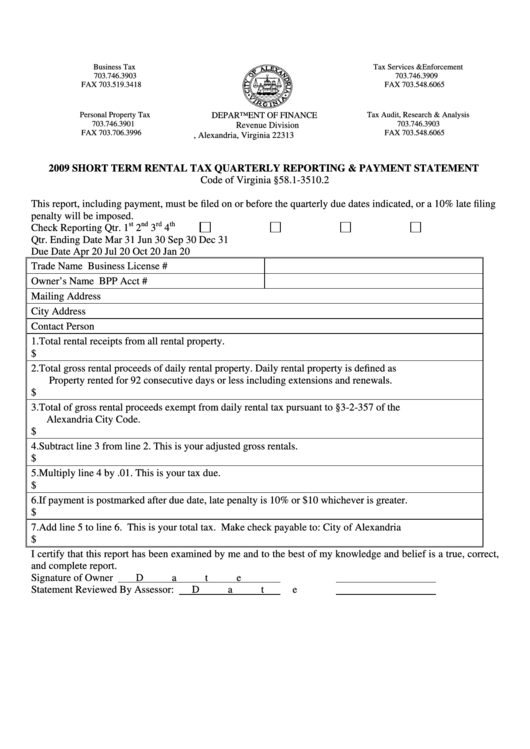

Short Term Rental Tax And Payment Statement Form - 2009

ADVERTISEMENT

Business Tax

Tax Services &Enforcement

703.746.3903

703.746.3909

FAX 703.519.3418

FAX 703.548.6065

Personal Property Tax

DEPARTMENT OF FINANCE

Tax Audit, Research & Analysis

703.746.3901

703.746.3903

Revenue Division

FAX 703.706.3996

FAX 703.548.6065

P.O. Box 178, Alexandria, Virginia 22313

alexandriava.gov/finance

2009 SHORT TERM RENTAL TAX QUARTERLY REPORTING & PAYMENT STATEMENT

Code of Virginia §58.1-3510.2

This report, including payment, must be filed on or before the quarterly due dates indicated, or a 10% late filing

penalty will be imposed.

st

nd

rd

th

Check Reporting Qtr.

1

2

3

4

Qtr. Ending Date

Mar 31

Jun 30

Sep 30

Dec 31

Due Date

Apr 20

Jul 20

Oct 20

Jan 20

Trade Name

Business License #

Owner’s Name

BPP Acct #

Mailing Address

City Address

Contact Person

1. Total rental receipts from all rental property.

$

2. Total gross rental proceeds of daily rental property. Daily rental property is defined as

Property rented for 92 consecutive days or less including extensions and renewals.

$

3. Total of gross rental proceeds exempt from daily rental tax pursuant to §3-2-357 of the

Alexandria City Code.

$

4. Subtract line 3 from line 2. This is your adjusted gross rentals.

$

5. Multiply line 4 by .01. This is your tax due.

$

6. If payment is postmarked after due date, late penalty is 10% or $10 whichever is greater.

$

7. Add line 5 to line 6. This is your total tax. Make check payable to: City of Alexandria

$

I certify that this report has been examined by me and to the best of my knowledge and belief is a true, correct,

and complete report.

Signature of Owner

Date

Statement Reviewed By Assessor:

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1