Municipal Net Profit Return Form - Ohio Division Of Taxation

ADVERTISEMENT

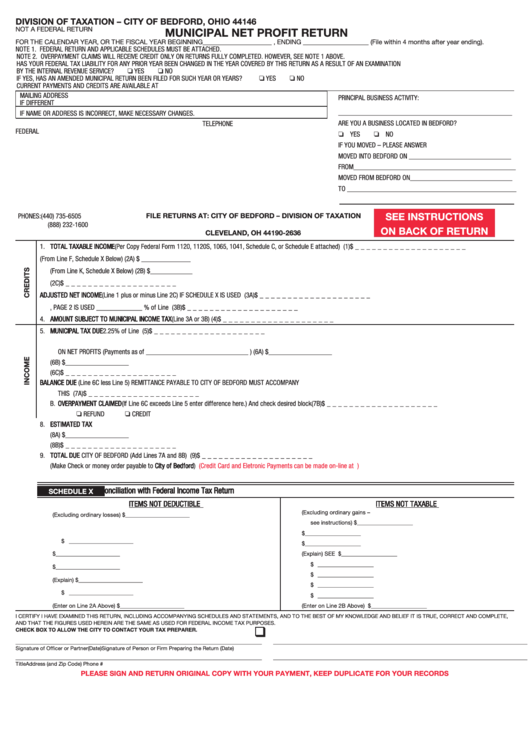

DiViSion oF taxation – City oF beDForD, ohio 44146

MuniCipal net proFit return

NOT A FEDERAL RETURN

FOR THE CALENDAR YEAR, OR THE FISCAL YEAR BEGINNING _____________________ , ENDING ____________________ (File within 4 months after year ending).

NOTE 1. FEDERAL RETURN AND APPLICABLE SCHEDULES MUST BE ATTACHED.

NOTE 2. OVERPAYMENT CLAIMS WILL RECEIVE CREDIT ONLY ON RETURNS FULLY COMPLETED. HOWEVER, SEE NOTE 1 ABOVE.

HAS YOUR FEDERAL TAX LIABILITY FOR ANY PRIOR YEAR BEEN CHANGED IN THE YEAR COVERED BY THIS RETURN AS A RESULT OF AN EXAMINATION

BY THE INTERNAL REVENUE SERVICE?

YES

NO

IF YES, HAS AN AMENDED MUNICIPAL RETURN BEEN FILED FOR SUCH YEAR OR YEARS?

YES

NO

CURRENT PAYMENTS AND CREDITS ARE AVAILABLE AT

MAILING ADDRESS

PRINCIPAL BUSINESS ACTIVITY:

IF DIFFERENT

__________________________________________

IF NAME OR ADDRESS IS INCORRECT, MAKE NECESSARY CHANGES.

ARE YOU A BUSINESS LOCATED IN BEDFORD?

TELEPHONE

FEDERAL I.D. NUMBER

NUMBER

YES

NO

IF YOU MOVED – PLEASE ANSWER

MOVED INTO BEDFORD ON _____________________________

FROM______________________________________________

MOVED FROM BEDFORD ON _____________________________

TO ________________________________________________

See inStruCtionS

File returnS at: City oF beDForD – DiViSion oF taxation

PHONES: (440) 735-6505

p.o. box 92636

(888) 232-1600

on baCk oF return

CleVelanD, oh 44190-2636

1. TOTAL TAXABLE INCOME (Per Copy Federal Form 1120, 1120S, 1065, 1041, Schedule C, or Schedule E attached) .......................................... (1)

$ ____________________

2. A. ITEMS NOT DEDUCTIBLE (From Line F, Schedule X Below).................................................................................Add (2A) $ ______________

B. ITEMS NOT TAXABLE (From Line K, Schedule X Below) ......................................................................................Deduct (2B) $ ____________

C. ENTER EXCESS OF LINE 2A OR 2B..................................................................................................................................................................(2C)

