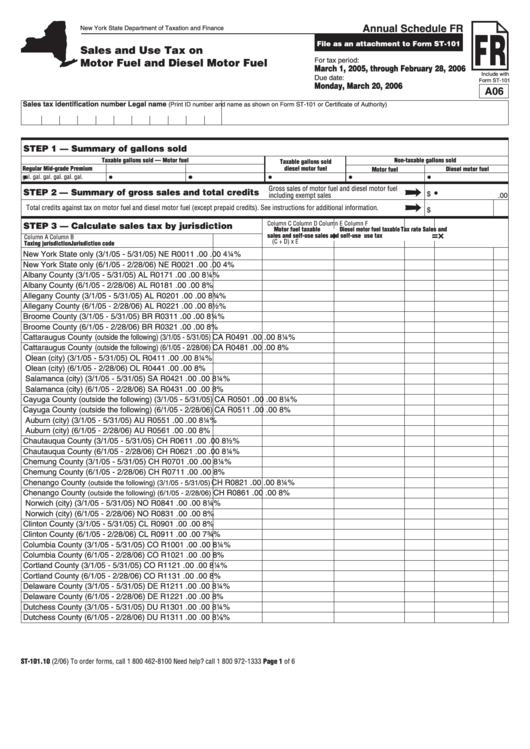

Form St-101.10 - Sales And Use Tax On Motor Fuel And Diesel Motor Fuel

ADVERTISEMENT

Annual Schedule FR

New York State Department of Taxation and Finance

File as an attachment to Form ST-101

Sales and Use Tax on

Motor Fuel and Diesel Motor Fuel

For tax period:

March 1, 2005, through February 28, 2006

Include with

Due date:

Form ST-101

Monday, March 20, 2006

A06

Sales tax identification number

Legal name

(Print ID number and name as shown on Form ST-101 or Certificate of Authority)

STEP 1 — Summary of gallons sold

Taxable gallons sold — Motor fuel

Non-taxable gallons sold

Taxable gallons sold

Regular

Mid-grade

Premium

diesel motor fuel

Diesel motor fuel

Motor fuel

gal.

gal.

gal.

gal.

gal.

gal.

Gross sales of motor fuel and diesel motor fuel

STEP 2 — Summary of gross sales and total credits

$

including exempt sales

.00

Total credits against tax on motor fuel and diesel motor fuel (except prepaid credits). See instructions for additional information.

$

Column C

Column D

Column E

Column F

STEP 3 — Calculate sales tax by jurisdiction

Motor fuel taxable

Diesel motor fuel taxable

Tax rate

Sales and

+

×

=

sales and self-use

sales and self-use

use tax

Column A

Column B

(C + D) x E

Taxing jurisdiction

Jurisdiction code

New York State only (3/1/05 - 5/31/05)

NE R0011

.00

.00 4¼%

New York State only (6/1/05 - 2/28/06)

NE R0021

.00

.00

4%

Albany County (3/1/05 - 5/31/05)

AL R0171

.00

.00 8¼%

Albany County (6/1/05 - 2/28/06)

AL R0181

.00

.00

8%

Allegany County (3/1/05 - 5/31/05)

AL R0201

.00

.00 8¾%

Allegany County (6/1/05 - 2/28/06)

AL R0221

.00

.00 8½%

Broome County (3/1/05 - 5/31/05)

BR R0311

.00

.00 8¼%

Broome County (6/1/05 - 2/28/06)

BR R0321

.00

.00

8%

Cattaraugus County (outside the following) (3/1/05 - 5/31/05) CA R0491

.00

.00 8¼%

Cattaraugus County (outside the following) (6/1/05 - 2/28/06) CA R0481

.00

.00

8%

Olean (city) (3/1/05 - 5/31/05)

OL R0411

.00

.00 8¼%

Olean (city) (6/1/05 - 2/28/06)

OL R0441

.00

.00

8%

Salamanca (city) (3/1/05 - 5/31/05)

SA R0421

.00

.00 8¼%

Salamanca (city) (6/1/05 - 2/28/06)

SA R0431

.00

.00

8%

Cayuga County (outside the following) (3/1/05 - 5/31/05) CA R0501

.00

.00 8¼%

Cayuga County (outside the following) (6/1/05 - 2/28/06) CA R0511

.00

.00

8%

Auburn (city) (3/1/05 - 5/31/05)

AU R0551

.00

.00 8¼%

Auburn (city) (6/1/05 - 2/28/06)

AU R0561

.00

.00

8%

Chautauqua County (3/1/05 - 5/31/05)

CH R0611

.00

.00 8½%

Chautauqua County (6/1/05 - 2/28/06)

CH R0621

.00

.00 8¼%

Chemung County (3/1/05 - 5/31/05)

CH R0701

.00

.00 8¼%

Chemung County (6/1/05 - 2/28/06)

CH R0711

.00

.00

8%

Chenango County

CH R0821

.00

.00 8¼%

(outside the following) (3/1/05 - 5/31/05)

Chenango County

CH R0861

.00

.00

8%

(outside the following) (6/1/05 - 2/28/06)

Norwich (city) (3/1/05 - 5/31/05)

NO R0841

.00

.00 8¼%

Norwich (city) (6/1/05 - 2/28/06)

NO R0831

.00

.00

8%

Clinton County (3/1/05 - 5/31/05)

CL R0901

.00

.00

8%

Clinton County (6/1/05 - 2/28/06)

CL R0911

.00

.00 7¾%

Columbia County (3/1/05 - 5/31/05)

CO R1001

.00

.00 8¼%

Columbia County (6/1/05 - 2/28/06)

CO R1021

.00

.00

8%

Cortland County (3/1/05 - 5/31/05)

CO R1121

.00

.00 8¼%

Cortland County (6/1/05 - 2/28/06)

CO R1131

.00

.00

8%

Delaware County (3/1/05 - 5/31/05)

DE R1211

.00

.00 8¼%

Delaware County (6/1/05 - 2/28/06)

DE R1221

.00

.00

8%

Dutchess County (3/1/05 - 5/31/05)

DU R1301

.00

.00 8¼%

Dutchess County (6/1/05 - 2/28/06)

DU R1311

.00

.00 8⅛%

ST-101.10 (2/06)

To order forms, call 1 800 462-8100

Need help? call 1 800 972-1333

Page 1 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4