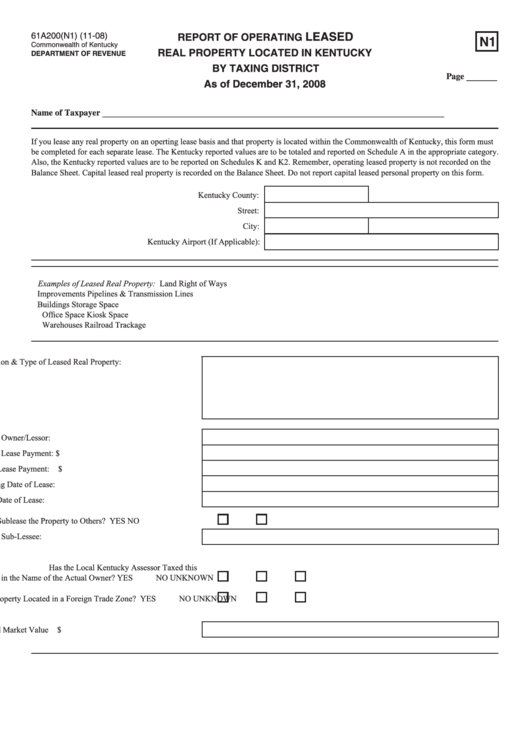

Form 61a200(N1) - Report Of Operating Leased Real Property Located In Kentucky By Taxing District

ADVERTISEMENT

LEASED

61A200(N1) (11-08)

REPORT OF OPERATING

N1

Commonwealth of Kentucky

REAL PROPERTY LOCATED IN KENTUCKY

DEPARTMENT OF REVENUE

BY TAXING DISTRICT

Page _______

As of December 31, 2008

Name of Taxpayer ______________________________________________________________________________

If you lease any real property on an operting lease basis and that property is located within the Commonwealth of Kentucky, this form must

be completed for each separate lease. The Kentucky reported values are to be totaled and reported on Schedule A in the appropriate category.

Also, the Kentucky reported values are to be reported on Schedules K and K2. Remember, operating leased property is not recorded on the

Balance Sheet. Capital leased real property is recorded on the Balance Sheet. Do not report capital leased personal property on this form.

Kentucky County:

Street:

City:

Kentucky Airport (If Applicable):

Examples of Leased Real Property:

Land

Right of Ways

Improvements

Pipelines & Transmission Lines

Buildings

Storage Space

Office Space

Kiosk Space

Warehouses

Railroad Trackage

Description & Type of Leased Real Property:

Name of Owner/Lessor:

Monthly Lease Payment:

$

Annual Lease Payment: $

Beginning Date of Lease:

Ending Date of Lease:

Do you Sublease the Property to Others?

YES

NO

Name of Sub-Lessee:

Has the Local Kentucky Assessor Taxed this

Property in the Name of the Actual Owner?

YES

NO

UNKNOWN

Is this Property Located in a Foreign Trade Zone?

YES

NO

UNKNOWN

Reported Market Value $

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3