Instructions For Completing Texas Battery Sales Fee / Waste Tire Recycling Fee Report Form

ADVERTISEMENT

66-102 (Back) (8-95/5)

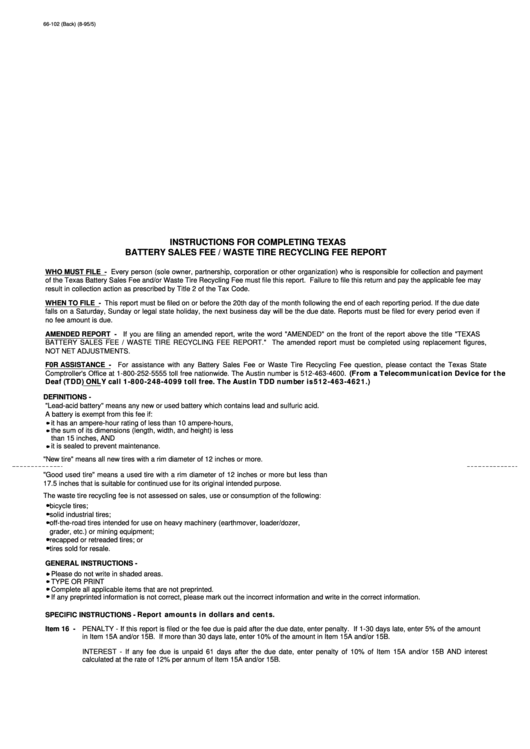

INSTRUCTIONS FOR COMPLETING TEXAS

BATTERY SALES FEE / WASTE TIRE RECYCLING FEE REPORT

WHO MUST FILE -

Every person (sole owner, partnership, corporation or other organization) who is responsible for collection and payment

of the Texas Battery Sales Fee and/or Waste Tire Recycling Fee must file this report. Failure to file this return and pay the applicable fee may

result in collection action as prescribed by Title 2 of the Tax Code.

WHEN TO FILE -

This report must be filed on or before the 20th day of the month following the end of each reporting period. If the due date

falls on a Saturday, Sunday or legal state holiday, the next business day will be the due date. Reports must be filed for every period even if

no fee amount is due.

AMENDED REPORT -

If you are filing an amended report, write the word "AMENDED" on the front of the report above the title "TEXAS

BATTERY SALES FEE / WASTE TIRE RECYCLING FEE REPORT." The amended report must be completed using replacement figures,

NOT NET ADJUSTMENTS.

F0R ASSISTANCE -

For assistance with any Battery Sales Fee or Waste Tire Recycling Fee question, please contact the Texas State

Comptroller's Office at 1-800-252-5555 toll free nationwide. The Austin number is 512-463-4600.

(From a Telecommunication

Device for the

Deaf (TDD) ONLY call 1-800-248-4099 toll free. The Austin TDD number is 512-463-4621.)

DEFINITIONS -

"Lead-acid battery" means any new or used battery which contains lead and sulfuric acid.

A battery is exempt from this fee if:

it has an ampere-hour rating of less than 10 ampere-hours,

the sum of its dimensions (length, width, and height) is less

than 15 inches, AND

it is sealed to prevent maintenance.

"New tire" means all new tires with a rim diameter of 12 inches or more.

"Good used tire" means a used tire with a rim diameter of 12 inches or more but less than

17.5 inches that is suitable for continued use for its original intended purpose.

The waste tire recycling fee is not assessed on sales, use or consumption of the following:

bicycle tires;

solid industrial tires;

off-the-road tires intended for use on heavy machinery (earthmover, loader/dozer,

grader, etc.) or mining equipment;

recapped or retreaded tires; or

tires sold for resale.

GENERAL INSTRUCTIONS -

Please do not write in shaded areas.

TYPE OR PRINT

Complete all applicable items that are not preprinted.

If any preprinted information is not correct, please mark out the incorrect information and write in the correct information.

Report amounts in dollars and cents.

SPECIFIC INSTRUCTIONS -

Item 16 -

PENALTY - If this report is filed or the fee due is paid after the due date, enter penalty. If 1-30 days late, enter 5% of the amount

in Item 15A and/or 15B. If more than 30 days late, enter 10% of the amount in Item 15A and/or 15B.

INTEREST - If any fee due is unpaid 61 days after the due date, enter penalty of 10% of Item 15A and/or 15B AND interest

calculated at the rate of 12% per annum of Item 15A and/or 15B.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1