.50 is rounded to $5.00 and entered on the line.

in the amount of gross earnings reported on Line 6.

If you do not round, the Department of Revenue Services (DRS) will

disregard the cents.

Line 13: Enter the gross earnings from sales of natural gas to users

or entities located outside Connecticut during the calendar

Line Instructions

quarter if included in the amount of gross earnings reported

on Line 6 or Line 7. Enter zero if you apportion gross earnings

Local gas distribution companies (LDCs) and municipal (gas or

and have completed Line 16 and Line 17.

electric) utilities: Complete Lines 1 through 6 and Lines 8 through 25.

Line 15: Subtract Line 14 from Line 6 or Line 7 and enter the difference.

Gas suppliers: Complete Lines 7 through 9 and Lines 13

If you apportion gross earnings, complete Line 16 and

through 25.

Line 17. Otherwise, skip to Line 18.

Line 1:

Enter all income during the calendar quarter classified as

Gross earnings may only be apportioned if:

operating revenues by the Department of Public Utility Control

(DPUC) in the Uniform Systems of Accounts, whether or not

•

Part of your operations or business is conducted outside

derived from Connecticut sources.

of Connecticut;

Line 2:

Enter all income during the calendar quarter classified as

•

The amount on Line 9 does not include sales for resale

income from merchandising, jobbing, and contract work by

to non-Connecticut public service companies or

DPUC in the Uniform Systems of Accounts.

non-Connecticut municipal utilities; and

•

You have not entered an amount on Line 13 of this return.

Line 3:

Enter all income during the calendar quarter from non-utility

operations.

Line 16: LDCs and municipal (gas or electric) utilities: Compute an

apportionment fraction (expressed as a percentage carried

Line 4:

Enter the revenues during the calendar quarter from leases

to six decimal places). The numerator is the miles of gas

of physical property not devoted to utility operation.

mains or electric wires (municipal electric utilities only)

Line 5:

Enter the receipts during the calendar quarter from the sale

operated in Connecticut on the first and last day of the

of residuals and other by-products obtained in connection

preceding calendar year. The denominator is the total miles

with the production of gas or electricity.

of gas mains or electric wires (municipal electric utilities

only) operated inside and outside Connecticut on the first

Line 7:

Gas suppliers: Enter the gross earnings during the calendar

and last day of the preceding calendar year.

quarter from sales of natural gas. Do not include gross

earnings from sales to a combined cycle facility (in existence

Gas suppliers: Compute an apportionment fraction

as of May 1, 2003) comprised of three gas turbines providing

(expressed as a percentage carried to six decimal places).

electric generation services, as defined in Conn. Gen. Stat.

The numerator is gross earnings from sales to end users

§16-1, with a total capacity of 775 megawatts for use in the

located in Connecticut during the calendar quarter. The

production of electricity.

denominator is gross earnings from sales to end users

located inside and outside Connecticut during the calendar

Line 8:

Enter refunds during the calendar quarter resulting from

quarter.

errors or overcharges if included in the amount of gross

earnings reported on Line 6 or Line 7.

Line 17: Multiply Line 15 by Line 16.

Line 9:

Enter the gross earnings during the calendar quarter from

Line 18: Multiply Line 15 (if not apportioning) or Line 17 (if apportioning)

the resale of gas or electricity if included in the gross earnings

by 5% (.05). Enter the result.

reported on Line 6 or Line 7 to:

Line 19: Enter the amount from Schedule C, Line 3.

• Public service companies (whether or not located in

Connecticut) (see Conn. Gen. Stat. §16-1);

Form UCT 212I (Rev. 12/05) ITAS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2