Instructions For Form Ft-1021-A - Certification For Purchases Of Non-Highway Diesel Motor Fuel Or Residual Petroleum Product By Certain Exempt Organizations - Department Of Taxation And Finance

ADVERTISEMENT

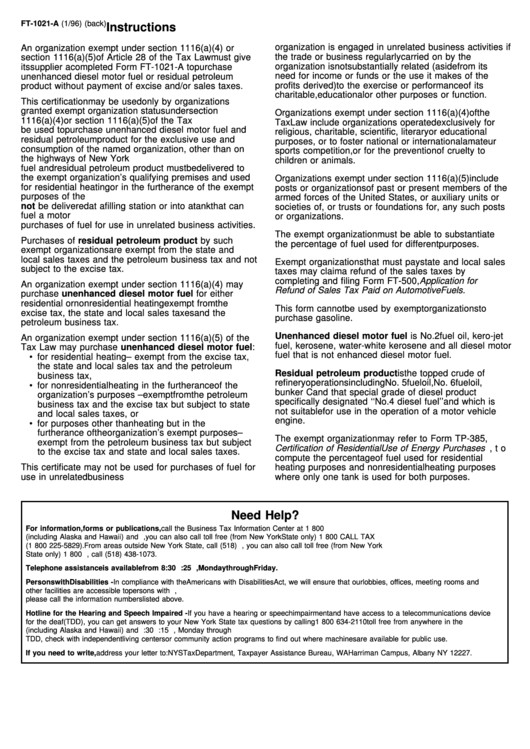

FT-1021-A (1/96) (back)

Instructions

organization is engaged in unrelated business activities if

An organization exempt under section 1116(a)(4) or

the trade or business regularly carried on by the

section 1116(a)(5) of Article 28 of the Tax Law must give

organization is not substantially related (aside from its

its supplier a completed Form FT-1021-A to purchase

need for income or funds or the use it makes of the

unenhanced diesel motor fuel or residual petroleum

profits derived) to the exercise or performance of its

product without payment of excise and/or sales taxes.

charitable, educational or other purposes or function.

This certification may be used only by organizations

granted exempt organization status under section

Organizations exempt under section 1116(a)(4) of the

1116(a)(4) or section 1116(a)(5) of the Tax Law. It may

Tax Law include organizations operated exclusively for

be used to purchase unenhanced diesel motor fuel and

religious, charitable, scientific, literary or educational

residual petroleum product for the exclusive use and

purposes, or to foster national or international amateur

consumption of the named organization, other than on

sports competition, or for the prevention of cruelty to

the highways of New York State. All such diesel motor

children or animals.

fuel and residual petroleum product must be delivered to

the exempt organization’s qualifying premises and used

Organizations exempt under section 1116(a)(5) include

for residential heating or in the furtherance of the exempt

posts or organizations of past or present members of the

purposes of the organization. The diesel motor fuel may

armed forces of the United States, or auxiliary units or

not be delivered at a filling station or into a tank that can

societies of, or trusts or foundations for, any such posts

fuel a motor vehicle. The certificate may not be used for

or organizations.

purchases of fuel for use in unrelated business activities.

The exempt organization must be able to substantiate

Purchases of residual petroleum product by such

the percentage of fuel used for different purposes.

exempt organizations are exempt from the state and

local sales taxes and the petroleum business tax and not

Exempt organizations that must pay state and local sales

subject to the excise tax.

taxes may claim a refund of the sales taxes by

completing and filing Form FT-500, Application for

An organization exempt under section 1116(a)(4) may

Refund of Sales Tax Paid on Automotive Fuels.

purchase unenhanced diesel motor fuel for either

residential or nonresidential heating exempt from the

This form cannot be used by exempt organizations to

excise tax, the state and local sales taxes and the

purchase gasoline.

petroleum business tax.

Unenhanced diesel motor fuel is No. 2 fuel oil, kero-jet

An organization exempt under section 1116(a)(5) of the

fuel, kerosene, water-white kerosene and all diesel motor

Tax Law may purchase unenhanced diesel motor fuel:

• for residential heating – exempt from the excise tax,

fuel that is not enhanced diesel motor fuel.

the state and local sales tax and the petroleum

Residual petroleum product is the topped crude of

business tax,

refinery operations including No. 5 fuel oil, No. 6 fuel oil,

• for nonresidential heating in the furtherance of the

bunker C and that special grade of diesel product

organization’s purposes – exempt from the petroleum

specifically designated ‘‘No. 4 diesel fuel’’ and which is

business tax and the excise tax but subject to state

not suitable for use in the operation of a motor vehicle

and local sales taxes, or

engine.

• for purposes other than heating but in the

furtherance of the organization’s exempt purposes –

The exempt organization may refer to Form TP-385,

exempt from the petroleum business tax but subject

Certification of Residential Use of Energy Purchases , to

to the excise tax and state and local sales taxes.

compute the percentage of fuel used for residential

This certificate may not be used for purchases of fuel for

heating purposes and nonresidential heating purposes

use in unrelated business activities. An exempt

where only one tank is used for both purposes.

Need Help?

For information, forms or publications, call the Business Tax Information Center at 1 800 972-1233. The call is toll free from anywhere in the

U.S. (including Alaska and Hawaii) and Canada. For information, you can also call toll free (from New York State only) 1 800 CALL TAX

(1 800 225-5829). From areas outside New York State, call (518) 438-8581. For forms or publications, you can also call toll free (from New York

State only) 1 800 462-8100. From areas outside New York State, call (518) 438-1073.

Telephone assistance is available from 8:30 a.m. to 4:25 p.m., Monday through Friday.

Persons with Disabilities - In compliance with the Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting rooms and

other facilities are accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities,

please call the information numbers listed above.

Hotline for the Hearing and Speech Impaired - If you have a hearing or speech impairment and have access to a telecommunications device

for the deaf (TDD), you can get answers to your New York State tax questions by calling 1 800 634-2110 toll free from anywhere in the U.S.

(including Alaska and Hawaii) and Canada. Hours of operation are from 8:30 a.m. to 4:15 p.m., Monday through Friday. If you do not own a

TDD, check with independent living centers or community action programs to find out where machines are available for public use.

If you need to write, address your letter to: NYS Tax Department, Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1