$ ____________________

3. A. ADJUSTED NET INCOME (Line 1 plus or minus Line 2C) IF SCHEDULE X IS USED .........................................................................................(3A)

$ ____________________

B. AMOUNT ALLOCABLE TO BEDFORD IF SCHEDULE Y, PAGE 2 IS USED _____________ % of Line 3A ............................................................(3B)

$ ____________________

4. AMOUNT SUBJECT TO MUNICIPAL INCOME TAX (Line 3A or 3B) ......................................................................................................................(4)

$ ____________________

5. MUNICIPAL TAX DUE 2.25% of Line 4................................................................................................................................................................(5)

$ ____________________

6. A. PAYMENTS ON DECLARATION OF ESTIMATED MUNICIPAL TAX

ON NET PROFITS (Payments as of _____________________________ ) ......................................................(6A) $__________________

B. AMOUNT OF PREVIOUS YEARS CREDITS.............................................................................................................(6B) $__________________

C. TOTAL CREDITS ALLOWABLE ..........................................................................................................................................................................(6C)

$ ____________________

7. A. BALANCE DUE (Line 6C less Line 5) REMITTANCE PAYABLE TO CITY OF BEDFORD MUST ACCOMPANY

THIS FORM .....................................................................................................................................................................................................(7A)

$ ____________________

B. OVERPAYMENT CLAIMED (If Line 6C exceeds Line 5 enter difference here.) And check desired block

(7B)

$ ____________________

REFUND

CREDIT

8. ESTIMATED TAX

A. ESTIMATED TAX LIABILITY FOR NEXT TAX YEAR .................................................................................................(8A) $__________________

B. QUARTERLY ESTIMATED TAX DUE 1/4 OF 8A LESS CREDIT FROM 7B..............................................................................................................(8B)

$ ____________________

9. TOTAL DUE CITY OF BEDFORD (Add Lines 7A and 8B) ........................................................................................................................................(9)

$ ____________________

(Make Check or money order payable to City of Bedford)

(Credit Card and Eletronic Payments can be made on-line at )

SCheDule x

Reconciliation with Federal Income Tax Return

ITEMS NOT DEDUCTIBLE

ITEMS NOT TAXABLE

G. CAPITAL GAINS (Excluding ordinary gains –

A. CAPITAL LOSSES (Excluding ordinary losses) .................. $ _______________________

see instructions)..............................................................$ ____________________

B. EXPENSES APPLICABLE TO NON-TAXABLE

H. INTEREST INCOME........................................................$ ____________________

INCOME...............................................................................$ _______________________

I. DIVIDENDS .....................................................................$ ____________________

C. TAXES BASED ON INCOME ...............................................$ _______________________

J. OTHER (Explain) SEE INSTRUCTIONS ..........................$ ____________________

........................................................................................$ ____________________

D. PAYMENTS TO PARTNERS ................................................$ _______________________

........................................................................................$ ____________________

E. OTHER EXPENSES NOT DEDUCTIBLE (Explain)...............$ _______________________

........................................................................................$ ____________________

.............................................................................................$ _______________________

........................................................................................$ ____________________

F. TOTAL ADDITIONS (Enter on Line 2A Above).....................$ _______________________

K. TOTAL DEDUCTIONS (Enter on Line 2B Above) ...........$ ____________________

I CERTIFY I HAVE EXAMINED THIS RETURN, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE,

AND THAT THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX PURPOSES.

CheCk box to allow the City to ContaCt your tax preparer.

____________________________________________________________________________________________

_______________________________________________________________________________________________

Signature of Officer or Partner

(Date)

Signature of Person or Firm Preparing the Return

(Date)

____________________________________________________________________________________________

_______________________________________________________________________________________________

Title

Address (and Zip Code) Phone #

pleaSe SiGn anD return oriGinal Copy with your payMent, keep DupliCate For your reCorDS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2